Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 21 Oct, 2021

This article is written and published by S&P Global Market Intelligence, a division independent from S&P Global Ratings.

Financial Institutions have been facing challenges when accounting for U.S. municipal exposures to both rated and unrated issuers given the impact of the COVID-19 pandemic. During the pandemic, 90% of U.S. cities saw lower revenues and 76% higher expenditures,[1] leaving potential for reserve deterioration and a negative impact on credit quality. This blog looks at some of the effects of the pandemic on the sector.

The COVID-19 Pandemic and Municipals

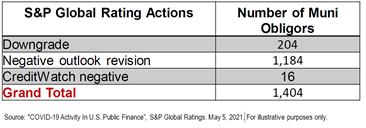

Looking at the impact of the pandemic on state, local governments, higher education, health care, transportation and utilities, S&P Global Ratings[2] saw 204 obligor-specific downgrades, as shown in Figure 1.

Figure 1: Impact of COVID 19 on State, Local Governments, Higher Education, Health Care, Transportation and Utilities.

As of January 2021, S&P Global Ratings’ view of the municipal sector remained negative, given the level of pressure brought on by the pandemic and the recession.[3] On March 11, 2021, however, the America Rescue Plan was signed into law to speed up the country's recovery, promising to benefit many. S&P Global Ratings revised all municipal sector outlooks to stable or change from where they were f or most of last year, with stable implying that the rating is unlikely to change during the outlook period, which is up to two years. There remains some concern as to how much support will be permanent and what might happen if it were to end. That said, the situation is better than a year ago, although sensitivities still exist in certain sectors, such as higher education, health care and transportation that have a higher percentage of credit negative outlooks than other municipal segments.

A Closer Look at the Pandemic Impacts

S&P Global Market Intelligence (“Market Intelligence”) did an analysis back in January of 2021 on the impact of COVID-19 on cities, counties and school districts using its proprietary models and Scorecards. From October 2020 onwards, U.S. municipal issuers started reporting their first audited financial statements for the period ending June 30, 2020. Using its Public Finance Automated Scoring Tool (PFAST), the Market Intelligence team reviewed the data for 1,548 municipal issuers to understand the impact of the pandemic on local governments. PFAST is a CUSIP-driven automated surveillance portfolio tool that generates credit sub-scores and final scores in minutes. These scores act as an early warning indicator by leveraging the most current financial and economic data updated monthly. The results of the analysis revealed five important findings:

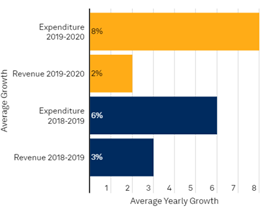

Figure 2: Expenditure Growth Outpaced Revenues in 2020

Source: “What’s the Bottom Line: Credit Impact of COVID 19 on US Municipals”, S&P Global Market Intelligence. February 23, 2021. For illustrative purposes only.

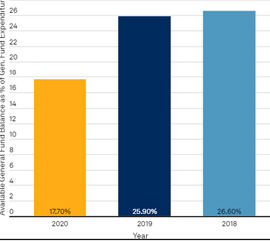

Figure 3: Faster Expenditure Growth Led to Lowe Reserves

Source: “What’s the Bottom Line: Credit Impact of COVID 19 on US Municipals”, S&P Global Market Intelligence. February 23, 2021. For illustrative purposes only.

Areas to Watch

As a path to recovery begins to unfold, future performance will likely depend on revenue stream affiliation, federal stimulus or other credit and geographical considerations. Market Intelligence believes there are several critical areas that should be closely watched. This includes:

U.S. states. It will be important to see how the Biden administration’s new direction on many policies − including stimulus programs, health care, trade and energy – will take hold. In addition, it will also be important to monitor further distribution and adoption of COVID vaccinations, which are essential for any return to normal levels of social and economic activity. Structural budget balances will also be key to maintaining credit quality, with states often maintaining balanced budgets by using reserves, cutting programs, or even instituting layoffs. Variations in terms of different regional economic conditions and responses to the pandemic will continue to have implications for credit quality.

Local governments. A large $155 billion stimulus package has been allocated for local governments, which is significant. Pressure at the state level from lower reserves can cause issues for local governments, however. In addition, economies that take longer to recover will continue to see more pressure on sales, taxes, and other revenues. The housing market is strong, and unemployment is improving, but retail and commercial recovery will take time to reach pre-pandemic levels.

Higher education. Successful vaccination is critical for in-person resumption of activities. State revenue pressure can especially affect public school funding, plus expenses related to COVID will likely yield weaker margins and make cash flow a greater priority. Challenges facing the education industry are not impacting all schools equally, so there will be haves and have nots.

Health care. Prevalence of COVID-19 cases and patient preference regarding elective health care are likely to vary across providers and regions. COVID-19 containment, the effectiveness of vaccine distribution and higher vaccination rates will help facilitate the return of volumes. Margin, revenue, and expense stress related to COVID-19 and industry shifts, especially labor challenges, may yield lower margins and weaker cash flows. Demand for services, proactive strategic management and institutional characteristics continue to support credit quality, but they do require substantial investment. In addition, credit quality may continue to widen between the stronger and weaker providers post COVID.

Transportation. An anemic and uncertain recovery, the collapse of transportation demand and evolving behaviors will pressure finances. There are large capital needs, and the pandemic has not changed long-term capital requirements to expand and replace aging infrastructure assets. Business and international travel (particularly intercontinental) will take longer to recover, and some business demand may be lost permanently to videoconferencing, as businesses scrutinize their budgets and fast-track their environmental agendas. Airlines with access to government support and capital markets have been able to build up cash, despite their heavy losses. Cash levels will likely decline somewhat for most airlines and, aside from a few strong low-cost airlines, unencumbered collateral to secure further borrowing is dwindling, so a turnaround in operating results is crucial.

Looking Forward

There has been a return to credit stability during the first two quarters of 2021, and S&P Global Ratings expects this to continue for the remainder of the year.[5] The rating distribution for U.S. public finance remains strong and negative outlooks represent about 6% of total ratings, compared to about 8% last year at this time. Despite these generally positive trends, challenges remain as the pace of vaccination has slowed and COVID variants have accelerated in the U.S. and globally. The recent rise of the delta variant again highlights the regional variations and uneven health outcomes that have been observed throughout the pandemic. It will be important for financial institutions to stay on top of the quickly changing municipal market to avoid unwanted risks and capitalize on any emerging opportunities.

[1] As of January 2021.

[2] Credit ratings are prepared by S&P Global Ratings, which is analytically and editorially independent from any other analytical group at S&P Global.

[3] “Outlook For U.S. Local Governments: Revenue Pressures Mount and Choices Get Harder”, S&P Global Ratings, January 6, 2021, www.spglobal.com/ratings/en/research/articles/210106-outlook-for-u-s-local-governments-revenue-pressures-mount-and-choices-get-harder-11789912.

[4] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit model scores from the credit ratings issued by S&P Global Ratings.

[5] “U.S. Public Finance Mid-Year Outlook: Beyond COVID?”, S&P Global Ratings, July 22, 2021, www.spglobal.com/ratings/en/research/articles/210722-u-s-public-finance-mid-year-outlook-beyond-covid-12047926.

RatingsDirect®

PFAST

Products & Offerings

Segment