Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 26 Apr, 2021

By Alice Yu

Highlights

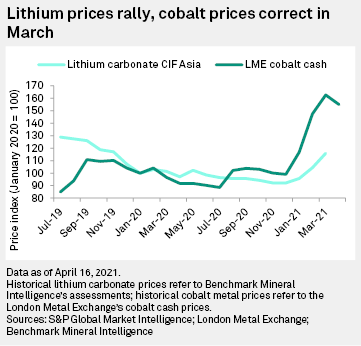

The lithium carbonate CIF Asia price rose 11% in March to $10,000 per tonne — the biggest monthly increase since the price recovery began in January.

The lithium carbonate CIF Asia price rose 11% in March to $10,000 per tonne — the biggest monthly increase since the price recovery began in January. There are signs prices are nearing a peak, however, with an improving supply outlook.

Cobalt prices declined sharply at end-March and into April on expectations of an easing supply-chain bottleneck; prices stabilized at $22.60 per pound April 16.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Webinar

Blog

Products & Offerings