Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 19 Jul, 2022

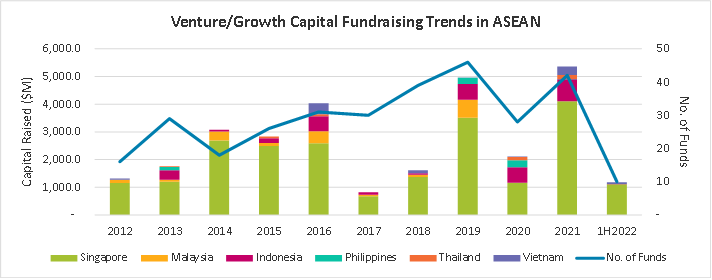

Fundraising Trends

Fundraising by venture capital and growth funds across the ASEAN economies slowed in the first half of 2022. Only ten funds in the region managed to raise USD1.2bn, down 78% from USD5.4bn in the previous year, according to Preqin data on the S&P Capital IQ Pro platform.

Funds have struggled to raise more money against a backdrop of rising interest rates, global geopolitical tensions, and lingering pandemic-related headwinds.

Source: Preqin data on S&P Capital IQ Pro platform as of July 1, 2022. Charts/Tables for illustrative purposes only.

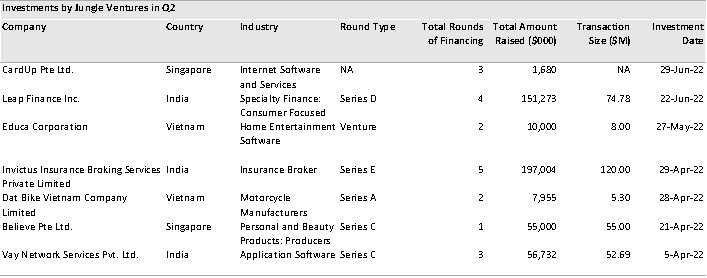

Singapore-based venture capital firm Jungle Ventures (MI KEY: 5815475) closed its fourth fund earlier in May totaling USD600mn, from a group of private equity and financial investors including Temasek ( MI KEY: 4138769), Stepstone (NASDAQGS:STEP), and Mizuho (MI KEY: 114518) etc. The venture capital firm currently manages a total asset under management (AUM) of USD1bn, with 86 investments across technology, consumer, financials, and healthcare sectors, according to S&P Capital IQ Pro data.

The new fund is said to be focused on investing in early stage fintech companies across ASEAN and India markets, with a bite size of USD1mn to USD15mn in direct equity investment.

Source: S&P Capital IQ Pro platform data as of July 1, 2022. Charts/Tables for illustrative purposes only.

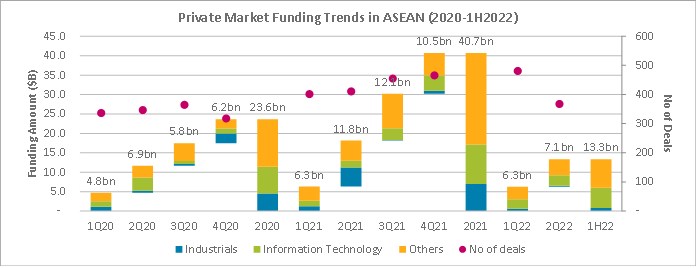

Private Market Funding Trends

Private funding in ASEAN was impacted by the slowdown in fundraising and subdued investor sentiment. ASEAN start-ups raised a total value of USD7.1bn in the second quarter of 2022, down nearly 40% from USD11.8bn a year ago. The industrials sector saw the biggest losses, falling from USD4.9bn to just USD300mn, while funding in information technology rose 50% to USD2.7bn from USD1.8bn.

The overall decline is also related to the scarcity of mega deals – there were five deals over USD1bn last year, including Grab (NASDAQGS:GRAB), Flipkart (MI KEY: 5303187), PT Lotte (MI KEY: 7667022) and MediaTek (two deals) (MI KEY: 4551166), with a combined deal value of USD10.9bn, while the biggest deal this year being Coda payment (MI KEY: 5250740), a digital content monetization platform which raised USD690mn in April led by GIC (MI KEY: 4005446), Insight Venture (MI KEY: 4158699), and Smash Capital (MI KEY: 105954532).

Source: S&P Capital IQ Pro platform data as of July 1, 2022. Charts/Tables for illustrative purposes only.

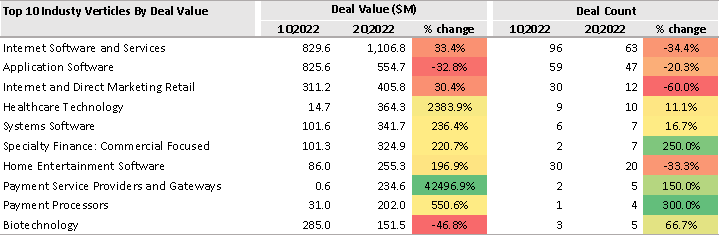

Internet software and services industry continued to lead, with a total funding value rising 33.4% quarter-on-quarter to USD1.1bn, despite a 34.4% decline in the number of deals to 63. Application software came in second, albeit both deal value and volume decreased. Health-tech, systems software, specialty finance and payments companies are gaining momentum from investors, driving up both deal value and volume.

Source: S&P Capital IQ Pro platform data as of July 1, 2022. Charts/Tables for illustrative purposes only.

A handful of companies have joined the unicorn club, including Singapore-based biotech start-up Novotech (MI KEY: 100450043), backed by GIC (MI KEY: 4005446), Sequoia Capital (MI KEY: 4151885) and TPG (MI KEY: 14911328), and digital therapeutics solutions provider Biofourmis (MI KEY: 5327957), each valued at USD3bn and USD1.3bn in their latest funding round. Growth management platform Insider (MI KEY: 5264177) and payments companies Voyager (MI KEY: 11011855) and Omise (MI KEY: 5282676) are also valued at more than USD1bn.

Private Equity Exits

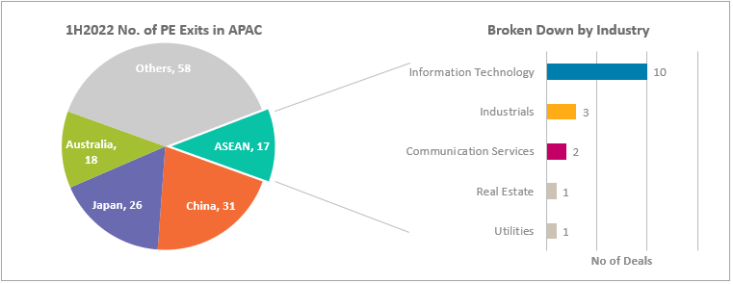

Private equity exits are unlikely to surpass last year’s record. In the first half of the year, only 150 exits were announced/completed in Asia Pacific, with a total deal value of USD20.8bn, nearly a third of last year’s deal value and volume.

ASEAN saw 17 deals for a total value of USD2.3bn, compared to 39 deals totaling USD11.2bn last year. Information technology targets led the way with 10 exits, followed by industrials and communication services with 3 exits and 2 exits, respectively.

Source: S&P Capital IQ Pro platform data as of July 1, 2022. Charts/Tables for illustrative purposes only.

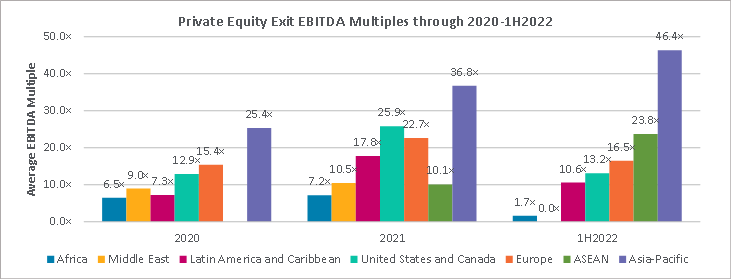

Valuations remain high amid weaker overall market conditions. The average exit EBITDA multiple for private equity firms in Asia Pacific hit a record high of 46.4x, up from 36.8x in 2021 and 25.4x in 2020.

ASEAN’s exit multiple also reached a new high of 23.8x, up from 10.1x last year.

The high valuations are somewhat skewed towards the tech and healthcare sectors, reflecting increased competition among potential buyers to chase quality assets in both sectors, and sponsors being more selective with many of these opportunities.

Source: S&P Capital IQ Pro platform data as of July 1, 2022. Charts/Tables for illustrative purposes only.

Leveraged Buyouts

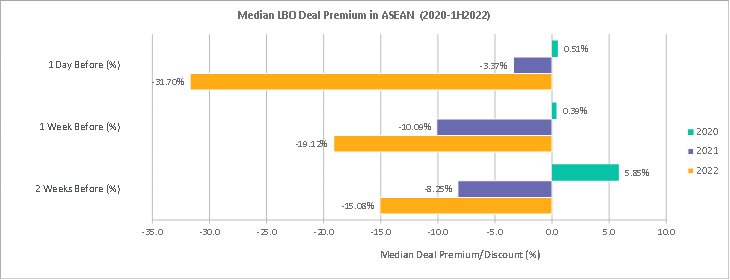

Leveraged buyout (LBO) deal activity in ASEAN was at its lowest point, with just five deals announced or completed in the second quarter. Private equity firms are only trading at rock-bottom prices for risk protection as the public markets continue to slump.

The median first-day premium for announced/closed LBO deals in the current year was a 31.7% discount, even worse than the 3.37% discount in the previous year.

Discounted acquisitions include Morgan Stanley’s (MI KEY: 4380166) SGD130mn bid of a 59.8% stake in real estate services provider APAC Reality (SGX:CLN) in April. The cash offer price of SGD0.61 per share represents a 30.06% discount to the target’s last traded share price.

Source: S&P Capital IQ Pro platform data as of July 1, 2022. Charts/Tables for illustrative purposes only.

Beyond The Numbers

Looking ahead, what does the future hold for private equity firms in ASEAN?

Inflation, digitalization, supply chain, environmental, social and governance (ESG) and fintech are the top five trends shaping 2022, according to the findings of our broker research team. Topics such as valuations, key drivers, long-term prospects and near-term challenges in the fintech space were also widely discussed in the region.

As the market matures from its nascent state, the behavior of today's private equity firms has certainly changed. Given the competitive pressures in such a depressed market, private equity firms will be eager to seek insights that can help them better navigate the current challenging environment.