Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 20 Mar, 2024

Key takeaways: Conquering risks in the banking sector

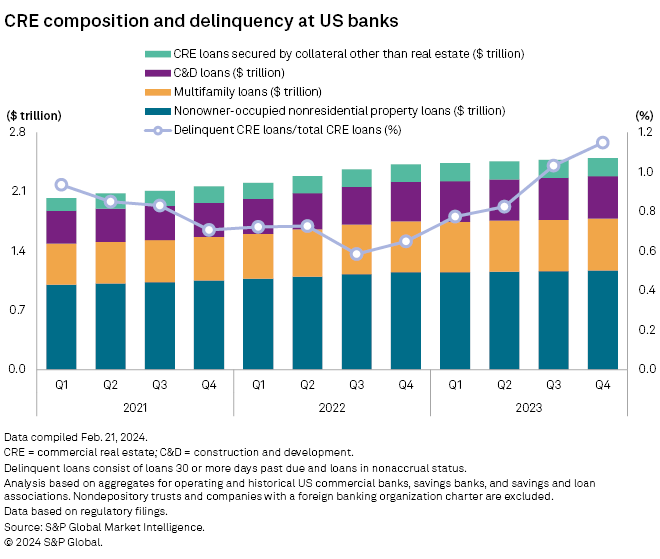

Banks came out of the COVID-19 pandemic relatively unscathed and are now enjoying bumper profits thanks to higher interest rates in many major global markets. Yet the risk environment is arguably more complex than ever for lenders. Wars in Ukraine and the Middle East have heightened existing geopolitical tensions. Higher borrowing costs and a post-pandemic shift in working habits have revealed fragility in the commercial real estate segment. Digitalization means bank runs can now cripple lenders in minutes rather than weeks. And that’s not to mention climate risk, or the massive growth of the opaque non-bank financial institutions segment.

Thankfully, there are tools and strategies that banks can deploy to confront these challenges. Here are some of the approaches discussed on the webinar:

Look beyond the surface

A high-level look at CET1 and liquidity coverage ratios in the US, Europe and Asia-Pacific showed a healthy state of affairs. Banks are generally well capitalized and have sufficient headroom in case of unforeseen challenges. However, in order to gain a full picture of a bank’s health, one should look at the underlying components of these metrics. For example, when looking at a bank’s liquidity coverage ratio, diving deeper into the funding structure — be it secured lending, retail deposits or wholesale funding — can give a better understanding of what is driving changes over time and where risks may emerge.

Understand reporting requirements

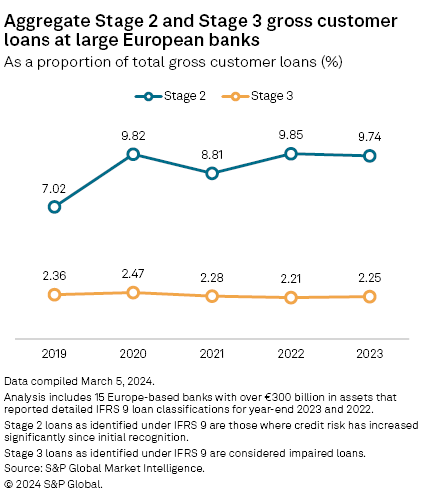

When assessing counterparty risk or making investment decisions, reliable data is essential. IFRS 9 loan staging data can give an excellent insight into credit quality among European banks, but in the US you will need look at different metrics to gain the same knowledge.

Even within widely adopted accounting standards there can be nuances in what is captured. To understand more granular exposures, there is often little consistency between banks, which places a greater emphasis on manual data collection, research and news. This is particularly the case for commercial real estate, where subsegment classification and data availability can vary significantly. Knowing the requirements and limitations of a bank’s reporting can help identify potential blind spots.

Utilize the power of AI

Ramping up the use of data, natural language processing and AI can revolutionize credit risk. These tools can speed up and scale routine tasks, and help detect emerging areas of risk long before they hit the mainstream. One example is text sentiment indexes, which can parse large volumes of information from a range of sources and languages. When layered with company fundamentals, pricing data and other elements, this can create a more rounded view of credit risk. One of the next steps in this evolution is the integration of generative AI, which can provide a user with an instant response to a query relating to, for example, a counterparty’s credit quality. However, it is important to remember that these systems can only respond to the user’s input and rely on the accuracy of the data they are sourcing from, so caution should be taken when using such tools.

To learn more about our data and solutions that will help you address risks in the banking segment visit S&P Capital IQ Pro and Ratings Direct®.