Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 29 Mar, 2022

By Sarah Cottle

Today is Tuesday, March 29, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

In this edition, we examine the market impact of rising U.S. interest rates. The Federal Reserve has raised its benchmark federal funds rate for the first time since 2018. Fed officials forecast six more rate hikes in 2022 and three more in 2023, further flattening the Treasury yield curve and boosting the odds of triggering a recessionary indicator. The jump in corporate borrowing costs tied to rising interest rates would pressure companies on the verge of default or bankruptcy, though struggling players still have plenty of options to stay afloat.

U.S. banks repurchased $75.02 billion of common shares in 2021, more than double the $31.99 billion in 2020 buybacks, according to S&P Global Market Intelligence data. Banks accelerated share buybacks last year after the Fed relaxed its restrictions on capital distributions by big lenders. In 2022, analysts are expecting a slowdown in share repurchases, with banks nearing internal targets, loan growth picking up and some banks heading toward higher buffer requirements.

U.S. coal producers are running out of customers and the situation is likely to get worse. Coal plants intending to close by 2030 received 26.9% of U.S. coal production in 2021, according to a data analysis by S&P Global Commodity Insights. Public health and environmental groups have put coal power under relentless pressure to clean up its high levels of air pollution, while the falling cost of renewables and low price of natural gas has undercut the economic case for coal.

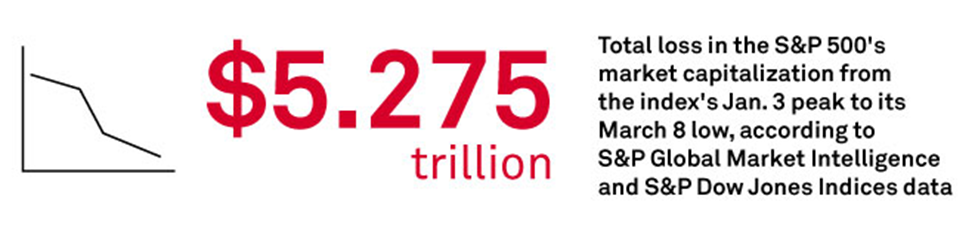

The Big Number

Trending

—Read more on S&P Global Market Intelligence and follow @taykuy on Twitter

Navigating Risks and New Realities

Geopolitical tensions are at an unprecedented high and markets are noticeably stressed. Explore the data and analysis you need to stay ahead of evolving conditions with insights on credit risk, supply chain, maritime & trade, economic & country risk, and more.

Written and compiled by Louis Bacani