Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 14 Dec, 2021

By Louis Bacani

In this edition, we take a close look at the rise of cyberrisk and its impact on various industries. In financial services, experts fear that a cyberattack on a company could trigger a domino effect leading to a financial crisis due to the sector’s digital interconnectedness. According to the IMF, cyberthreats could cost banks up to 9% of their average annual net income globally, or about $100 billion. Cyberincidents are also especially costly in the healthcare industry, which is facing greater risk of cybersecurity hacks amid aging medical devices and a shift to at-home care during the pandemic. The energy sector is also grappling with expanding vulnerabilities and evolving threats as governments and private stakeholders race to secure critical infrastructure.

The COVID-19 pandemic has bolstered digital banking usage, allowing U.S. banks to accelerate branch closures and shift resources toward technology and digital. The industry has closed more than 2,700 branches so far in 2021, surpassing the record number of net closures in 2020, and industry experts do not expect banks to slow down anytime soon.

Nonfungible token, or NFT, uses the concept of a distributed blockchain for the chain of ownership of any type, or sometimes just a piece, of a digital asset. NFT technology is expected to persist and form part of the digital transformation for many types of trade, according to 451 Research.

Cyberrisk in Focus

Cyberattacks threaten stability of interconnected financial services

Rapid digitalization puts the global financial system at risk as cybercriminals rake in tens of millions of dollars by attacking businesses and institutions.

Read the full article from S&P Global Market Intelligence

At-home care boom, aging medical devices open up healthcare to cyberattacks

From pacemakers to insulin pumps, the healthcare technology revolution has transformed patient care and created new entrances for enterprising hackers.

Read the full article from S&P Global Market Intelligence

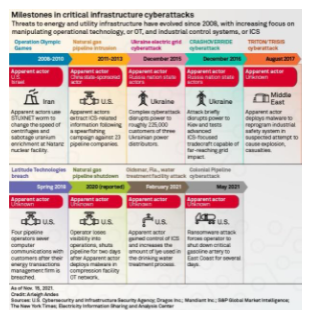

Power sector races against multiplying cyberthreats

The specter of cybersecurity risk is growing as the electricity sector decentralizes and digitizes, with the influx of millions of smaller assets on the system — from wind turbines to electric vehicles — increasing the surface of attack.

Read the full article from S&P Global Market Intelligence

Pipeline operators face huge challenge preventing repeat of Colonial hack

With vulnerabilities expanding, threats multiplying and regulation developing, U.S. pipeline operators will have to rapidly scale up their cyber capabilities.

Read the full article from S&P Global Market Intelligence

Deep Dives

In-depth features looking at the impact of major news developments in key industries.

Financials

No end in sight for US banks' record-breaking branch closure spree

U.S. banks are looking to do more with less by rapidly consolidating their branch footprints and reinvesting resources into digital channels.

Read the full article from S&P Global Market Intelligence

US banks' efficiency ratios improve in Q3 as net interest income jumps

U.S. banks posted total net interest income of $134.4 billion in the quarter, up from $129.2 billion in the linked quarter and $128.8 billion in the year-ago period.

Read the full article from S&P Global Market Intelligence

Biden's pick for supervision vice chair to be tough on banks, whoever it is

Attention has turned to President Joe Biden's choice to regulate the country's bank holding companies after he reappointed Chair Jerome Powell to his post and tapped Fed Governor Lael Brainard to be vice chair.

Read the full article from S&P Global Market Intelligence

European banks record 'material' rise in problem loans for pandemic-hit sectors

The average nonperforming loan ratio in the accommodation and food service sector grew to 9.7% from 7.8% a year ago, according to the European Banking Authority.

Read the full article from S&P Global Market Intelligence

Global systemic importance set to rise for China banks, fall for Japan lenders

Chinese lenders will likely be more interconnected with the global financial system, thus boosting their global systemic importance, while Japanese megabanks are set to further scale back their overseas operations.

Read the full article from S&P Global Market Intelligence

Credit and Markets

Quicker Fed taper to bolster dollar, hit bonds, stocks

Federal Reserve Chairman Jerome Powell opened the door to ending bond purchases sooner as markets weigh the possible impact of the latest COVID-19 variant.

Read the full article from S&P Global Market Intelligence

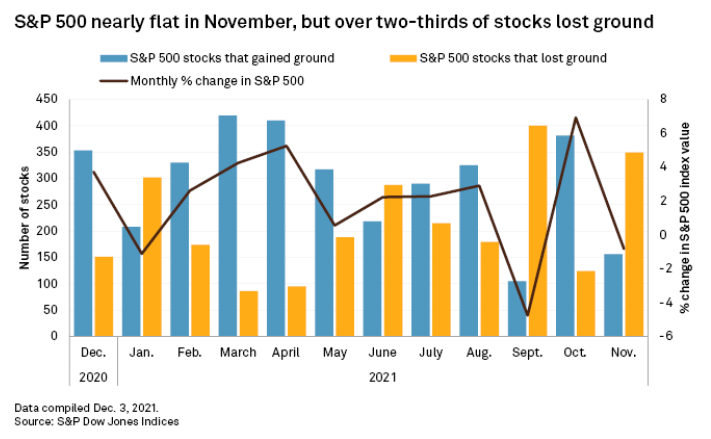

Bad breadth plagues Nasdaq as mega-cap stocks mask market weakness

Leaving aside its five largest stocks, the Nasdaq Composite Index is down more than 22% on the year.

Read the full article from S&P Global Market Intelligence

Technology, Media and Telecom

E-commerce retailers' hiring spree shows robots not ready for many human tasks

Retailers are utilizing more automation to help improve operational efficiencies in a tight labor market, but attracting and retaining human workers remains essential as many tasks are too advanced for robots.

Read the full article from S&P Global Market Intelligence

Metals and Mining

Top miners' copper output plummets 4.4% in Q3'21

Among the top 20 copper miners, only six companies had year-over-year production increases in the third quarter.

Read the full article from S&P Global Market Intelligence

Nickel producers suffer bruising Q3'21 despite steel, battery hype

The world's top five nickel producers reported lower primary nickel output during the third quarter as accidents and unplanned maintenance, alongside persistent supply disruptions, bogged down production at several facilities.

Read the full article from S&P Global Market Intelligence

Energy and Utilities

US solar developers see hot Q3 as they turn to battery storage

The U.S. added 2,369 MW of solar generation and pairing projects with 127.6 MW of battery storage, according to S&P Global Market Intelligence data.

Read the full article from S&P Global Market Intelligence

Gas utilities see earnings decline in Q3; few beat Wall Street estimates

Just two out of nine natural gas utilities in a select group topped year-ago EPS in the third quarter, and only three beat equity analysts' expectations, continuing and deepening a short-term earnings slump for the group.

Read the full article from S&P Global Market Intelligence

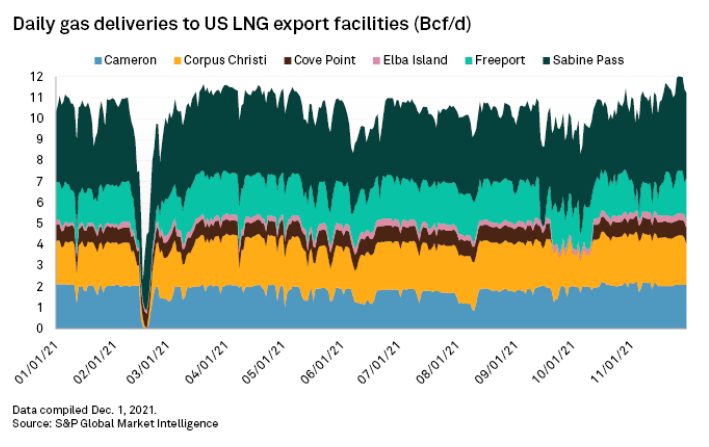

US LNG exports hit record highs as global gas crunch persists

Exports of the fuel from the U.S. have shown little sign of slowing down in the final month of 2021 as world buyers continue to seek winter supplies.

Read the full article from S&P Global Market Intelligence

The Week in M&A

NVIDIA-Arm deal scrutiny risks torpedoing big payday for financial advisers

Asia-Pacific financial institutions M&A interest tracker

NextEra considers financial flexibility in internal, external M&A strategies

Athene's $1B Aqua Finance buy evokes a bygone era but furthers a modern strategy

The Big Number

Trending

Read more on S&P Global Market Intelligence and follow @mollyknc on Twitter.

S&P Capital IQ Pro. A single platform for essential intelligence.

Do you need a single source of industry intelligence? Discover the S&P Capital IQ Pro platform. Bringing together an unrivaled breadth and depth of data, news, and research, combined with tech-forward productivity tools. All in one platform that powers your edge.

Upcoming & On-demand Webinars

Journey to Credit Digitisation: A View from the Banks | January 12, 2022

M&A in Focus: 2021 Trends and the Deal Horizon featuring City and Blackstone

The Growth of (Fin)tech in Europe: What’s in Store for Investment and M&A in 2022?

2021 Year in Review: Key Investment Banking Trends

M&A activity recovered from its bottom in Q2 2020 and continued its momentum throughout 2021, generating a total of $3 trillion in deal value across 35,042 deals in 2021 year-to-date.

Additional Insights from S&P Global Market Intelligence

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions. Click here to subscribe.

Policy Intel: Explore exclusive news and research on policy and regulatory developments in the U.S. and around the globe. Click here to subscribe.

Essential Healthcare: Our guide to the week's top headlines in pharmaceuticals, biotech, hospitals, medtech and more. Click here to subscribe.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories. Click here to subscribe.

NEXT: Stay up-to-date on how technology is reshaping the future of industries across global markets. Click here to subscribe.