S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Blog — 4 Apr, 2024

This blog is written and published by S&P Global Market Intelligence, a division independent from S&P Global Ratings. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings.

Private credit has seen substantial growth over the past decade, reaching a total of almost $1 trillion in North America and $500 billion in Europe (as of Q1 2023), between disbursed credit and “dry-powder”,[1] and attracting both investors and borrowers. [1,2] The former are drawn in due to the prospect of higher yields, diversification of their investment portfolios beyond publicly traded securities, and reduced exposure to market volatility typically seen for publicly traded bonds and equities. The latter see an opportunity to access capital on more flexible terms, easier and faster than via the traditional banking system, avoid equity dilution, and maintain resilience during economic downturns, when public markets usually become volatile.

However, the floating-rate characteristics of private credit exposes borrowers to increased default risk, whilst interest rates remain higher for longer. Thus, it is critical for investors to unveil past and current trends at sector level, to better define their risk appetite and refine their sector-agnostic investment strategy by prioritizing specific sectors.

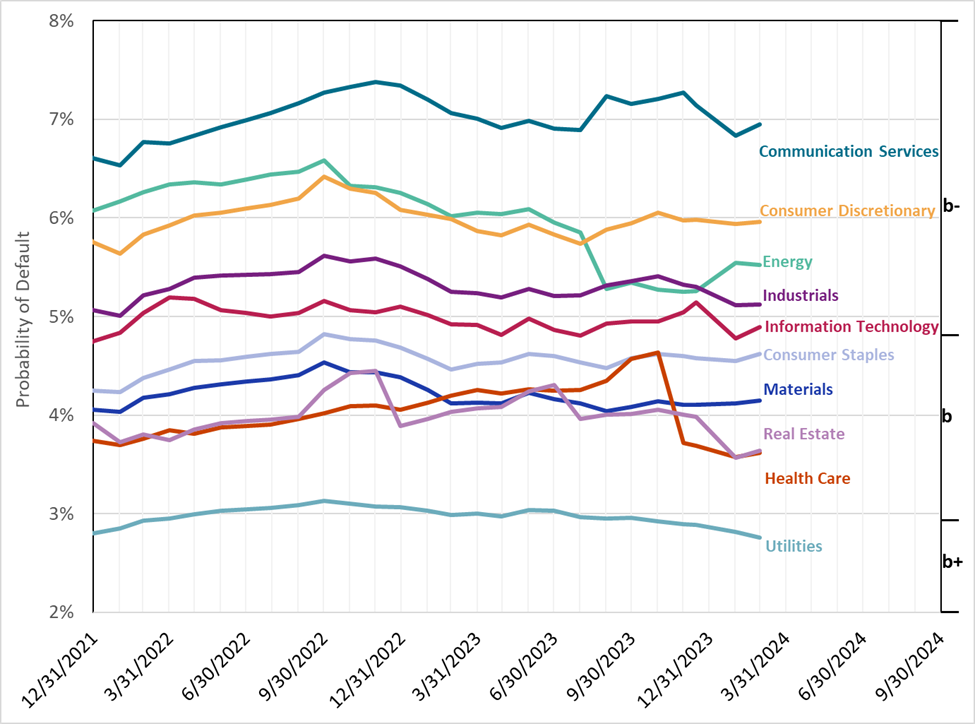

Figure 1 shows the median 1-year probability of default (PD) for private companies in S&P Global Market Intelligence’s prescored database, generated by RiskGaugeTM, from December 2021 to February 2024.[2] This quantitative credit risk model combines company financials, market information and socio-economic drivers to generate a PD (also mapped to a credit score), thus providing a holistic perspective on firms’ creditworthiness. The market component enables the model to generate daily outputs, despite private company financials only being updated on an annual basis, and to react to any sudden shocks that may affect forward looking expectations about the economic cycle. The median PD for private companies has been steadily increasing since December 2021, due to the concurrent rise of central banks’ interest rates, a number of geopolitical instabilities and supply chain shocks, reaching a peak in Q4 2022. After that, the PD has been mostly decreasing as the market “digested” the most recent shocks and is currently anticipating a decrease of the interest rates in coming months.

Figure 1: RiskGauge 2.0 median PD benchmarks for private companies.

Source: S&P Global Market Intelligence. For illustrative purposes only (as of March 31, 2024).

The RiskGauge PD is also mapped to a credit score, expressed in lower-case, to distinguish it from an actual S&P Global Ratings’ issuer credit rating. The concentration of median scores in the speculative grade part of the scale simply reflects the inherent weakness of private companies in servicing debt.

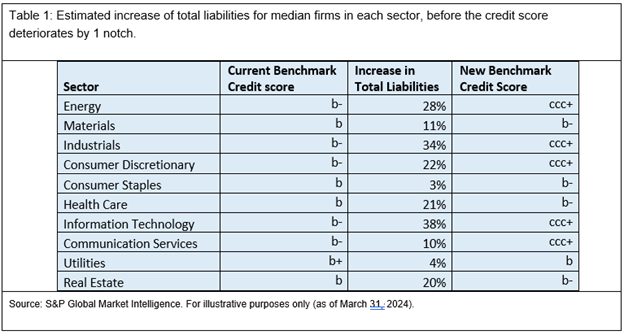

Before extending credit to a firm, it is not only important to check its current creditworthiness, but also how this may be perturbed by the additional debt; this is particularly important when the borrowing firm plans to finance its business over a long period of time. In fact, the financial performance will not improve instantaneously, but with a lag that will expose the company to higher interest expenses and potential debt repayments. Table 1, below, reports an estimate of the additional liabilities that benchmark companies in each sector can withstand before their creditworthiness deteriorates by one notch.

The differences across sectors are driven by the proximity of the median PD level to the boundary PD of the next credit score. However, this table provides a textbook example as to why it is critical for direct lending investors to perform a robust sensitivity analysis of each potential borrower, since the overall performance of a debt facility will often depend on the creditworthiness of the obligor, and a sizable increase in total liabilities will certainly lead to a creditworthiness deterioration by one or more notches. With the growing trend of private credit secondaries as a source of liquidity for direct lending funds, the impact of this may soon be magnified too.

If you want to learn more about RiskGauge, please click here.