S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Blog — 9 Jan, 2023

By Kamil Zielinski and Kevin Zacharuk

On the morning of 15th April 2008, Lehman’s CEO Richard Fuld memorably told shareholders “the worst is behind us” with respect to the credit-market crunch that ultimately wiped $60 billion of value from the bank. Shortly afterwards, the executive added that his firm would sell assets and should be able to counter market rumours with strong performance. As the story famously played out, investors did not buy into Fuld’s statement and began to question the valuation of Lehman's mortgage portfolio. The company’s stock price resumed its decline, and five months later on September 15th 2008 the 161-year-old bank filed for bankruptcy protection, effectively wiping out investors.

Today, investors are putting safeguards in place to manage risk and reduce exposure to companies that may go through similarly difficult times. To do so, investors have added more sophisticated methods of analysis to their approach, such as Natural Language Processing, to identify and measure executive speech during earnings calls.

The primary goal of this new method of analysis is to quantify how executives truly feel about their performance and future prospects in a way that traditional financial analysis can’t tell us. While the idea of using NLP to score the sentiment of earnings calls has been used in practice for several years, NLP use cases have evolved to also measure how executives articulate references to key market-moving topics such as Revenue, Earnings, and Profitability, which can be a more powerful source of information than a simple sentiment score.

Studies have shown that when executives speak about key business drivers in a negative way, the company is more likely to see deteriorating fundamentals over several quarters.[1] As one would expect looking through history, challenging economic climates see executives more frequently reference key business drivers in a negative light.

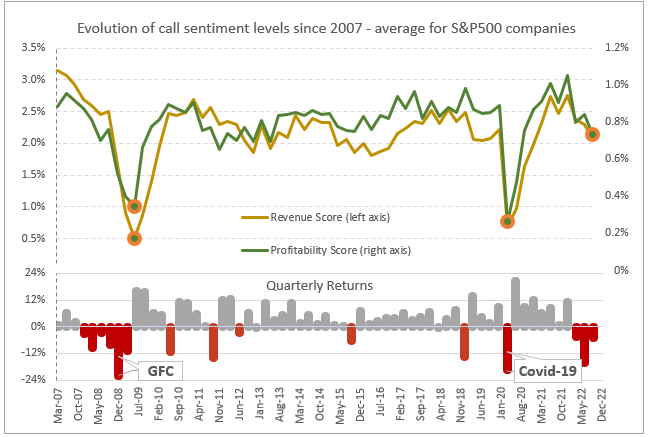

With most global markets still deeply “in the red” at the end of 2022, what does current executive sentiment tell us? The answer, unsurprisingly, is not overly positive. 2022 saw a reversal in positive references to sales, margins, and profit at an accelerating pace that shows similarities to the Global Financial Crisis and 2020 Covid-19-driven recession, warning investors of deteriorating executive optimism.

To estimate sentiment related to revenue and profitability, the algorithm searches for sentences containing words and expressions connected to these two topics. Subsequently, it labels the flagged sentences as positive or negative based on directional indicators, sums the values, and computes for each metric a Net Positivity Score.

The intuition behind capturing sentiment lies in the information asymmetry between executives and investors. Executives possess non-public knowledge of items such as major upcoming sales, pipeline growth/decline, and KPI performance that subconsciously influences how confidently an executive may speak during an earnings call which, if measured correctly, can imply future performance prospects.

When companies have been performing well historically, executives have often used more positive language to report earnings than when firms have been experiencing headwinds. While directionally intuitive, it also suggests executives are more eager to share good news and less inclined to share negative news, except where absolutely necessary. This subtle human tendency to overshare positive news and avoid negative news can be identified and scored using NLP in a way humans listening to earnings calls can’t. More specifically, by scoring only the sentences where executives reference key drivers such as revenue, profitability, and earnings, we can get a better interpretation of true executive sentiment.

However, a common challenge in measuring sentiment is ensuring that when an executive appears to display positive sentiment, the sentiment is genuine and not poor news being presented in a positive manner. NLP can also help solve this problem by identifying patterns in how executives speak to validate when positive sentiment is sincere, commonly referred to as behavioural metrics. To use an example to explain, if an executive spoke with language complexity that differs and is more complex than how that executive normally speaks during earnings calls, then there is an apparent behavioural change that may give less faith in the validity of the sentiment. On the flip side, an executive speaking with a consistent language complexity can help validate that an executive is demonstrating normal behaviour (i.e. Not attempting to present negative news positively), confirming that scored sentiment is more likely to be genuine and not with a behavioural bias. The intuition is that simpler language is preferred as it is direct and to the point, whereas more complicated language can hide or distort the message.[2] A look back at Lehman shows that the language complexity was considerably higher than the average of SP500 and that in 2008, listeners needed the equivalent of 17.5 years of formal education (i.e. a postgraduate degree!) to be able to follow the executive’s speech.[3] In an alternate scenario, when both a poor sentiment score and a subsequent negative remark blaming an external factor, such as the industry, market, or economy, is present within the same earnings call, the executive sentiment is likely to be more pessimistic than what the sentiment score alone suggests.

With much anticipation of what 2023 may hold, aggregating sentiment and behavioural scores for all executives in the S&P 500 can give us a consensus value reflecting the overall market sentiment to identify trends and patterns through prior periods of recession. Notably, each prior bear market since 2007 saw sharp reversals in sentiment followed by a very strong quarter exiting bear market territory as executive sentiment rebounded.

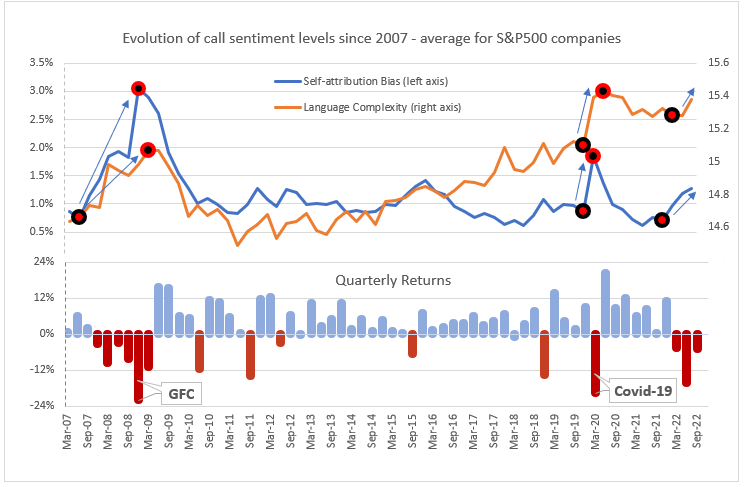

The same trend reversals can be seen in behavioural metrics such as the average language complexity of S&P 500 executives. However, a few additional trends may warrant further investigation in forecasting 2023 market performance based on executive sentiment and speech.

First, both highlighted behavioural metrics, self-attribution bias (ie. Blaming exogenous factors) and language complexity, are currently above the long-term average. This would suggest the genuine sentiment of S&P 500 executives may well be gloomier than what the sentiment score alone indicates.

Secondly, the chart below shows that a sudden deterioration (i.e. metric-value increase) in the behavioural metrics has historically preceded a substantial stock market selloff. If these trends replicate prior performance through bear markets, then as long as behavioural scores continue to deteriorate, there is unlikely to be a broader market rebound. If instead, we see a turnaround in call sentiment and transparency scores, then markets can be expected to follow executive sentiment higher shortly afterwards. For investors, the ability to monitor executive speech using NLP can help identify a potential inflection point at an early stage and fully capitalize on any post-recession rally that may occur.

The self-attribution-bias score reflects the standardized share of firms whose executives’ attributed softness in their numbers to the economy or industry For Language Complexity we use the Gunning Fog Index as a proxy, which indicates the number of years of formal education one needs to understand the language used. For both metrics, low scores are viewed favourably, and high scores unfavourably.

If we look at the prior recessions, the US financial sector displays considerably more unstable behavioural metrics than all other industries. It should come then as little surprise that the average levels of language complexity and self-attribution bias have recently increased far more for financial firms than even for energy and utility segments. In the upcoming months, investors should be therefore particularly cautious about the statements made by executives employed by the financial industry.

Worries about inflation, slowing growth, and hawkish central banking policies aren’t likely to disappear as we enter 2023. It’s too early to anticipate either a prolonged or deep recession as a probable outcome for the US economy, but several signs suggest concern is justified. By harnessing NLP to monitor genuine trends in executives’ speeches, either for the aggregate S&P 500 or individual companies, investors can avoid a surprise and instead let executive sentiment indicate the likelihood of various economic outcomes. We believe that a deeper understanding of the unintentional message within executive speech can help investors make more informed decisions in the upcoming months and ensure they are protected from both market and idiosyncratic risks. Earnings calls will continue to represent a critical source of information such that an astute investor can gain an edge in the large volume of textual data and implement low-risk strategies that are thoughtful and appropriately hedged.

For additional information and updates on future sentiment level, you can visit S&P Global Marketplace https://www.marketplace.spglobal.com All data used is sourced from the S&P Global Market Intelligence’s textual data suite.