S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Blog — 3 Dec, 2021

By Seth Shafer

Discovery+ debuted in the U.S. in January, looking to make a splash in a saturated market that features a wealth of streaming subscription video-on-demand services. According to data from Kagan's U.S. Consumer Insights survey conducted in March, about 9% of U.S. internet households reported using discovery+, putting it roughly on par with other new U.S. launches from broadcast and cable network owners such as Peacock Premium (11% of households) and Paramount+ (10%).

The Take

* Success for newer network-backed services such as discovery+ may hinge on the willingness of American consumers to tack on additional subscriptions on top of incumbent offerings such as Netflix, Amazon Prime Video, Disney+ and Hulu.

* GenZ/millennials accounted for more than half of discovery+ users, welcome news for a linear TV stalwart looking to stay relevant with younger viewers.

* Discovery+ households not only subscribe to a high number of SVOD services but also tune into a high number of free, ad-supported video services including The Roku Channel and Pluto TV.

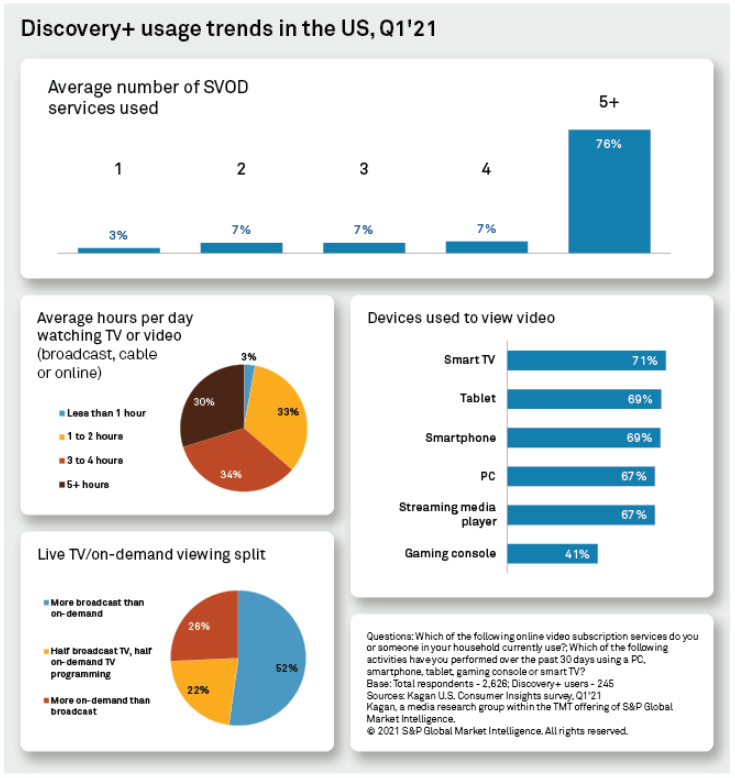

High-level survey trends show that early adopters in the U.S. for discovery+ are already stacking on a large number of SVOD services each month, with 76% of discovery+ households reporting that they use five or more SVOD services. Discovery+ users are unsurprisingly fans of TV viewing in general — about 30% spend five hours or more watching TV/video on an average day — and about half watch more traditional live TV than on-demand streaming content.

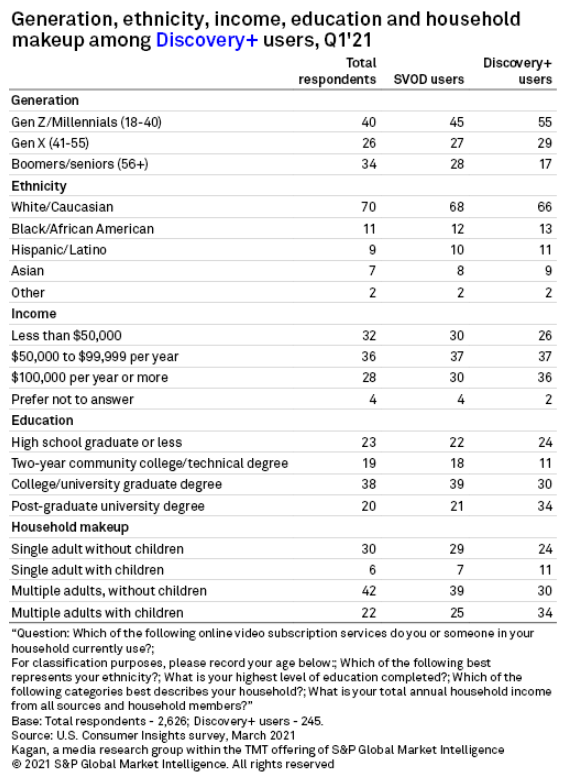

Demographic trends point to a discovery+ audience that skews young, well-educated and more likely to live in higher-income households as well as in homes with children. While discovery+'s streaming catalog looks different than most other SVOD services — consisting solely of TV episodes that primarily focus on unscripted programming — demographic data for its user base was very similar to overall survey respondents that use at least one SVOD service.

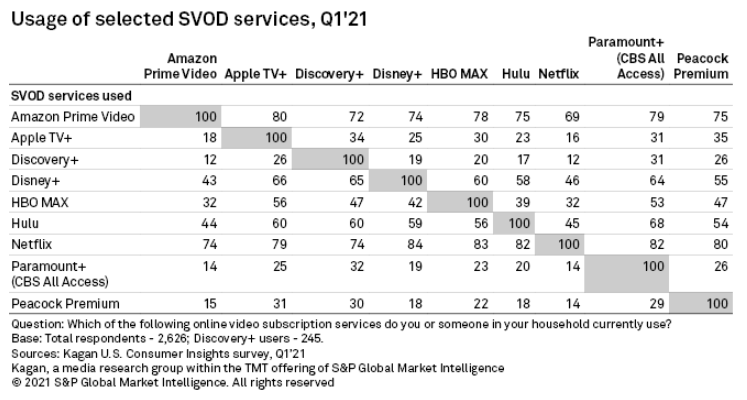

Most discovery+ households also reported using Netflix (74% of discovery+ users), Amazon Prime Video (72%) and Disney+ (65%). 47% of households using discovery+ also viewed HBO Max, an overlap that could become important when the planned merger of Warner Media and Discovery is likely completed in 2022. Cross-selling of the two services or a combined bundle similar to those offered by Disney and ViacomCBS could be key for a combined Warner Bros.-Discovery hitting a stated goal of 200 million global streaming subscribers by 2024 or 2025.

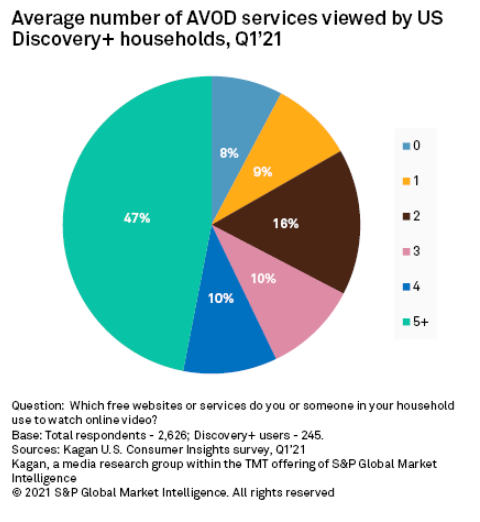

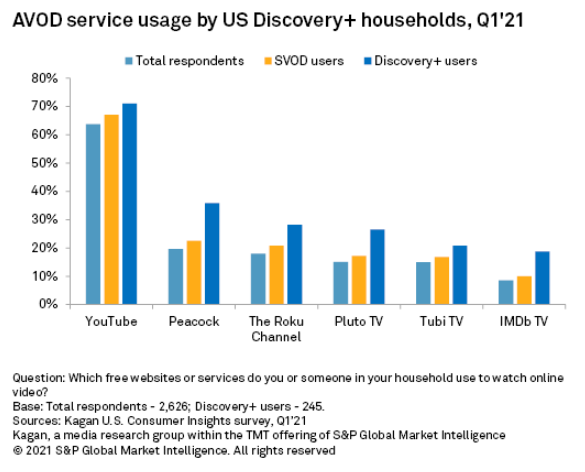

Discovery+ households also turned to a large number of free, ad-supported video offerings, with nearly half using five or more free AVOD services and more than two-thirds watching at least three free services. YouTube was the clear top choice among free services but Peacock, The Roku Channel, Pluto TV, Tubi and IMDb TV were viewed by discovery+ users at a much higher rate than both total survey respondents and overall SVOD users.