Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 6 May, 2022

Twitter deal ranks as the fifth-largest technology transaction since 2002

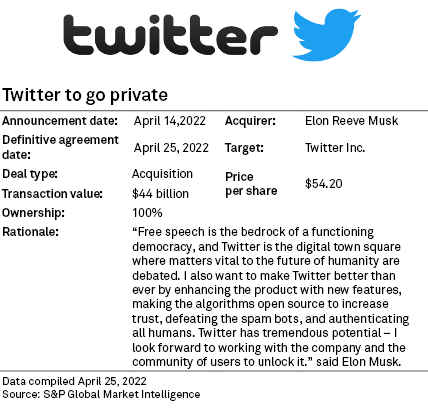

Billionaire tech executive Elon Musk's $44 billion deal for Twitter Inc. ranks as the fifth-largest technology transaction in recent decades, according to 451 Research's M&A KnowledgeBase. The transaction value far surpasses other recent large social media deals, including Microsoft Corp.'s $26.4 billion purchase of professional networking service LinkedIn Corp. in 2016 and Facebook's $19 billion acquisition of mobile messaging platform WhatsApp Inc. in 2014. To pay for the deal, Musk secured funding commitments, including $25.5 billion of debt and margin loan financing. Musk is also providing an equity commitment of about $21.0 billion.

Twitter's valuation is 9.9x of its trailing 12-month revenue

Twitter stockholders will receive $54.20 in cash per share of Twitter common stock that they own upon the proposed transaction's completion. The amount represents a 38% premium compared to Twitter's closing stock price on April 1, the last trading day before Musk disclosed his 9.2% stake in Twitter. The disclosure touched off a series of events leading to Musk's unsolicited offer and ultimate deal announcement. The valuation is 9.9x Twitter's trailing-12-month revenue, exceeding almost all of the top 10 tech deals struck in the past two decades. Upon completion of the transaction, Twitter will become a privately held company.

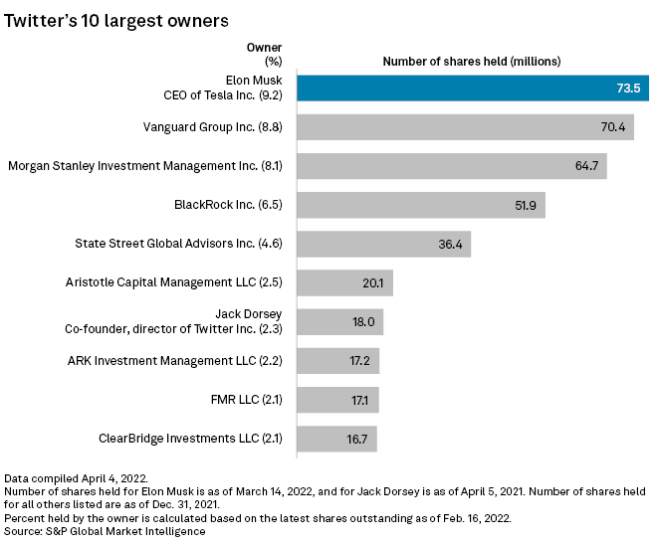

Elon Musk is Twitter's largest shareholder and has one of the top 10 most-followed Twitter accounts

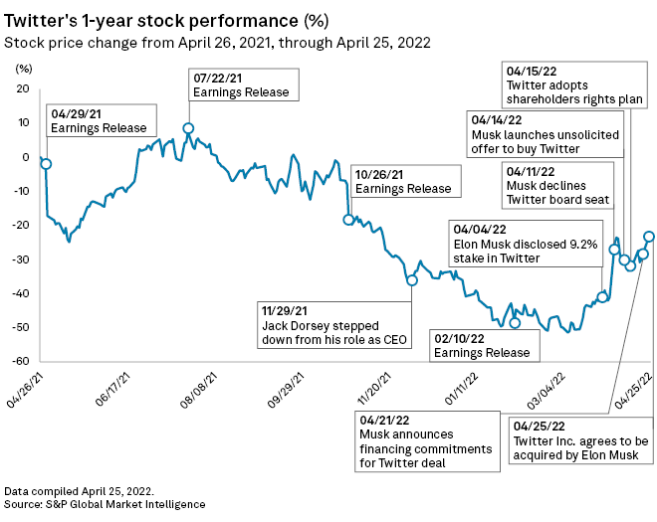

On April 4, Twitter's management agreed to appoint Elon Musk, CEO of Tesla Inc. and Space Exploration Technologies Corp., to a two-year director term expiring in 2024. The appointment followed a disclosure that Musk acquired a 9.2% stake in Twitter. As a condition of the board appointment, Musk agreed not to acquire more than a 14.9% stake in Twitter. Even at 9.2%, Musk's new Twitter stake made him the largest shareholder in the social media company, ahead of institutional investors including Vanguard Group and Morgan Stanley Investment Management. Musk has more than 80 million Twitter followers, making Musk one of the 10 most-followed accounts on the platform and giving the executive considerable influence. Read related article >

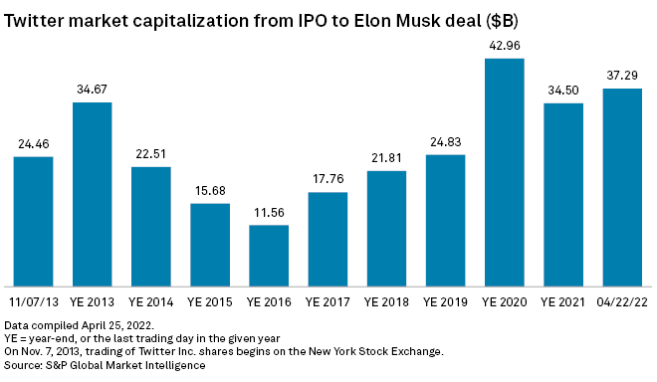

Twitter's market capitalization trends

Twitter's market capitalization rose to $34.67 billion at the end of 2013, shortly after its initial public offering launched in November of that year. The stock slid in the following years, and its market capitalization hit a year-end low point of $11.56 billion in 2016. It rebounded during the pandemic, reaching a year-end high of $42.96 billion in 2020.

Twitter's stock price performance

Twitter's shares rose nearly 30% following Musk's stake disclosure. The one-day bump helped to reverse some of Twitter's recent price losses, but the stock remained down 22% on the one-year chart. Musk's shares were worth more than $3 billion as of market close April 4. Read related article >

Twitter's future ahead?

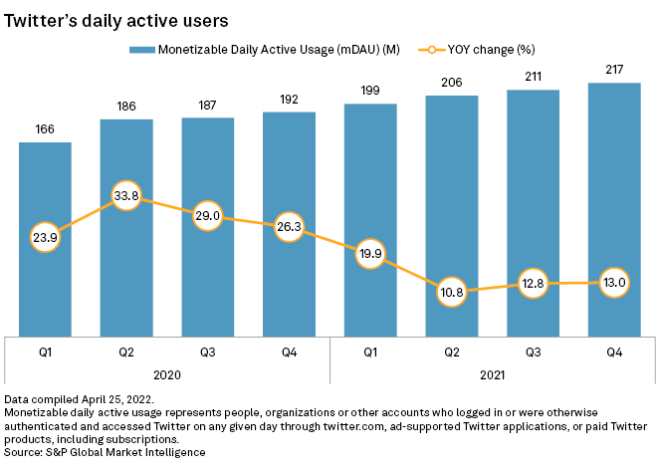

The microblogging company already faced questions about its content moderation practices and slowing user growth. After spiking to 33.8% early in the pandemic, Twitter's monetizable user growth had slowed to 13% in its most recent reporting period. The company also faced heightened political uncertainty amid questions about how it balanced free speech with concerns about misinformation or hate speech on its platform. Twitter reports monetized daily active users or usage, which only counts subscribers who are using its ad-support or subscription applications. The company is scheduled to report first-quarter 2022 financials on April 28.

Twitter has set a goal of reaching 315 million monetized daily active users by the end of 2023. Musk said his plans for Twitter include making its content-moderation algorithms open source, reducing spambots and opening the platform's blue-checkmark verification process to all human users. Read related article >

Learn more about the data behind Twitter’s takeover.

Research

Research

Products & Offerings