Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 14 Mar, 2024

This blog is written and published by S&P Global Market Intelligence, a division independent from S&P Global Ratings. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings.

The Oil and Gas (O&G) sector plays a pivotal role in the global economy. It serves as a primary energy source, fueling industries, transportation, and households worldwide. Moreover, the sector significantly contributes to government revenues in oil-producing nations, supporting infrastructure development and creating employment opportunities. Additionally, O&G serve as critical raw materials for various industries, including petrochemicals and manufacturing. The stability and efficiency of the O&G industry can have widespread implications on the overall health and growth of the world economy.

The O&G industry has faced significant challenges in the past few years. Factors such as fluctuating oil prices, geopolitical tensions, and the growing emphasis on renewable energy have impacted the sector. Escalations can disrupt supply chains, impact production, and lead to volatility in oil prices, affecting the financial stability and operational strategies of companies in the industry. Analyzing these trends, along with technological advancements and regulatory changes, can provide a comprehensive overview of the industry's challenges.

The majority of the customer base for O&G companies consists of other O&G-related firms and transportation firms such as Airlines, Road, Marine ports.1 The concentration of the customer credit risk is particularly pronounced within these industries.2 Based on S&P Global Market Intelligence’s default database and key developments information, missed interest payments and distressed debt exchanges are the major reasons of defaults in O&G sector over past few years.

S&P Global Market Intelligence’s RiskGaugeTM an integrated solution, harmonizing multiple risk drivers (i.e., fundamentals-based, market-driven, socio and macro-economic, etc) into a probability of default (also mapped to a credit score), thus providing a holistic perspective on a counterparty’s creditworthiness. Furthermore, it can be employed within a surveillance system framework, promptly identifying formation of heightened credit risk pockets at country and industry-level, and/or providing early warning signals of increased credit risk at company-level.

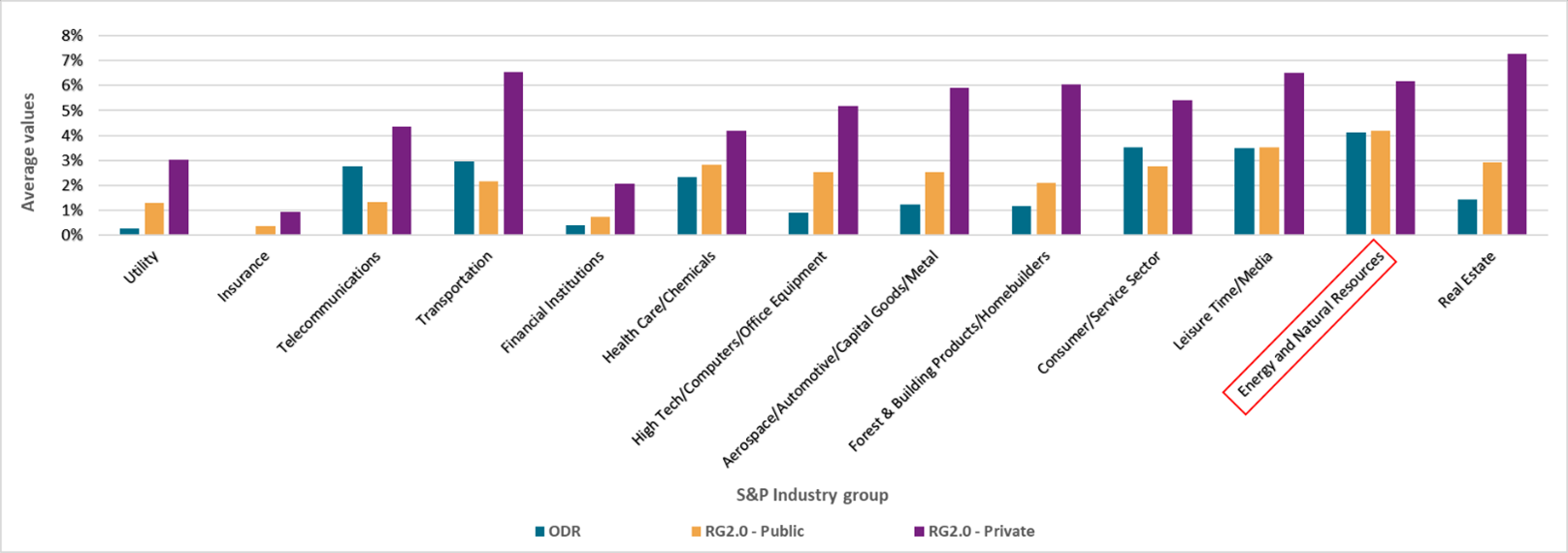

Figure 1 below shows the 2020-2023 average of the annual observed default rates (ODRs) from the S&P Global Ratings’ rated universe alongside RiskGauge median probability of default (PD) values for various industries. Here are the key observations:

Figure 1: Comparison of ODR and RiskGauge 2.0 median benchmarks for various industries

Source: S&P Global Market Intelligence as of Feb 20, 2024. For illustrative purposes only.

Let’s narrow our focus to a particular company in the O&G industry, examining the month-end output of the RiskGauge score within an Early Warning System (EWS). EWS uses a combination of dynamic risk thresholds and risk momentum to capture significant signals of an imminent credit risk deterioration, all the way down to default, expressed in an intuitive, traffic light colour scale.3 We look at the behaviour of our EWS over the past five years, including the latest selective default due to a distressed exchange, and the subsequent recovery.

Tullow Oil plc engages in the oil and gas exploration, development, and production activities primarily in Africa and South America. Tullow Oil plc was founded in 1985 and is headquartered in London, the United Kingdom.4

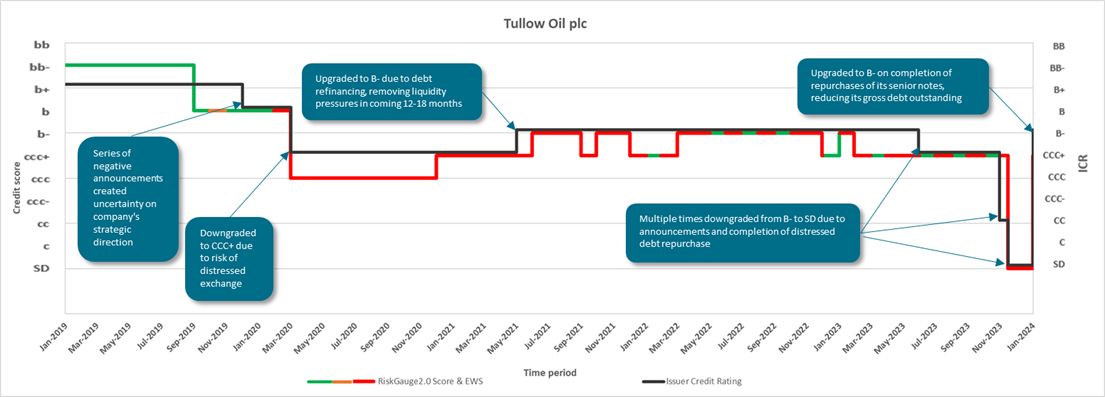

Figure 2 illustrates the evolution of the EWS signal for Tullow Oil plc from January 2019 to January 2024, as measured via the RiskGauge model score. We report the S&P Global Ratings’ issuer credit rating in the same period for refrence purposes only.

The EWS framework provided distinctive signals throughout the entire period under investigation, by turning into amber or red to highlight heightened risk of default, thus showcasing its ability to discriminate genuine default risk, from occasional changes of RG score in either direction.

Notably, during the whole of 2022 and in the period immediately leading to the selective default (SD) in November 2023, the EWS signal remained highly volatile, changing back and forth between red and green, indicating heightened uncertainty, whilst the company announced multiple debt repurchases to try and fend off default risk.

Eventually, as a result of reducing its gross debt outstanding through the completion of repurchases of portions of its senior notes below par, Tullow oil plc emerged from default at the end of December 2023.

Figure 2: Historical Evolution of Credit Risk for Tullow Oil plc

Source: S&P Global Market Intelligence as of Feb 20, 2024. For illustrative purposes only.

If you want to learn more about RiskGauge and EWS, please click here.

1 For instance, Downstream and Midstream O&G companies are customers to Upstream O&G companies and vice versa.

2 Customer credit risk is the risk of loss due to a customer’s failure or inability to repay a loan or other credit product.

3 For more details, please refer to the Early Warning Signals Framework 1.0 White Paper

4 Source: The S&P Capital IQ® Platform.

Blog