Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 11 Aug, 2023

By Monica Coca and Yiannis Koutelidakis

This blog is written and published by S&P Global Market Intelligence, a division independent from S&P Global Ratings. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings.

Another hallmark of the British high street has succumbed to inflationary pressures and supply chain disruptions. Wilko Retail Ltd., (Wilko) founded in 1930 by JK Wilkinson and still majority family-owned, filed an NOI (notice to appoint administrators) at the High Court on August 3rd, 2023, citing mounting cash pressures.[1] This gave the company ten days of breathing space from its creditors while it attempted to secure a rescue deal. Talks with potential buyers have now failed, forcing the company into administration, the UK version of bankruptcy. This blog highlights the early warning signals of credit risk deterioration supplied by S&P Global Market Intelligence’s Probability of Default Model Fundamentals (PDFN), which could have been identified as early as November 2022, when the company filed its latest accounts.

PDFN is one of three statistical models available within S&P Global Market Intelligence’s Credit Analytics suite. It combines financial ratios with systematic risk indicators (Corporate Industry Risk Score and Country/Region Risk Score) to generate a forward-looking 1-year probability of default and equivalent letter grade score in the S&P Global Ratings scale. [2] The model provides transparency into the main drivers of risk and allows for comparisons with companies operating within the same country and industry.

The image below showcases the assessment generated for Wilko based on its fiscal year ending January 29, 2022. Wilko’s probability of default (PD) of 8.57%, corresponding to a score of ‘ccc+’, places it in the Very High-Risk category. The model employs financial ratios that have been deemed statistically significant in predicting default, and macroeconomic variables that provide a measure of the environment in which the business operates. These inputs are transparently displayed alongside their median values, calculated based on companies operating in the same country and industry.[3]

Figure 1 – Fundamental Probability of Default

Source: Credit Analytics from S&P Global Market Intelligence. Data as of August 10th2023. For illustrative purposes only.

It is immediately apparent that Wilko’s financial results are weaker than the median: the company has negative Net Income to the tune of £31.9 million, lower Cash/Current Liabilities, and higher Current Liabilities/Net Worth, despite its significantly larger Total Revenue figure of £1.24 billion versus the median of £0.6 million. The latter suggests that while Wilko operates in an industry made up of small players, it is certainly no longer the big fish in a small pond. The non-financial inputs, Corporate Industry Risk Score and Country/Region Risk Score are also below the median, indicating that the 2021 business environment was more challenging than it had been historically. It can therefore be inferred that Wilko’s high-risk profile designation is driven by both idiosyncratic (company-specific) and systematic (country and industry-specific) factors.

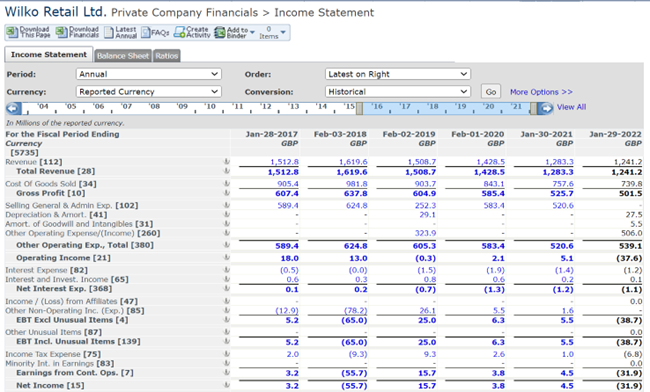

The company’s 5-year financial history, available in S&P Capital IQ Financials, reveals that its losses are driven primarily by a reduction in Total Revenue. In its annual report, management points to reduced footfall in stores due to national lockdowns, particularly during the last quarter, a peak trading period. The company was also affected by global supply chain disruptions and staff shortages at its distribution centres, which left shelves empty.[4] While the company also posted negative net income in 2018, this was caused by a one-off loss on currency forward contracts and costs related to store management restructure.[5] Consequently, the company was able to recover and return to profitability in 2019. It appears the current economic climate did not allow it to do the same this time around.

Figure 2 – S&P Capital IQ Financials

Source: S&P Capital IQ data as of August 10th, 2023. For illustrative purposes only.

Ultimately, Wilko’s latest PDFN assessment was a foreshadowing of more distress to come. In January 2023, the company further increased its debt, borrowing £40 million from restructuring firm Hilco Capital Limited. In an attempt at reducing costs, it also hired property agent CBRE and professional services firm PwC to assist in negotiating lower rents for its 400 nation-wide stores[6]. This may have detracted from pursuing alternative growth strategies – Wilko had previously invested £3 million in StreetDrone, an autonomous vehicle delivery and logistics service,[7] an initiative aimed at addressing supply chain challenges and current customer shopping trends.

A 93-year-old British retail staple falling prey to the current economic headwinds only further emphasizes the importance of robust, forward-looking models combining both financial and macroeconomic variables to provide a clear and transparent view of a company’s credit risk profile. PD Model Fundamentals not only pinpoints a company’s potential weaknesses but also provides a wider market context that enables informed conclusions and decision-making.

To learn more about S&P Global Market Intelligence’s timely signals, unrivaled insights, and leading data, please get in touch.

[1] “UK discount retailer Wilko on the brink of collapse”, Financial Times, August 3, 2023

[2] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence PD scores from the credit ratings used by S&P Global Ratings.

[3] For the Corporate Industry Risk Score and Country/Region Risk Score, the median is calculated based on historical values.

[4] Wilko Limited Annual Report and Financial Statements, Companies House, November 28, 2022

[5] Wilko posts £65m loss, Retail Gazette, October 10, 2018

[6] Discount chain Wilko drafts in advisers ahead of rent cut talks, SkyNews, June 9, 2023

[7] S&P Capital IQ Key Developments, 14 September 2021.

Products & Offerings

Segment