Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 20 Feb, 2024

By Sidiq Dawuda

This blog is written and published by S&P Global Market Intelligence, a division independent from S&P Global Ratings. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings

Business Description:

Golden Developing Solutions (OTCPK: DVLP) was an American company founded in 1998, based in Fort Lauderdale, Florida. The company was in the health and wellness sector, providing rapid delivery of medical products and services in the United States. Golden Developing Solutions specialized in producing cannabidiol (CBD), hemp oil, vitamins, and supplements. The company started to face financial difficulties, thus, delaying their SEC (Securities Exchange Commission) filings, demanding a shareholder’s vote as per 14A, and finally ending in the company filing for Chapter 11 bankruptcy.

Bankruptcy Summary:

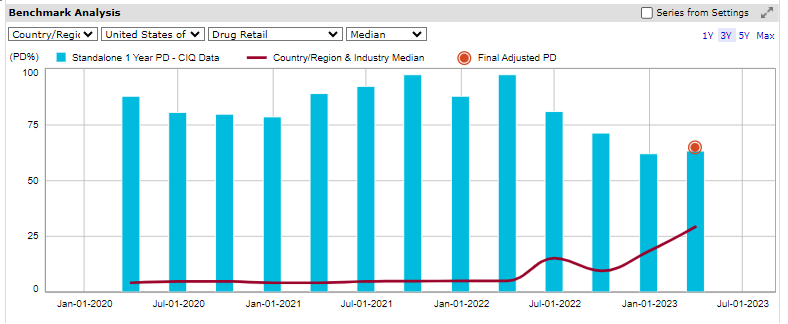

Golden Developing Solutions ran into difficulty due to the unstable macroeconomic environment, typified by rising inflation and interest rates negatively impacting consumer spending ultimately ending in underwhelming sales revenues. As seen in Figure 1, for the final reporting date of 31st March 2023 the poor performance culminated in it exhibiting a fundamental probability of default (PD) of 64.83% which was higher than the corresponding industry and country/region PD median benchmark of 29.12%. Interestingly, the PD of Golden Developing Solutions had been higher than the benchmark for a considerable amount of time, due to the regulatory headwinds they experienced, namely the rollback of the 2016 legislation liberalizing the use of medicinal marijuana.[1]

In addition, between Q3 2020 and Q3 2023, the PD had been consistently above 50% highlighting the instability and riskiness of the company. On the 22nd of June 2023 Golden Developing Solutions, Inc., along with its affiliates filed for a voluntary petition under Chapter 11 in the United States Bankruptcy Court for the Southern District of Florida. Further analysis of Figure 1 shows that since July 2019, the company presented elevated signs of risk. S&P Global Market Intelligence’s Credit Analytics showed that the PD values increased from 30th September 2018 to 31st March 2023, indicating that the company was extremely risky and more likely to default.

Figure 1: PD Performance vs. Country Benchmark

Source: S&P Global Market Intelligence as of August 1, 2023. For illustrative purposes only.

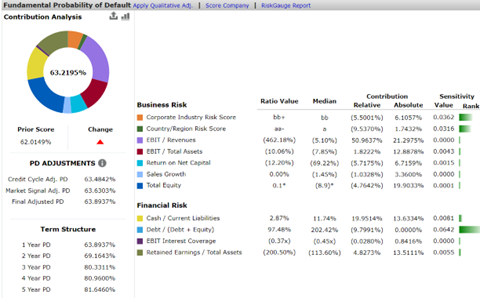

Based on Figure 2, Global Developing Solutions’ most negative risk factor was EBIT/Revenues, or EBIT margin, which represents how efficient the company is at using its own capital to generate profits. Global Developing Solutions was at –462.18%, in comparison, to the country/region and industry median of -5.10%, thus, worsening the PD by 50.94%.

The second most impactful risk factor for Golden Developing Solutions was the cash/current liabilities ratio which was at 0.02, in contrast to the country/region and industry median of 0.11 increasing the company’s risk by 19.95%. The cash/current liabilities ratio, which can also be referred to as the quick ratio, which along with the current ratio (current assets/current liabilities) provides a snapshot of the company’s position in terms of liquidity. For Global Developing Solutions, this worsening combination of factors ultimately led to the company filing for bankruptcy. As such the company struggled to keep itself afloat due to the low levels of sales. Therefore, as the costs were higher than the sales, Golden Developing Solutions significantly struggled, and this was reflected in their balance sheet. Similarly, the quick ratio showed that Global Developing Solutions was too liquid, and did not have a strong cash flow. As a result, all the factors contributed to the company defaulting and entering into administration.

Exhibit 2: Fundamental Probability of Default

Source: S&P Global Market Intelligence as of August 1, 2023. For illustrative purposes only.

Exhibit 3: Key Developments

|

Date |

Type |

Headline |

|

5th July 2023 |

Executive/ Board Change - Other |

GD announces Resignation of John Sosville as Member of the Board of Directors |

|

22nd June 2023 |

Bankruptcy Filing |

GD Filed for Bankruptcy |

|

23rd May 2023 |

Announcement of Earnings |

GD Reports Earnings Results for the 1st Quarter Ended March 31, 2023 |

|

15th May 2023 |

Delayed SEC Filing |

GD announced delayed 10-Q filing |

|

17th April 2023 |

Announcement of Earnings |

GD reports Earnings Results for the Full Year Ended December 31, 2022 |

|

17th April 2023 |

Auditor Going Concern Doubt |

GD Auditor Raises ‘Going Concern’ Doubt |

|

31st March 2023 |

Delayed SEC Filing |

GD announced delayed annual 10-K filing |

|

7th February 2023 |

Announcement of Sales/ Trading Statement |

GD provides Sales Results for December 2022 |

Source: S&P Global Market Intelligence as of August 1, 2023. For illustrative purposes only.

Contact us to find out how you can efficiently score and monitor your potential credit risk exposure to over 50 million public and private companies worldwide – including small- and medium-sized enterprises (SMEs).

Theme

Products & Offerings