S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Blog — 23 Mar, 2022

By Joe Mantone

Highlights

Given the growing prominence of environmental, social, and governance (ESG) issues and the rapid growth in sustainable investing, he also wanted students to be able to evaluate the ESG stance of companies before making decisions.

The lead faculty advisor for the student investment fund saw an opportunity to gain a competitive edge over other schools by introducing an array of new datasets and analytical tools to capture current thinking about investments.

Market Intelligence mentioned numerous capabilities to assess risks relating to climate change, natural resource constraints, and broader ESG factors.

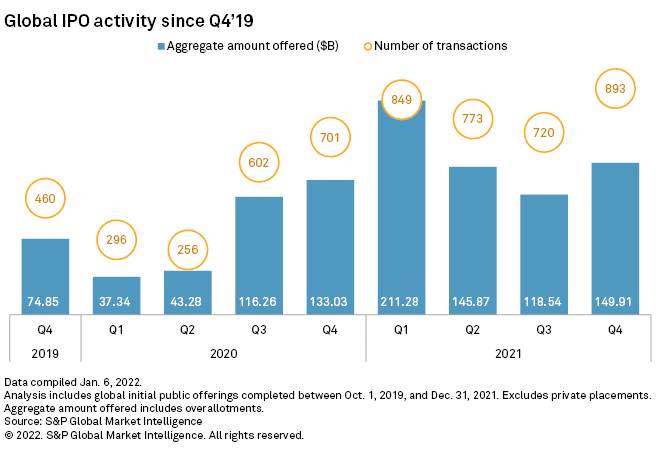

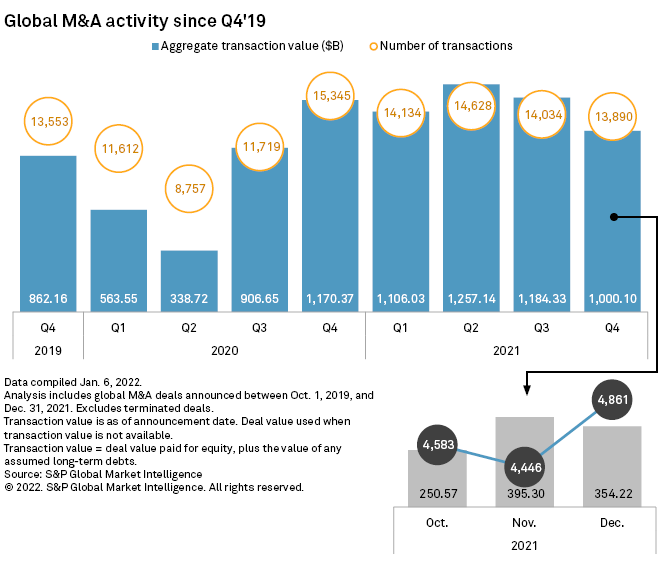

Increased market volatility poses a risk to deal-making in 2022 after IPOs and M&A activity reached historic heights in 2021.

The fourth quarter of 2021 marked the fifth straight period in which the total announced value of global M&A activity topped $1 trillion. Before this streak, deal announcements had not crossed the $1 trillion threshold for three consecutive quarters, according to S&P Global Market Intelligence data that stretches back to the 1990s. Accommodative financing markets helped fuel large M&A transactions, with low interest rates on debt financing and open capital markets giving buyers the wherewithal to execute large deals. Looking ahead, the Federal Reserve's efforts to combat inflation in the U.S. market could slow M&A activity, with higher interest rates leading to more expensive deal financing.

The IPO market faced a particularly difficult year-over-year comparison headed into 2022, and the activity through the first two months of 2022 paced significantly behind levels witnessed early in 2021. Through the first two months of 2022, 282 global IPOs came to market, down 43.0% from the same period in 2021, while the total amount raised plunged 66.1% to $128.1 billion, according to S&P Global Market Intelligence data.

The IPO totals in the first two months of 2021 were boosted substantially by the fever pitch surrounding special purpose acquisition companies, which reached its height in the first quarter of 2021. While SPACs had been able to price in the early part of 2022, executing any IPO has been more challenging with the increased market volatility stemming from the escalation of the Russia and Ukraine war.

During the week ended March 2, the VIX — the Chicago Board Options Exchange S&P 500 volatility index — recorded an average close of 30.4, up 26.7% from the year-to-date average close of 24.0 recorded through Feb. 25, 2022.

Volatility leads to fluctuating stock prices and complicates M&A activity as parties have more difficulty agreeing on deal terms and executives lose confidence in the economic outlook. Through the first two months of 2022, global M&A totals tracked behind 2021 numbers. As of Feb. 28, the total value of announced M&A dropped 25.5% to $517.93 billion from the same period a year earlier, while the number of announcements was down 8.1% to 7,928.

In 2021, the M&A market had a tailwind, benefitting from pent-up demand that developed when deal-making stalled during the height of COVID-19 pandemic. Still, large M&A deals have surfaced in 2022.

A total of six $10 billion-plus M&A deals were announced through the first two months of 2022, which is on pace with the nine announced during the entire 2021 first quarter. Two of the 2022 deals came on Feb. 28, when The Toronto-Dominion Bank announced a $13.54 billion deal for First Horizon Corp., and Healthcare Trust of America Inc. and Healthcare Realty Trust Inc. announced an $11.21 billion combination.

The large deals came to market even with the recent market volatility. Bigger deals in the U.S. also face the prospect of increased of regulatory scrutiny as the Biden administration has said it wants to reduce "the trend of corporate consolidation" in an effort to promote competition in the American economy. Elevated inflation also serves as headwind to deal activity and is expected to prompt the Fed to raise interest rates and thereby increase the cost of financing.

While the obstacles have not derailed deal-making to start 2022, they have helped depressed activity when compared to 2021.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Theme