S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Blog — 22 Feb, 2021

By Matt Aslett

Highlights

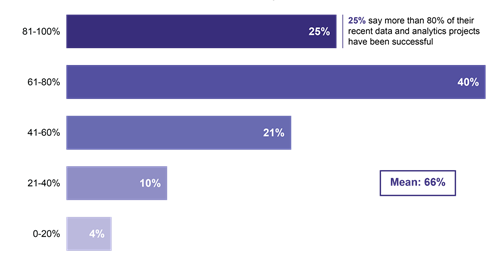

On average, respondents stated that 66% of their organization's data and analytics initiatives in the last two years could be characterized as successful.

Introduction

We received mixed messages from enterprises during 2020 about the impact that COVID-19 was having on data and analytics projects. The suggestion was that the companies that have been the most successful were investing further and accelerating ahead, creating a growing divide from those that had been less successful, which risk getting left behind. Our latest Voice of the Enterprise: Data & Analytics, Data Management & Analytics 2020(opens in a new tab) survey provides clear evidence of that divide, showing that enterprises that have been the most successful with analytics projects in the past two years are significantly more likely to be increasing the scope of their analytics projects, and spending more on data management and analytics products. The survey also illustrates the different approaches being taken by the companies that have been the most successful with analytics projects and those that have been less successful, particularly in relation to investing in steps to improve data culture.

The 451 Take

The results of this survey show that the COVID-19 pandemic is accelerating the divide between those that are investing to grow their data and analytics initiatives and those that risk being left behind. The results provide a clear indication of that divide, with a near 50/50 split between enterprises increasing investment in data management and analytics as a result of the pandemic and those that are not. The results also provide evidence that this is exacerbating the divide between those that are enjoying the benefits of successful analytics initiatives and those that have been less successful to date. The higher the rate of analytics success over the past two years, the greater the likelihood of increased investment. Those that have already seen success are doubling down and setting the pace in terms of investment in a variety of approaches to improve data culture. As a result, the companies that have already been the most successful with analytics projects are set to extend their competitive advantage over those that have not.

Data and analytics habits of the most successful

In recent years, 451 Research's Voice of the Enterprise: Data & Analytics surveys have illustrated the increasing recognition of the importance of data, as well as the growing trend toward data-driven decision-making. The survey results have also highlighted the habits of the most data-driven companies, and indicate a growing competitive advantage for those that are successfully exploiting data and analytics to drive operational efficiency and derive new value.

Our VotE: Data & Analytics, Data Management & Analytics 2020 survey provides further evidence of that advantage. On average, respondents stated that 66% of their organization's data and analytics initiatives in the last two years could be characterized as successful – indicating that, on average, one-third of data and analytics projects are not considered a success. One-quarter of respondents stated that they had been successful with 81% or more of their projects, however.

Figure 1: Success of Data and Analytics Initiatives

Source: 451 Research's Voice of the Enterprise: Data & Analytics, Data Management & Analytics 2020

The survey results also indicate that these companies are enjoying the benefits of being more successful. For example, 80% of the most successful state that nearly all or most of their strategic decisions are driven by data, compared with 63% of all respondents, while 88% of the most successful say that data will be more important to their organization's decision-making in the next 12 months, compared with 81% of all respondents.

The results also indicate that these companies have very similar attitudes with regard to the adoption of new technologies and approaches to data and analytics. For example, 94% of the most successful with data and analytics initiatives are using or considering augmented analytics interfaces for business and data analysts, while 93% of the most successful are considering or using the same technologies for senior and departmental/LOB decision-makers.

Analytics success in the time of COVID-19

The new VotE: Data & Analytics survey results also illustrate the impact that the COVID-19 pandemic has had in accelerating the divide between those that are investing further in data and analytics and those that are not. Slightly more than half (51%) of respondents agree that their organization increased the number or scope of active analytics projects as a result of COVID-19, while slightly less than half (48%) agree that their organization has increased spending on data management and analytics products and services as a result of the pandemic.

Significantly, there is a close correlation between those investing in project expansion and those increasing spending: 85% of those spending more on data management and analytics products and services as a result of COVID-19 are also increasing the number or scope of active analytics projects.

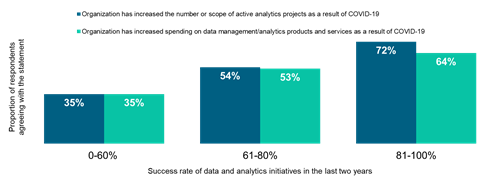

Additionally, the survey results indicate that, the higher the rate of analytics success, the greater the likelihood of increased investment in data and analytics as a result of COVID-19. Almost two-thirds (64%) of enterprises that have been the most successful with analytics projects in the past two years have increased spending on data management and analytics products and services as a result of the pandemic. That compares with just 35% of organizations that have been successful with 60% or less than of their analytics projects in the past two years.

Similarly, nearly three-quarters (72%) of the companies that have been the most successful with analytics projects in the past two years have increased the number or scope of active analytics projects as a result of COVID-19, compared with 35% of organizations that have been successful with 60% or less of their analytics projects in that time.

Figure 2: Analytics Success and Investment in Response to COVID-19

Source: 451 Research's Voice of the Enterprise: Data & Analytics, Data Management & Analytics 2020

Investing in a culture of success

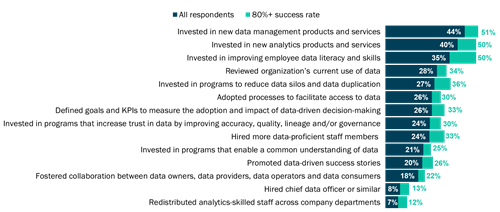

The survey results also highlight the importance of data culture to successful outcomes: 98% of the companies that have been most successful with data and analytics initiatives have taken steps to improve data culture. One of the areas in which the most successful are substantially ahead is having invested in improving employee data literacy and skills – for example, 50% of those that have been the most successful with analytics projects in the past two years have invested in improving employee data literacy and skills, compared with 35% of all respondents.

Similarly, 50% of those that have been the most successful with analytics projects in the past two years have also invested in new analytics products and services, compared with 40% of all respondents, while 36% have invested in programs to reduce data silos and data duplication, compared with 27% of all respondents. In fact, the companies that have been the most successful with analytics projects in the past two years outpace all respondents in all categories of steps taken to improve data culture, including hiring more data-proficient staff members, such as data analysts and data scientists (33% vs. 24%); investment in new data management products and services (51% vs. 44%); and defining goals and KPIs to measure the adoption and impact of data-driven decision-making (33% vs. 26%).

Figure 3: Steps Taken to Improve Data Culture

Source: 451 Research's Voice of the Enterprise: Data & Analytics, Data Management & Analytics 2020

Blog