Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 18 Oct, 2022

By Sarah Cottle

In this edition of Insight Weekly, we take a look at potential outcomes of the U.S. midterm elections. Based on strong ties between most of the Democrats in Congress and strict generic congressional party polls, IHS Markit expects the Democrats to hold the Senate, and Republicans to take the House of Representatives. The next most likely scenario would see the Democrats emerge with a majority in both the congressional chambers. The party is expected to benefit from the U.S. Supreme Court's decision to overturn federal abortion rights and a favorable Senate map. Results of key individual races and control of Congress will shape the direction of national climate and energy legislation over the next two years.

Surging interest rates and reducing liquidity in financial markets are driving borrowing costs higher around the world. Due to weakening investors interest in the global sovereign bonds, the benchmark U.S. 10-year Treasury bond yielded 3.89% as of Oct. 7, up from 1.63% in the beginning of the year.

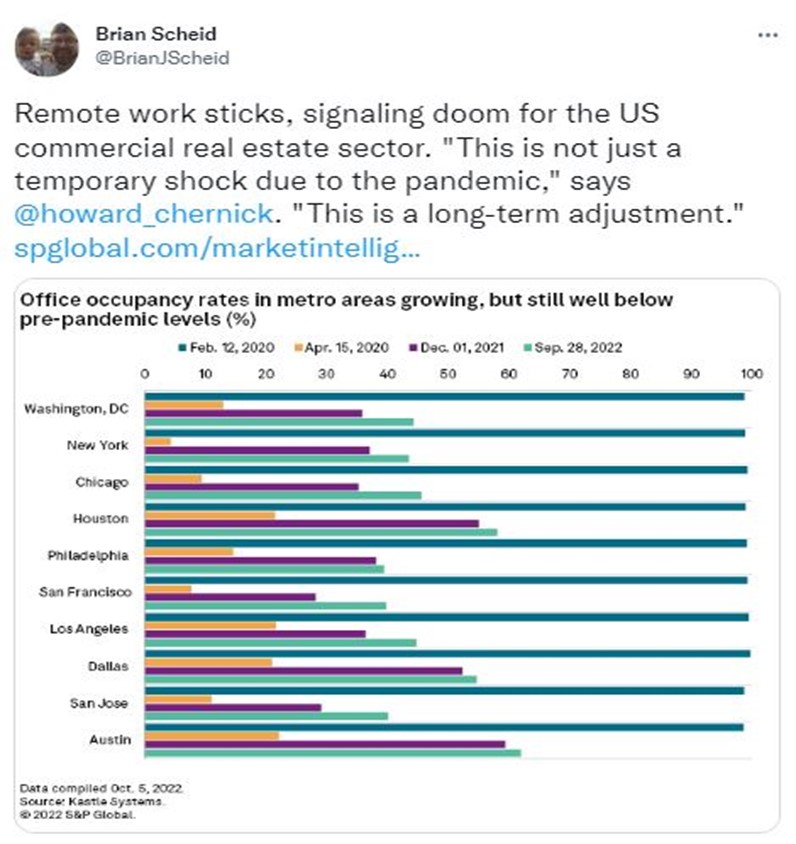

The U.S. commercial real estate market is expecting to deteriorate due to increasing demand from employees to work remotely. Average office occupancy across 10 major U.S. cities was at about 47% at the end of September, according to Kastle Systems, more than 50% below the prepandemic levels, or up from 36% in 2021.

Forward this email to colleagues so they can subscribe to Insight Weekly.

Need help getting set up on the S&P Capital IQ Pro platform? We’ve made it simple for you to access by using your existing S&P Capital IQ credentials. Learn more >

The Big Number

Read more on S&P Global Market Intelligence

Trending

—Read more on S&P Global Market Intelligence and follow @Brian Scheid on Twitter.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

Questions or feedback? Contact Steve Matthewson (steve.matthewson@spglobal.com) at S&P Global Market Intelligence.

Theme

Location