S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Blog — 11 Sep, 2023

By Sidiq Dawuda

Knowing When It's Time to Act: Detecting the Early Warning Signs of Surgalign Holdings Inc. Bankruptcy

Author: Sabrina Steinberga, Sidiq Dawuda

This blog is written and published by S&P Global Market Intelligence, a division independent from S&P Global Ratings. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings.

Business Description:

Surgalign Holdings, Inc., (Surgalign) founded in 1997 and was based in Deerfield, Illinois. It operated as a medical technology company, developing, manufacturing, distributing spinal hardware implants and biomaterial products worldwide. Surgalign sold its products through independent distributors such as hospitals, surgery centres, and healthcare providers. On the 19th of June 2023, the company along with its affiliates, filed for bankruptcy under Chapter 11 in the US Bankruptcy Court for the Southern District of Texas.

Bankruptcy Summary:

Throughout 2022, Surgalign struggled to support itself and its financial costs. Initially, trying to increasing their cash flow by cutting costs, and, selling two of their orthopaedic product lines to Xtant Medical Holdings, Inc. (Xtant) for $17 million.[1] However, they continued to encounter difficulties. In the end, Surgalign filed for bankruptcy, and, agreed to sell its US hardware and biomaterials assets to Xtant for $5 million.[2] In addition to the company's financial woes– they entered a 12-month period where they faced charges and were threatened with being delisted by the Nasdaq. Then, on the 19th of June 2023, Surgalign filed for bankruptcy with the intention to sell off their remaining assets.

Fundamental Probability of Default Analysis:

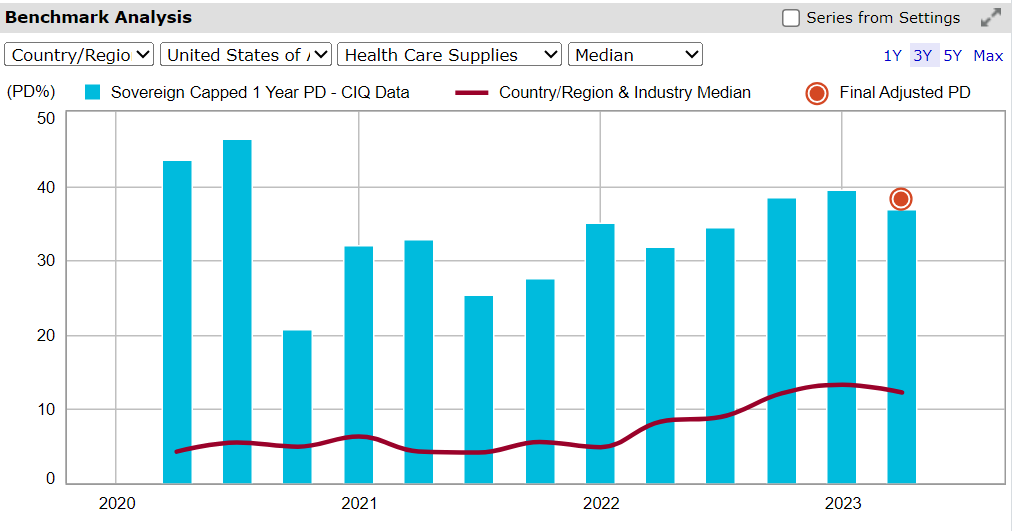

Surgalign maintained a probability of default (PD) that was in the worst 25% of the Health Care Supplies Industry in Q1 2023 versus the benchmark of their peer group in the United States (US). As per Figure 1, on the 31st of March 2020, the PD was at 43.59% which is greater than the benchmark (red line) at 12.34%. This high PD highlights how Credit Analytics’ models were able to reflect the higher risk that investors in the company faced. The last noted PD before the company went into bankruptcy on 31st March 2023 was at 36.88%. As of the 1st of July 2023, the company had defaulted and entered bankruptcy, with the Fundamental PD updated to 100% to reflect the defaulted state of the obligor.

Figure 1 – Benchmark Analysis:

Source: Credit Analytics from S&P Global Market Intelligence. Data as of 23 August, 2023. For illustrative purposes only.

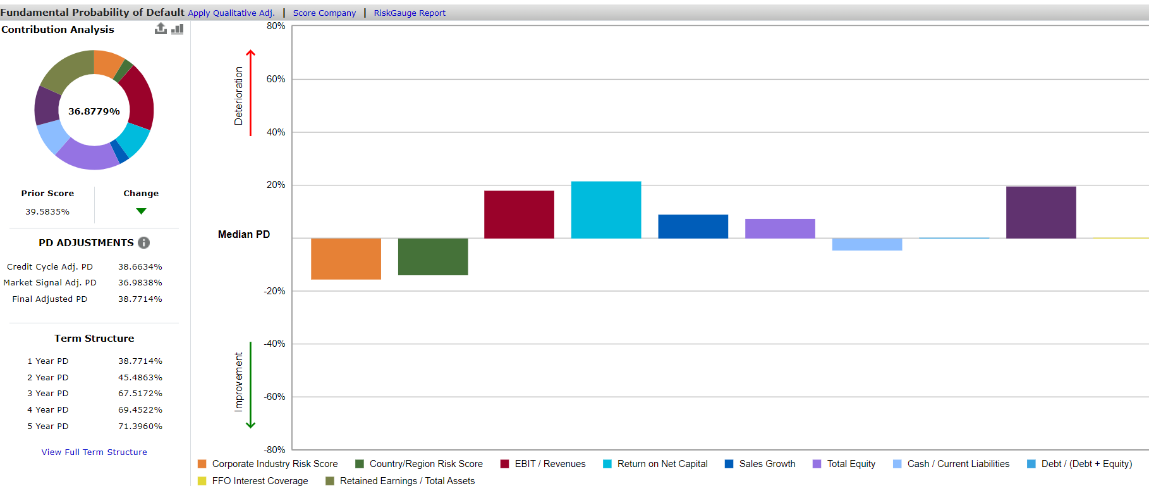

As seen in Figure 2, the most significant financial factor impacting the performance of Surgalign is the retained earnings/ total assets. This ratio shows and measures the profitability of the assets in a company. It was at –915.75%, versus the country and industry median of –54.96% which resulted in a 69.19% increase in the PD. In addition, the return on net capital is the second most influential financial factor increasing the firm’s risk by 21.68% relative to the peer median. It measures the company’s efficiency at generating profits from its total assets calculated by dividing the company’s net income by the total amount of its fixed assets and net working capital. The combination of this multitude of factors led to the decline of Surgalign.

Figure 2 – Fundamental Probability of Default:

Source: Credit Analytics from S&P Global Market Intelligence. Data as of 23 August, 2023. For illustrative purposes only.

Figure 3 - Key Developments:

|

Date |

Type |

Headline |

|

28th July 2023 |

M&A Transaction Announcements |

Augmedics, Inc was selected as the successful bidder to acquire the Digital Health Assets of Surgalign Holdings, Inc. for $0.9 million |

|

30th June 2023 |

Bankruptcy – Asset Sale/ Liquidation |

Bidding Procedure Approved for Surgalign Holdings Inc. |

|

30th June 2023 |

Index Constituent Drops |

Surgalign Holdings, Inc. Dropped from NASDAQ Composite Index |

|

23rd June 2023 |

Delistings |

Surgalign Receives NASDAQ Delisting Notice Following Its Chapter 11 Filing |

|

23rd June 2023 |

Index Constituent Drops |

Surgalign Holdings Inc. Dropped from S&P TMI Index |

Rising default rates and economic headwinds are putting a spotlight on the importance of robust, forward-looking models that combine both financial and macroeconomic variables to provide a clear and transparent view of a company’s credit risk profile. RiskGauge™ from Credit Analytics not only pinpoints a company’s potential weaknesses but also provides a wider market context that enables informed conclusions and decision-making.

To request a sample of the RiskGauge™ Report for Surgalign, or to learn more about our timely signals, unrivaled insights, and leading data, please get in touch.

[1] Xtant Medical Acquires Coflex® Product Line from Surgalign for $17 Million :: Surgalign Holdings, Inc. (SRGAQ)

[2] Surgalign Enters Into Definitive Agreement to Sell Global Hardware and Biologics Business Through a Structured Sale Process Under Chapter 11 of the U.S. Bankruptcy Code :: Surgalign Holdings, Inc. (SRGAQ)