S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Blog — 6 Sep, 2021

This article is written and published by S&P Global Market Intelligence, a division independent from S&P Global Ratings. The opinions herein are not reflective of those of S&P Global Ratings.

The COVID-19 pandemic has affected industry sectors differently, with the car rental industry experiencing mixed impact. During the first half of 2020, many car rental firms found themselves in challenging positions with suppressed demand due to travel restrictions and lockdown measures. However, as lockdown measures eased, this sector became more popular as a safer and favorable means of public transportation because of the minimal exposure to the virus, and the introduction of sanitizing processes resulting in a positive impact on the car rental sector revenues.

In this case study, we leverage S&P Global Market Intelligence’s RiskGauge model to analyze the impact of the pandemic on the creditworthiness of a selection of companies in this sector.

RiskGauge is a statistical credit risk model that generates a credit risk assessment for public and private companies, globally, which can be mapped to a credit score on a 1-100 scale, where a score of 100 (1) equates to the lowest (highest) credit risk. This model combines the outputs of three standalone credit risk models – CreditModel™ (CM), Probability of Default (PD) Model Fundamentals (PDFN), and PD Model Market Signals (PDMS) – into an overall credit risk score. The integration is tailored to simultaneously leverage the strengths of each of the three standalone models: CM’s long-term and stable credit quality, PDFN’s sensitivity to changes in a company’s fundamentals, and PDMS’s responsiveness to market-implied information. This enables the RiskGauge model to provide an aggregated, well-round, and timely view of a counterparty's creditworthiness. You can read more about this model in “Gauging Credit Risk Through A Multidimensional Lens”.

Credit Risk Radar – The Car Rental sector

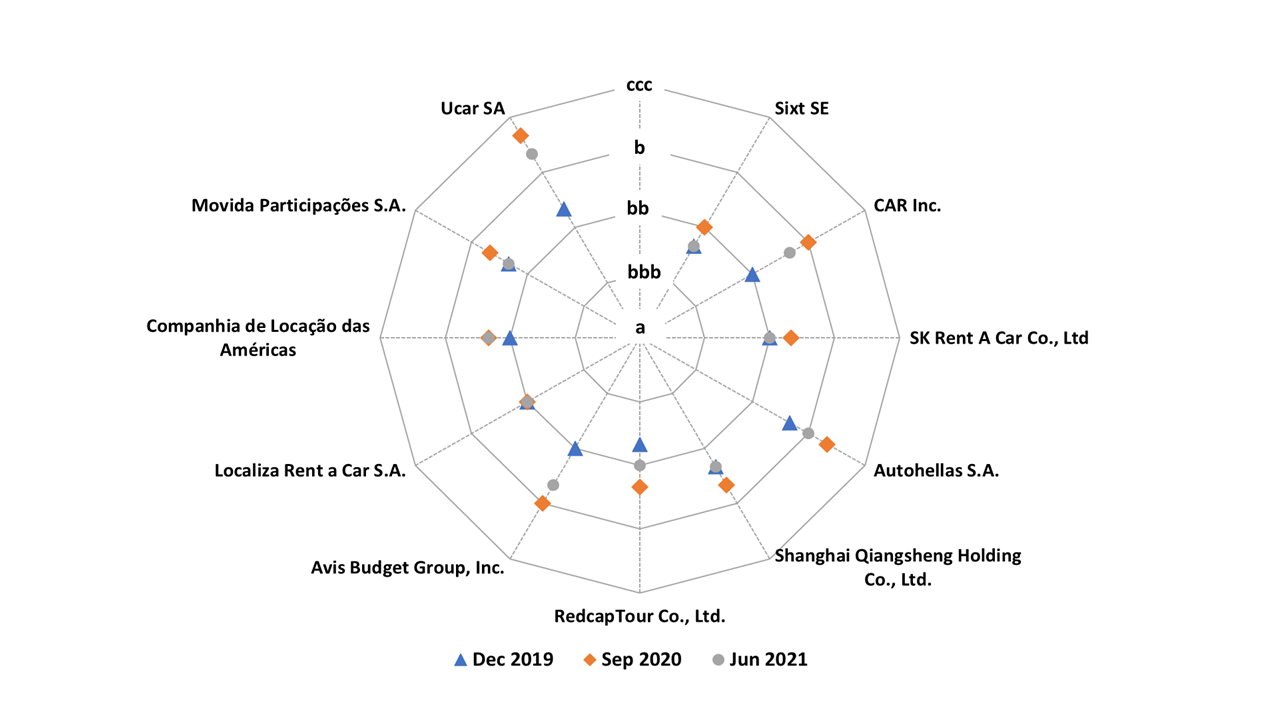

Figure 1 shows the evolution of credit risk for a selection of public corporations in this sector across all geographies.

At the end of 2019, the average RiskGauge Score for all companies in this sample is around ‘bb’. However, the global nature of the pandemic, accompanied by government-imposed restrictions, severely impacted the creditworthiness of this sector. By September 2020, the RiskGauge Score deteriorated by two notches towards an average score of ‘b+’, reflecting the breadth and depth of the COVID-19 impact. These two notches reflect peak of impact in all regions. At the beginning of 2021, most companies in this group managed to shore up their financials, limiting further deterioration in credit scores and, by June, started showing tentative signs of recovery and small improvements in their credit scores. However, an overall weak credit risk profile points to high sensitivity to further prolonged operational disruptions and long journey back to a smooth road.

Figure 1: S&P Global RiskGauge Score – Car Rental sector

Source: S&P Global Market Intelligence. Data consists of RiskGauge v2.0. As of June 30, 2021. For illustrative purposes only.

We now zoom into one company from China, the first major economy to exit from COVID-19 lockdown restrictions.

The case of CAR Inc

CAR Inc is one of the largest car rental service providers, specializing in car, fleet rental services and leasing to both individuals and corporate customers in China. It is the market leader in terms of fleet size, revenue, network coverage, and brand awareness.

CAR Inc. was severely impacted by the global pandemic, with booking cancellations peaking during restrictions in travel and lockdowns in several provinces. The shockwaves continued to reverberate throughout 2020, reducing the total revenues and cash flow across the whole car rental sector.

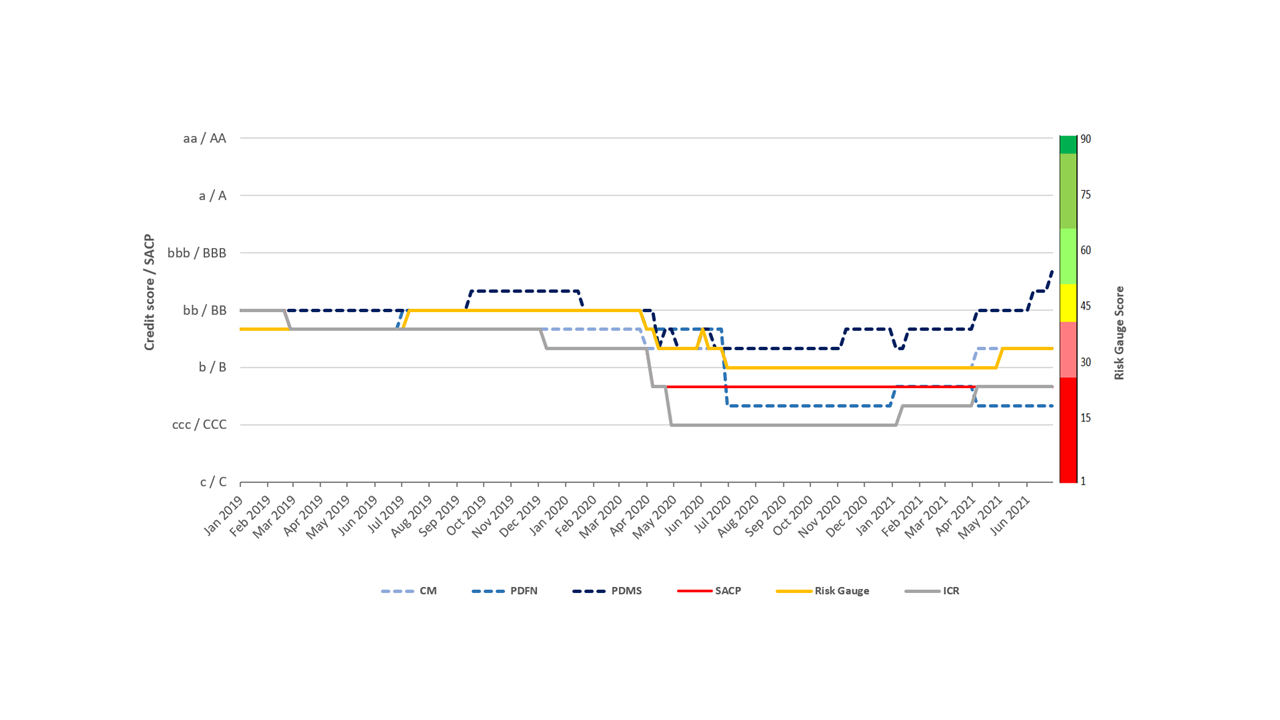

Figure 2 shows the evolution of credit risk for CAR Inc. from January 2019 to June 2021. Throughout 2019, CAR Inc. had a negative outlook and experienced deterioration in liquidity. S&P Global Ratings downgraded the CAR Inc. Issuer Credit Rating (ICR) twice from ‘BB’ at start of 2019 to ‘B+’ at the end of 2019 due to tighten liquidity and weakening profitability.

During this period, we also observed the RiskGauge Score fluctuate between ‘bb’ and ‘b+’ with average one notch difference with S&P Global Ratings’ stand-alone credit profile (SACP) and ICR during the same time period.[1]

In 2020, with the spread of COVID-19, the government announced further lockdown measures and travel restriction, which meant that customers had to cancel their travel plans, affecting CAR Inc. revenues and cash flow, putting pressure on the company’s debt servicing capacity, profitability and liquidity.

S&P Global Ratings downgraded CAR Inc’s issuer credit rating from ‘B+’ to ‘CCC’ in April 2020.

The RiskGauge Score also started deteriorating after March 2020 and reached ‘b’ in July 2020 after three notches deterioration in credit score. This deterioration is due to the combined effect of negative market perception reflected in PDMS score and the weaking fundamentals captured by CM & PDFN scores, especially during the first two quarters of 2020 when stringent lockdown measures were implemented.

Figure 2: Historical Evolution of credit risk for CAR Inc.

Source: S&P Global Market Intelligence. Data consists of RiskGauge v2.0. As of June 30, 2021. For illustrative purposes only.

The gradual easing of both lockdown measures and travel restrictions by the Chinese government helped improved the cash flow from operations and enabled a reduction in current liabilities of CAR Inc. towards the end of 2020. This resulted in a change of RiskGauge score to ‘b+’ in the first quarter of 2021.

Notably, the S&P Global Ratings’ ICR was upgraded from ‘CCC’ to ‘B-’ in the same period of time.

Indigo Glamour Company Limited, a subsidiary of MBK Partners, completed the compulsory acquisition of all remaining offer shares of the company to complete the privatization.[2] MBK Partners said that the deal with CAR Inc. will enable it to benefit from the long-term growth trend in China. MBK Partners is one of the largest private equity funds in North Asia[3] with a strong track record in investing in the car rental industry having invested in eHi Car Services, China’s second largest car rental company. This could be a strong strategic move to foster consolidation of the two major car rental companies in China.[4]

In summary, the RiskGauge model intelligently integrates market-view and company fundamentals to provide unique insight into a company’s creditworthiness. It offers users a streamlined view of counterparty credit risk by generating daily PD and credit score estimates for a broad range of private and public companies globally, providing a timely signal of credit risk deterioration or improvement.

Learn more about the RiskGauge model, score and business credit reports here.

[1] The SACP is S&P Global Ratings' opinion of an issuer's creditworthiness in the absence of extraordinary support or burden.

[2]On July 5, CAR Inc. announced that Indigo Glamour Company Limited, a subsidiary of MBK Partners, completed the compulsory acquisition of all remaining offer shares of CAR Inc.

https://www.businesswire.com/news/home/20210709005107/en/CAR-Inc-Completes-Privatization-Set-to-Work-with-MBK-Partners-to-Foster-Industry-Growth

[3] On July 9, CAR Inc completes privatization, set to work with MBK Partners to foster industry growth

[4] On July 5, CAR Inc completed delisting after MBK Partners’ acquisition