Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 30 Nov, 2021

By Louis Bacani

Exclusive features and news analysis of key sectors and markets. Subscribe on LinkedIn >

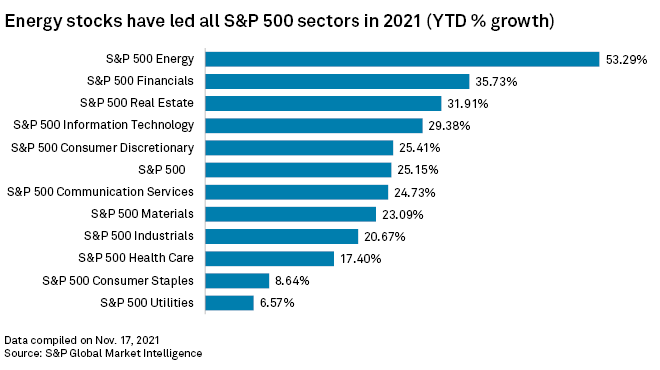

In this edition, we take a close look at the year-to-date performance of the U.S. stock market, which has become an unlikely haven for investors as inflation surges to levels not seen in decades. Since the start of 2021, the S&P 500 has jumped more than 25%. Energy has led all sectors due to increases in crude oil and fuel prices caused by rising demand and limited supply growth. Strong corporate earnings also have boosted stock prices and stoked a risk-on sentiment that is expected to continue through the rest of 2021 and into 2022.

The U.S. banking industry could see a slowdown in M&A activity due to a backlog of bank deal applications at the Federal Reserve. Though delays in Fed approvals seem to be limited to the largest pending deals, banks of all sizes are hyperaware of the regulatory environment and considering if now is a good time to strike a deal, one deal adviser said.

COVID-19 vaccine makers AstraZeneca and Moderna missed EPS estimates for the third quarter, while the majority of the 19 top biopharmaceutical companies, including Johnson & Johnson, Pfizer and BioNTech exceeded analysts' expectations. AstraZeneca recorded a jump in quarterly revenue but took a hit from higher research and development costs. Moderna slashed its COVID-19 vaccine sales outlook due to manufacturing delays and slowing demand in wealthier countries.

Chasing riskier bets, investors push equities higher

Investors are chasing riskier bets as strong corporate earnings push stock prices higher and the Federal Reserve's pandemic-era economic support begins to wind down.

Read the full article from S&P Global Market Intelligence

Inflation drives investors to US stocks

As inflation runs up to levels not seen in over 30 years, some S&P 500 sectors are rallying.

Read the full article from S&P Global Market Intelligence

In-depth features looking at the impact of major news developments in key industries.

Financials

Deal delays dampen US banks' M&A appetite

The current regulatory environment, in which several U.S. bank deals are facing delays as they await regulatory approval, is giving would-be buyers and sellers "some pause," one deal adviser said.

Read the full article from S&P Global Market Intelligence

Overdraft fees rise in Q3 but long-term trends point downward

U.S. banks pared a coronavirus slump in overdraft fees, as shop re-openings and an economic rebound provided some respite from an industrywide shift away from charges.

Read the full article from S&P Global Market Intelligence

Asian banks' debt raising falls off cliff in October on China property concerns

Banks in the Asia-Pacific region raised about $5.11 billion by issuing debt securities in October, compared to more than $26 billion in the previous month, according to data compiled by S&P Global Market Intelligence.

Read the full article from S&P Global Market Intelligence

Japan's megabanks face higher credit risk after government subsidy ends

Bad loans at Japan's three megabanks may rise further as many borrowers, still struggling with the aftermath of the pandemic, will be forced to start paying interest on their loans after a government subsidy program ended.

Read the full article from S&P Global Market Intelligence

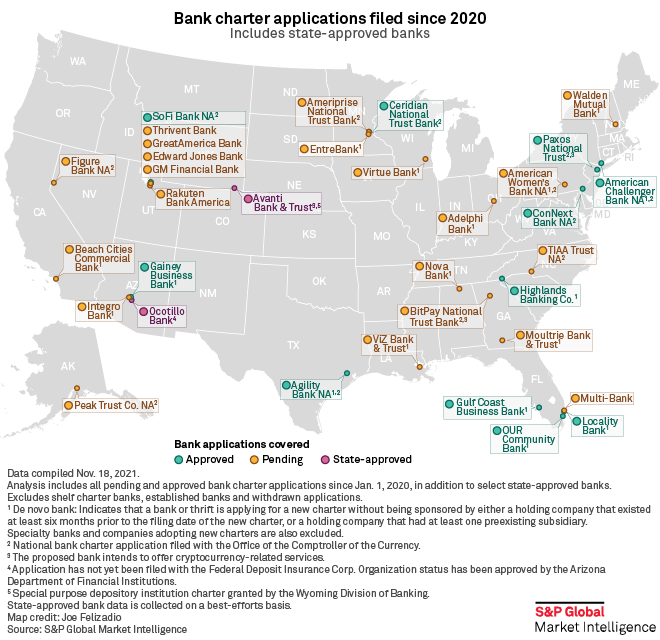

US new bank charter applications of 2021: De novo activity surpasses '20

A digital bank in Wisconsin targeting retail customers and a Florida bank seeking institutional clients are the latest bank charter applications.

Read the full article from S&P Global Market Intelligence

Insurance

Claims severity remains painful for largest US personal auto insurers

More serious auto accidents and inflationary pressures continue to push up insurers' average cost of claims in the private auto market.

Read the full article from S&P Global Market Intelligence

Healthcare

COVID-19 shots fail to immunize drugmakers from EPS misses in broadly upbeat Q3

Sixteen of the 19 top biopharmaceutical companies surpassed analysts' EPS forecasts for the quarter, with only Eli Lilly, AstraZeneca and Moderna missing their estimates — though each of the stragglers painted a picture of a brighter future.

Read the full article from S&P Global Market Intelligence

Real Estate

US hotel sector gains popularity with investors, leading to take-private deals

The U.S. hotel sector has seen deal volumes tick up throughout 2021, signaling a recovery from the hefty impact of the coronavirus pandemic. Improving fundamentals have attracted more investors to the sector, including private capital.

Read the full article from S&P Global Market Intelligence

Self-storage occupancy gains to taper off, leading to growth slowdown

Average occupancy at U.S. self-storage facilities is at unusually high levels, suggesting that demand will slow in 2022.

Read the full article from S&P Global Market Intelligence

Technology, Media and Telecommunications

Media sector's capital markets activity falls to new low in October

The media sector raised about $445.3 million from debt offerings and $3 million from common equity offerings last month. That compared to aggregate raises of $6.53 billion across offering types in September.

Read the full article from S&P Global Market Intelligence

Energy and Utilities

Institutions buy into shale gas stocks in Q3 as commodity prices shoot higher

Led by Blackstone, several private equity firms and Stanford University's endowment fund began to dip into pure-play shale gas stocks after the NYMEX gas price nearly doubled in 2021.

Read the full article from S&P Global Market Intelligence

European utilities surf price surge, escape clawback measures in Q3

European utilities largely exceeded analysts' EBITDA expectations in the third quarter, cashing in on surging power prices while less impacted by regulatory interventions than expected.

Read the full article from S&P Global Market Intelligence

Oil, gas deal values plunge in October despite major pipe deals

The combined value of whole-company and minority-stake deals in October plummeted by $21.92 billion over the prior-year period, while the value of asset-level transactions fell 53%.

Read the full article from S&P Global Market Intelligence

Metals and Mining

Bullish signals give uranium producers hope for market turnaround

Decreased supplies, higher prices and rising interest in nuclear power have encouraged major uranium producers to think long-term contracts from nuclear power utilities will follow.

Read the full article from S&P Global Market Intelligence

Mining companies flag rising inflation in Q3'21, climbing costs into 2022

Mining sector executives and analysts highlighted significant cost increases in fuels and other inputs as well as challenges in the labor market.

Read the full article from S&P Global Market Intelligence

The Week in M&A

Ericsson dials into enterprise wireless market with $6B Vonage buy

Read full article

Simmons First buying Spirit of Texas Bancshares in $581M deal

Read full article

October extends infotech M&A boom as new adviser mediates top deal

Read full article

Data center REITs CyrusOne, CoreSite Realty acquired in all-cash deals

Read full article

The Big Number

Trending

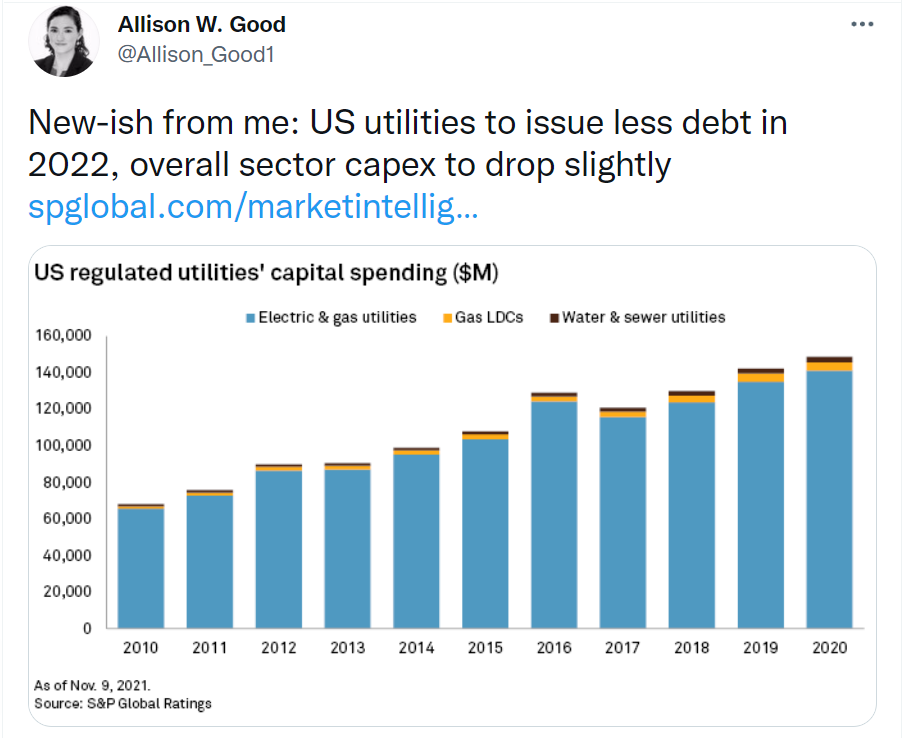

—Read more on S&P Global Market Intelligence and follow @Allison_Good1 on Twitter.

S&P Capital IQ Pro. A single platform for essential intelligence.

Do you need a single source of industry intelligence? Discover the S&P Capital IQ Pro platform. Bringing together an unrivaled breadth and depth of data, news, and research, combined with tech-forward productivity tools. All in one platform that powers your edge.

Discover your power >

The Big Picture.

Summarizing the key themes impacting companies and industries, around the world, in 2022.

[Reports] 2022 Outlook Reports - A look ahead to the key strategic trends and opportunities expected through 2022 and beyond.

Access Reports >

Additional Insights from S&P Global Market Intelligence

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions. Click here to subscribe.

Policy Intel: Explore exclusive news and research on policy and regulatory developments in the U.S. and around the globe. Click here to subscribe.

Essential Healthcare: Our guide to the week's top headlines in pharmaceuticals, biotech, hospitals, medtech and more. Click here to subscribe.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories. Click here to subscribe.

NEXT: Stay up-to-date on how technology is reshaping the future of industries across global markets. Click here to subscribe.