Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 31 Jan, 2023

By Sarah Cottle

Today is Tuesday, January 31, 2023, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

In this edition of Insight Weekly, we take a closer look at the U.S. economy as recession fears linger. U.S. bankers expect a downturn in the second half of 2023, if not sooner. Latest survey data from S&P Global show that the economy has started the year on a disappointingly soft note, with business activity contracting sharply again in January. The manufacturing sector might have entered a recession in late 2022 as consumers continued to shift away from goods and toward services.

Banks engaged in cryptocurrency-related assets have cut costs and pulled back from the space after increased regulatory scrutiny and deposit losses. In January, federal regulators warned of crypto-asset risks to banking organizations, including volatility and fraud. Several banks suffered heavy deposit losses related to digital assets in 2022 as prices and volumes declined, and three trading operating platforms filed for bankruptcy.

S&P 500's worst-performing sector in 2022, communication services, has rallied by 9.6% in the first three weeks of 2023. Nearly all communication services stocks that lost the most ground in 2022 have recorded sizable gains this year, including Match Group, Meta Platforms and Warner Bros. Discovery.

The Big Number:

Trending

—Read more on S&P Global Market Intelligence follow @SPGMarketIntel on Twitter

The Big Picture

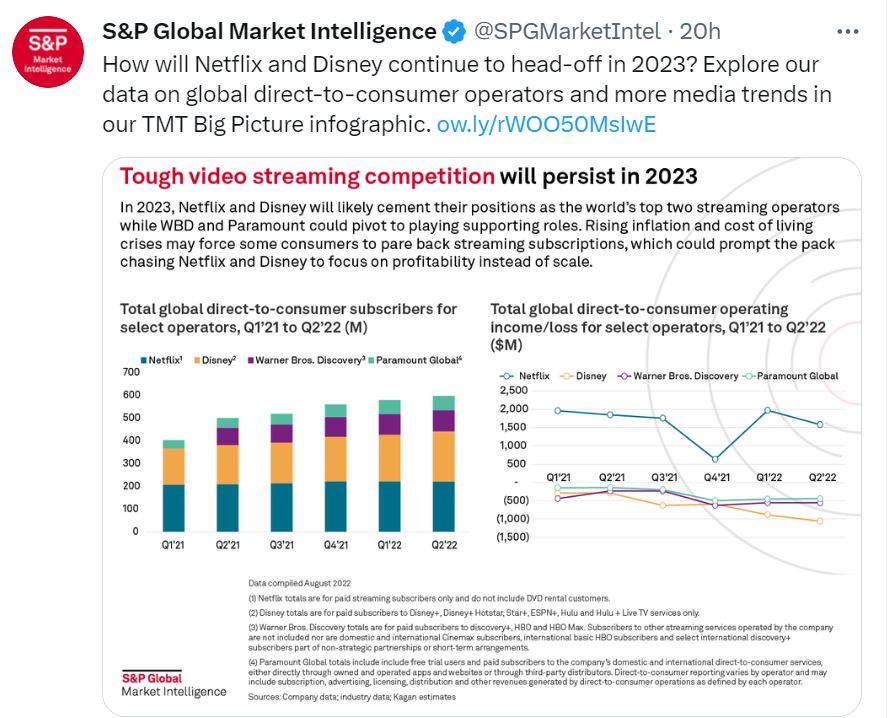

What will shape your big picture in 2023? How will disrupted supply chains, inflation, and new sustainability and M&A trends impact your sector? Our 2023 Big Picture Outlook reports can expand your perspective and enable decisions with conviction.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Written and compiled by Alex Virtucio

Theme