Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 31 May, 2022

By Sarah Cottle

Today is Tuesday, May 31, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

In this edition, we take a close look at the bond issuance of Asia-Pacific banks. Bond issuance remains subdued as rising interest rates across the world and concerns over the negative impacts of China's COVID-19 lockdown measures create uncertainties for both issuers and investors. But looking ahead, analysts expect some improvement in bank bond issuance in the region. In India, several banks plan to raise funds in the bond market, seeking to take advantage of still-low interest rates before the central bank embarks on a policy tightening cycle.

The global insurance industry disclosed roughly $1.3 billion in collective losses and reserve charges related to the Russia-Ukraine war in the first quarter, according to an S&P Global Market Intelligence analysis. Insurers and reinsurers in Europe were hit particularly hard, with some signaling that losses may impact future earnings as the situation escalates.

After soaring in 2021, the market for special purpose acquisition companies is falling back to earth in 2022. SPAC mergers, which bring private companies into public markets without a traditional IPO, have declined in value from a record 2021 and fewer new SPACs are coming to market, according to S&P Global Market Intelligence data. Some investment banks have pulled back on their SPAC businesses and private investment in public equity financing for SPACs has slowed, experts say.

The Big Number

Trending

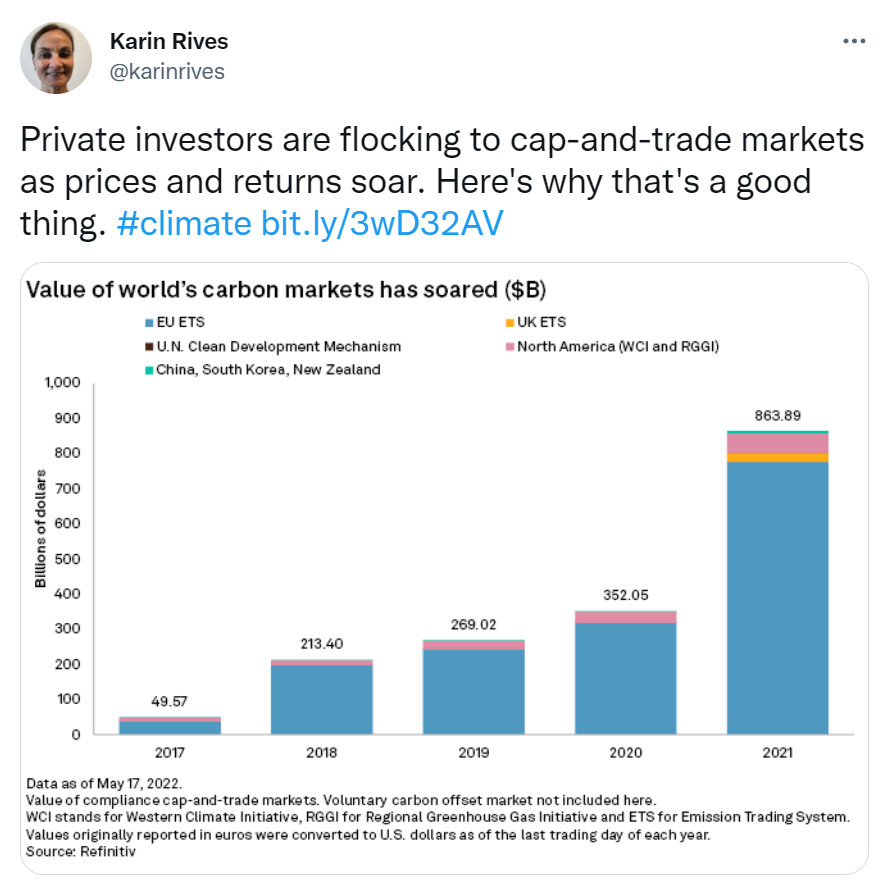

—Read more on S&P Global Market Intelligence and follow @karinrives on Twitter

Seek & Prosper

Essential Intelligence from S&P Global — a powerful combination of data, technology, and expertise — helps you push past the expected and renders the status quo obsolete. Because a better, more prosperous future is yours for the seeking.

Additional Insights from S&P Global Market Intelligence

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions. Click here to subscribe.

Policy Intel: Explore exclusive news and research on policy and regulatory developments in the U.S. and around the globe. Click here to subscribe.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories. Click here to subscribe.

NEXT: Stay up to date on how technology is reshaping the future of industries across global markets. Click here to subscribe.

Written and compiled by Louis Bacani

Theme