Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 22 Jun, 2021

By Atif Hussain

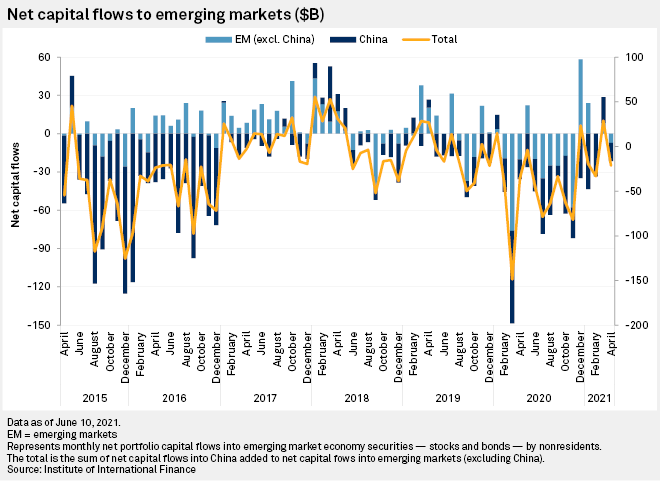

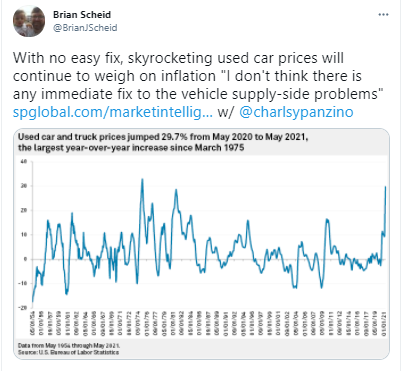

In this edition, we take a closer look at the U.S. Federal Reserve's stance on monetary policy and its impact on investment decisions. The Fed kept its benchmark federal funds rate at near-zero levels June 16, although most of its officials expect at least one rate hike in 2023. Yield-starved American investors who have shied away from emerging markets so far in 2021 are now turning to those very assets, signaling that they accept the Fed's messaging on the preservation of loose policy despite higher inflation signals. However, concerns still linger over prospects of the central bank narrowing its monthly bond purchase program, evoking memories of the 2013 "taper tantrum" exodus of capital from developing economies.

U.S. banks are feeling pressure from both politicians and competitors to adjust their overdraft fees, which account for a significant portion of revenue at some lenders. "Federal regulators for too long were asleep at the switch allowing an incremental fee to become the main business model for a couple of banks," said Aaron Klein, a senior fellow at Brookings Institution. "The gravy train on overdraft is coming to an end."

In the energy sector, skyrocketing oil prices and a focus on discipline over growth have propelled energy stocks to the top of the S&P 500 so far this year. The rally came as oil and gas companies shifted their financial approach, favoring more conservative balance sheet management and debt repayment over supply growth.

Fed in Focus

Fed keeps rate near zero, but majority of FOMC members see hike in 2023

Thirteen of the 18 Federal Open Market Committee members now expect at least one rate hike in 2023, up from just seven in the Fed's last quarterly forecast. "The early market reaction showed that traders were caught off-guard by the hawkish shift in the Fed's interest rate projections," one analyst said.

— Read the full article from S&P Global Market Intelligence

Emerging markets appeal to US investors as taper tantrum fears ease

The Fed's commitment to loose monetary policy will likely benefit emerging-market assets as the returns on offer are attractive enough to make up for the possibility of a sell-off of risky assets.

— Read the full article from S&P Global Market Intelligence

Deep Dives

In-depth features looking at the impact of major news developments in key industries.

Financials

US banks facing competitive, political pressure to move away from overdraft

At a recent congressional hearing, politicians laid into CEOs of large banks over the amount of overdraft revenue their institutions collected throughout the pandemic. Bankers expect overdraft revenue to decline as they roll out more consumer-friendly products.

— Read the full article from S&P Global Market Intelligence

After strong Q1, global i-bank trading revenue growth set to slacken in Q2

The normalization in global investment banks' trading revenues will become more visible in the second quarter as trading volumes in key fixed-income and equities products start to decline and market volatility eases.

— Read the full article from S&P Global Market Intelligence

Indian banks, nonbanking financial companies chase gold rush in loan market

Indian financial institutions struck gold, quite literally, as the COVID-19 pandemic triggered a surge in loans against jewelry. Analysts say banks and nonbanking financial companies may increasingly tap Indian consumers sitting on a $1.5 trillion hoard of the yellow metal.

— Read the full article from S&P Global Market Intelligence

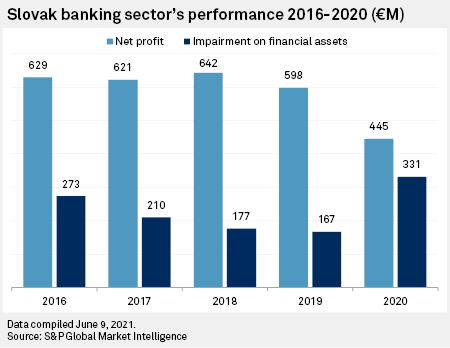

Slovak banks, resilient to pandemic, remain tested by low rates, credit risk

Slovak banks' profits declined by roughly a quarter in 2020, but local lenders will remain stable and resilient even if the economy or pandemic worsen, the country's central bank said in its latest financial stability report.

— Read the full article from S&P Global Market Intelligence

Energy and Utilities

Path to net zero: Investor pressure on oil, gas operators to cut emissions rises

U.S. firms trail behind European and Canadian peers in net-zero commitments, running the risk of falling out of favor with funds demanding more progress on greenhouse gas emissions reductions.

— Read the full article from S&P Global Market Intelligence

Path to net-zero: Energy, mining sectors crucial to broader decarbonization

Several new pledges to reach net-zero emissions emerged from the largest companies across the power generation, mining, and oil and gas sectors in the last six months, an S&P Global Market Intelligence assembly of climate targets shows.

— Read the full article from S&P Global Market Intelligence

As oil prices skyrocket, energy sector stocks rally after disastrous 2020

The S&P 500's energy sector climbed 44.5% from the start of the year through June 11, compared to the 13.08% growth in the overall S&P 500. Over the same period in 2020, the large-cap index's energy sector was down about 36.2%.

— Read the full article from S&P Global Market Intelligence

ESG

Most ESG funds outperformed S&P 500 in early 2021 as studies debate why

More than half of the environmental, social and governance-linked funds in this analysis outperformed the S&P 500 in the first several months of 2021. New studies laid out opposing views about the factors driving the trend.

— Read the full article from S&P Global Market Intelligence

Brazil's banking system braces for new ESG regulation

Brazilian authorities will require large and midsize banks to assess their climate and social risks on a portfolio level, focusing on such issues as land contamination, water shortage and the transition to a low-carbon economy.

— Read the full article from S&P Global Market Intelligence

Insurance

Annuity reinsurance battle heats up with new Brookfield vehicle's public listing

With a forthcoming public listing and a $2 billion equity commitment, Brookfield's new annuity reinsurer is targeting large-scale transactions akin to the $10 billion agreement in principle it struck in 2020 with American Equity Investment.

— Read the full article from S&P Global Market Intelligence

Credit and Markets

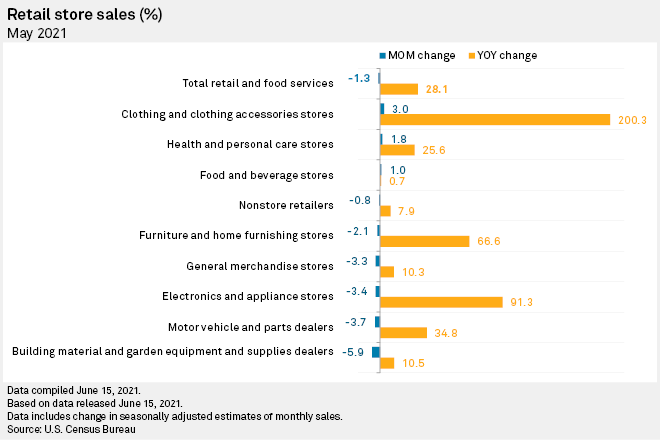

June retail market: US sales drop below expectations; 4 new bankruptcies

U.S. retail sales fell in May as stores in several categories reported less business than the prior month, though industry watchers remain optimistic about consumer spending as the economy continues to reopen.

— Read the full article from S&P Global Market Intelligence

The Week in M&A

Cerberus' purchase of HSBC's French unit could foreshadow more PE-bank deals

UAE's new capital rule could trigger further bank M&A in 'overbanked' market

What a combined Nordax-Norwegian Finans would look like

The Big Number

Trending

Read more on S&P Global Market Intelligence and follow @BrianJScheid on Twitter.

COVID-19 Impact & Recovery

Join us at our regional flagship events:

EMEA | The DNA of Innovation in a post-COVID World

APAC | The Drivers of APAC’s Strong and Fast Recovery | 22 June

AMERICAS | The Green, Digital and Tech Revolution | 24 June

Additional Insights from S&P Global Market Intelligence

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions.

Essential Healthcare: Our guide to the week's top headlines in pharmaceuticals, biotech, hospitals, medtech and more.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories.

NEXT: Stay up-to-date on how technology is reshaping the future of industries across global markets.