Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 4 Jan, 2024

By Erik Keith

Highlights

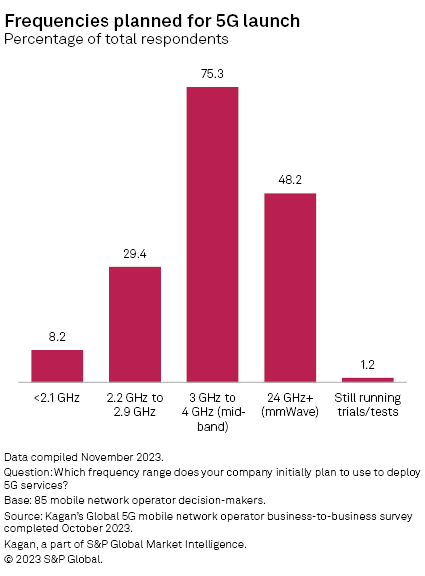

75% of respondents identified the mid-band range (3 GHz to 4 GHz) as the frequency spectrum of choice for delivering initial 5G services. This is up substantially from the 2022 survey where 67% indicated mid-band as their first choice for 5G service rollouts.

FWA technology, leveraging mmW frequency spectra (24 GHz and above), made the largest year-over-year gain, leaping from 37% to 48%, no doubt influenced by the strong customer uptake of FWA services by US operators T-Mobile USA and Verizon Communications. The appeal of FWA 5G has been validated by its 2023 market traction.

For the third year in a row, a substantial majority of mobile operators chose the mid-band — specifically, the 3 GHz to 4 GHz bands — as the frequency spectrum range most preferred for their 5G network deployments, according to Kagan's 2023 global 5G survey of 85 mobile network operator (MNO) decision-makers.

The 2023 5G survey also provided additional, expected validation for fixed wireless access (FWA) technology, i.e., 5G service that primarily leverages millimeter wave (mmW) spectra, marketed as a replacement for wireline broadband services by operators such as T-Mobile US Inc. and Verizon Communications Inc.

For the third year in a row, a substantial majority of Kagan's global 5G survey respondents chose the mid-band — specifically, the 3 GHz to 4 GHz bands — as the frequency spectrum range most preferred for their 5G network deployments. For 2023, 75% of respondents are already utilizing, or planning to leverage, the mid-band frequency range to deliver 5G services. This represents a substantial increase year over year from the 67% of operators that claimed mid-band as their first choice for 5G in the 2022 survey.

The 2023 5G survey also provided additional, expected validation for FWA technology, i.e., 5G service that primarily leverages mmW spectra (24 GHz and above), marketed as a replacement for wireline broadband services by operators such as T-Mobile USA and Verizon Communications. In fact, FWA/mmW made the largest year-over-year gain, from 37% in 2022 to 48% in 2023, as the answer to our question, "Which frequency range does your company initially plan to use to deploy 5G?"

Over the past three survey years, 2021 to 2023, there has been a clear shift in MNO plans for 5G deployment. While mid-band has been the top choice for frequency spectra to deploy 5G, the secondary choice indicated by MNOs has moved from a tie in 2021 (31% for both the 2.0 GHz to 2.9 GHz and the mmW spectra options), to a lean toward mmW in 2022, when 27% of operators said the 2.0 GHz to 2.9 GHz range, while 37% of respondents chose mmW. This gap widened even further this year, from 10 percentage points in 2022 to 19 percentage points in 2023.

Low band (sub 2.1 GHz) dropped further behind year over year as the least popular frequency choice for MNOs to deploy 5G service, with 8% of 2023 respondents indicating this option compared to 13% in 2022. However, it should be noted that even strong advocates of mmW technology, T-Mobile USA, for example, are utilizing low band RAN technology (600 MHz in T-Mobile's case) to deliver 5G service.

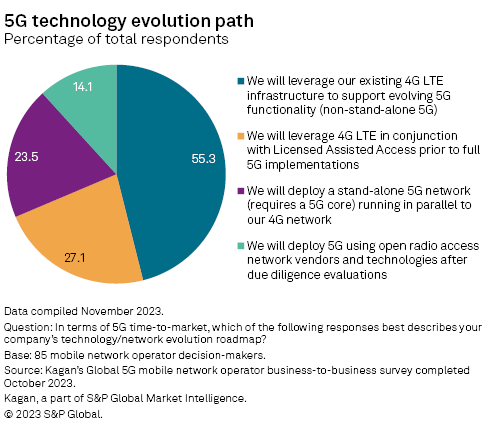

5G migration options

In terms of mobile operator time-to-market plans for the 5G network/architecture technology evolution roadmap, leveraging existing 4G LTE spectrum (and corollary infrastructure) remained the most favored option. In fact, this path to 5G gained popularity year over year, up 5 percentage points in 2023 to 55%, from 50% in 2022. This solution is known as non-stand-alone 5G and enables MNOs to deploy 5G services faster and more cost-effectively than the other 5G network options.

The second most popular choice for 5G service deployment (27% of respondents, compared to 23% in 2022) was utilizing 4G LTE networks in conjunction with licensed assisted access (LAA) technology. LAA enables faster time-to-market and lower-cost 5G service implementation, but like non-stand-alone 5G, it is also limited by lower overall performance due to its dependence on 4G network elements (and its lack of a 5G core). LAA is favored mostly by European operators (46%) and North American operators (36%).

The third most popular option — implemented or planned by nearly 24% of respondents, up from 18% in 2022 — for MNOs is to build a stand-alone 5G network, which runs parallel to existing 4G networks and services. This is more expensive as it requires investment in and deployment of a 5G core. 5G stand-alone architectures gained solid momentum in 2023 by operators in most global regions, as highlighted in our most recent 5G Tracker report.

Stand-alone 5G networks are sometimes referred to as "true 5G" as they do not utilize any 4G network elements and are therefore capable of delivering both higher throughput speeds and lower latency services. Stand-alone 5G networks also offer lower operational costs, albeit after a higher initial capital investment to launch a standalone network.

The least popular option for 4G to 5G network migration was the exclusive use of open RAN technology, which was selected by only 14% of respondents in 2023. However, this is a notable gain year over year; in 2022, only 8.5% of mobile operators said they planned to leverage Open RAN architectures to turn up their 5G services.

Open RAN leverages cloud- and software-based solutions to enable 5G service, as opposed to the more traditional hardware-centric approach. Moving forward, however, open RAN is expected to be utilized extensively as 5G networks become more widely deployed, and mobile operators become more comfortable with open and/or "virtual" RAN technology.

Data presented in this article is from Kagan's Fall 2023 business-to-business global 5G survey. A total of 85 carrier decision-makers that are well versed in their companies' 5G deployment plans were queried online or by phone. Of the respondents, 11 represented operators from North America, 28 were from Europe, 13 were from the Middle East/Africa, 14 were from Latin America, and 19 were from Asia-Pacific.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.