S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Blog — 3 Mar, 2023

This article is written and published by S&P Global Market Intelligence, a division independent from S&P Global Ratings. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings.

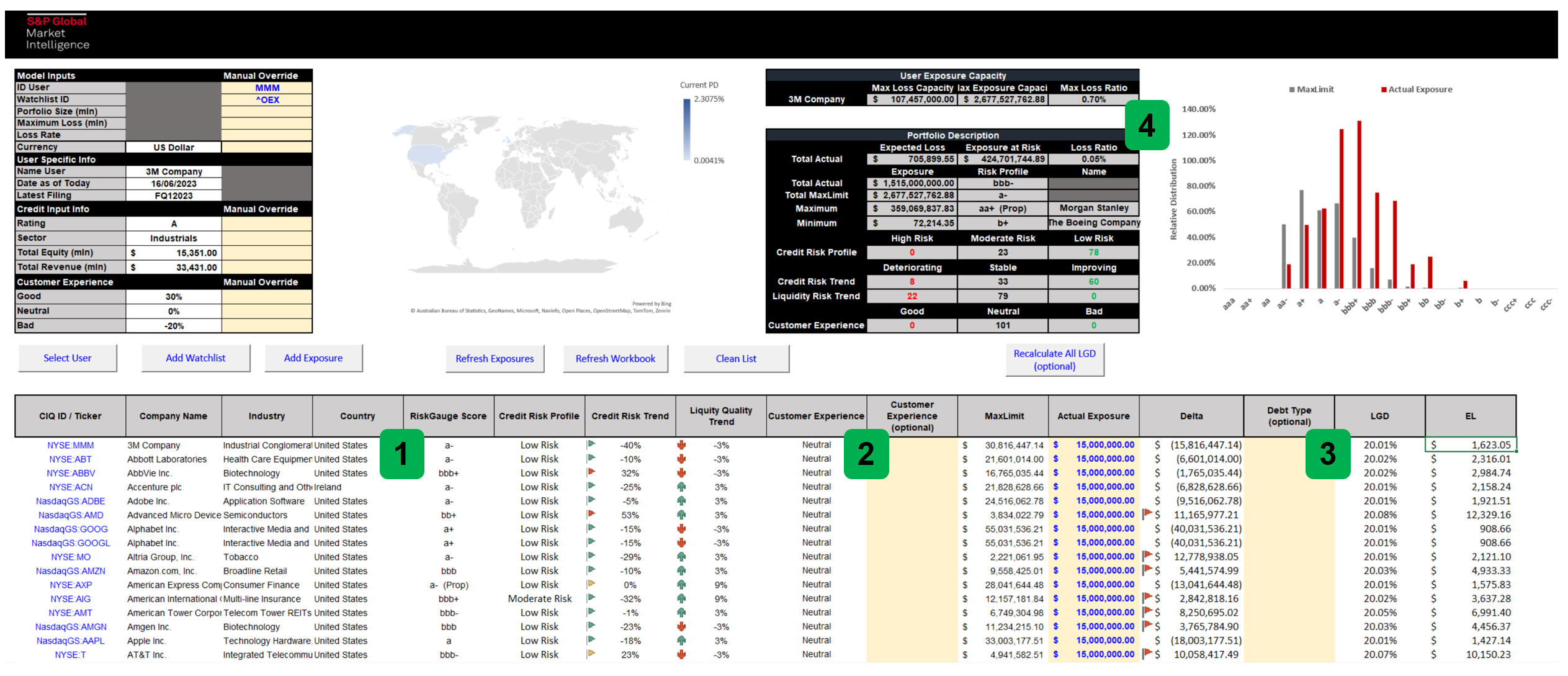

When a company assesses its exposure to counterparties, it is critical to understand its Risk Appetite (i.e., the theoretical maximum amount of risk they are willing to accept in pursuit of its strategic goals, such as profit or business growth). The MaxLimit (ML) framework from S&P Global Market Intelligence’s suite of quantitative Credit Analytics solutions helps you asses the optimal monetary exposure (or trade credit limits) towards counterparties by tackling the most difficult part of the calculation, assessing Risk Appetite.

ML defines Risk Appetite as the maximum monetary exposure the company is willing to withstand before its own credit score deteriorates by one notch. (e.g. deteriorating from ‘bbb’ to ‘bbb-’), conditioned to the counterparty’s risk profile and debt capacity. [1] [2] [3]

In order to assess the Risk Appetite, ML combines the following four steps in a comprehensive framework:

For every counterparty a company is exposed to, ML calculates the credit and liquidity risk profile. The credit risk profile considers holistically the counterparty’s financial and non-financial factors, the business size, and risk environment in which it operates. This is even possible when there is a lack of information about the counterparty by applying statistical techniques to analyze the business environment and a relevant peer group. The assessment of the credit risk profile is the first building block in assessing the trade debt capacity the counterparty can withstand before downgrading by one notch.

For the liquidity risk profile, it considers the changes in the counterparty’s industry characteristics in terms of average days payables and quick ratios (defined as the ratio between liquid assets and current liabilities). The liquidity risk profile also incorporates the counterparty’s debt environment by analyzing changes in the cost of servicing its short-term debt, embedding corporate bond market information. The assessment of the liquidity risk profile is crucial as it identifies changes and potential difficulties the counterparty might encounter financing its working capital facilities, which in turn might lead to subsequent challenges in servicing its trade payment commitments. Besides capturing changes in short-term debt spreads, inventory and cash available will also be factored, all factors that have proved to be fundamental in managing monetary exposures in the past few years (i.e., pandemic, inflation, and financial market crashes).

ML adjusts every counterparty’s risk profile by benchmarking it against its peers and deriving potential early warning signals. Adjusting the risk profile to its peers enables an adequate assessment of the counterparty by considering its business environment. This is done to avoid penalizing companies that might operate in riskier regions or industries but have a better credit quality than its peers. For both credit and liquidity risk profiles, early warning signals are calculated to help the ML user identify if there were significant changes in the counterparty’s risk profile and business environment in the most recent period.

ML users can incorporate proprietary payment experience and internal judgment to reflect company-specific business relationships, helping risk managers calibrate and manage monetary exposures and understand how different assumptions and conditions might impact the portfolio and risk appetite.

ML combines the three steps described above with the maximum monetary exposure capacity the company itself can withstand before deteriorating materially on its own risk profile (i.e., measured by a one credit score notch - deterioration).

This final step is fundamental as it intersects both the counterparty’s and company’s risk dimensions. Thereby it optimizes the monetary exposures to adequate levels, conditioned on the risk the company is surrounded by.

The exposure capacity and risk profile are calculated through statistical methodologies of combining financial and non-financial factors with the business size and risk environment.

Figure 1 outlines the workflow described above, tailored to the user’s profile. It visualizes each calculation step and transparently describes the rationale to determine the company’s risk appetite.

Source: S&P Global Market Intelligence, data as of February 2023. For illustrative purposes only.

Whether you’re looking to assess probability of default (PD) risk of unrated, or private companies with limited financials, generate a point-in-time credit risk view for public companies, or identify maximum exposure limits based on the analysis of a customer’s PD, liquidity risk, recovery, and a user’s risk appetite, Credit Analytics blends sophisticated models with robust data to help you reliably score and efficiently monitor your potential risk exposure to counterparties and investments across the globe.

Want to learn more? Request more information here

[1] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence PD scores from the credit ratings used by S&P Global Ratings.

[2] S&P Global Market Intelligence’s RiskGauge Model can be used to determine a credit score by analyzing multiple financial ratios and systemic risk factors that look holistically at the credit quality of an entity.

[3] Any notch move, such as a downgrade or upgrade, is referred to as the variation in credit score obtained via RiskGauge.

Products & Offerings

Segment