Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 15 Sep, 2021

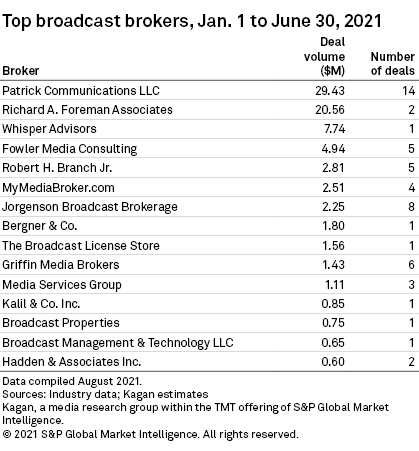

Under the current conditions of the challenging broadcast deal market, the assistance of broadcast brokers has been more important than ever. Not counting Gray Television Inc.'s big consolidation deals, the first half of 2021 registered a total deal volume of $139.2 million — less than the average monthly deal volume in any of the years between 2011 and 2019.

More than half of that volume ($70.8 million) came from just 12 deals ranging from $2.5 million to $18.1 million — with nine of the 12 deals conducted with the assistance of broadcast brokers.

The largest radio deal of the first half of 2021 was brokered by Richard A. Foreman Associates Inc. On June 3, Sinclair Broadcast Group Inc. announced the sale of two AM and two FM stations in the Seattle-Tacoma, Wash., market to Lotus Communications Corporation for $18.1 million.

Foreman also brokered the $2.5 million sale of two FM stations in upstate New York, targeting mainly Montreal, from Martz Communications Group Inc. to Educational Media Foundation.

Aside from the Gray transactions, the largest TV transaction was Sovryn Holdings Inc.'s $10.0 million acquisition of two Class A TV stations in Los Angeles from NRJ Holdings LLC, brokered by Patrick Communications LLC.

Sovryn Holdings also bought a Class A TV station in the Chicago market from Local Media TV Chicago LLC for $5.70 million. That transaction too was brokered by Patrick Communications, which was part of no less than 14 of the 73 brokered transactions in the first half and — with a total of $29.4 million — the broker with the largest deal volume.

In Sovryn Holdings' third acquisition, the $1.5 million purchase of a digital low-power TV station in Houston, Craig A. Ruark LLC d/b/a The Broadcast License Store assisted seller Abraham Telecasting Company LLC.

Whisper Advisors, a management consulting firm founded in 2017, logged its first entry in our broadcast broker database, facilitating the $7.7 million sale of a TV station in the Seattle-Tacoma, Wash., market from Venture Technologies Group LLC to Radiant Life Ministries Inc.

Fowler Media Consulting LLC brokered five deals, the largest one being the $4.0 million sale of an FM station in the Orlando, Fla., market from Entravision Communications Corp. to Radio Training Network Inc.

Bergner & Co. was the financial advisor for a large group sale in which seven FM and four AM radio stations, five FM translators and one FM booster in the New York markets of Elmira-Corning and Olean were sold from Sound Communications LLC to Seven Mountains Media of NY LLC and Southern Belle LLC for $1.8 million.

Robert H. Branch Jr. was the broker in the sale of an FM station in the Albuquerque, N.M., market from Calvary Albuquerque Inc. to Bible Broadcasting Network Inc. for $1.4 million.

Four other brokers, MyMediaBroker.com, Jorgenson Broadcast Brokerage, Griffin Media Brokers and Media Services Group Inc. registered a brokered deal volume above $1 million through a number of smaller deals. In July, at the beginning of the second half of the year, Hadden & Assoc. Inc. became the 12th broker of the year registering a million dollars or more.

July was a big month for Kalil & Co. Inc., the leader of our broadcast broker rankings in 2018, 2019 and 2020. Kalil registered only one deal announcement worth $850,000 in the first half of the year but announced eight transactions adding to a total of $65.7 million between July 12 and July 29.

Altogether, between January and June 2021, we received deal announcements from 32 broadcast brokers — only five fewer than all of 2020. More significantly, the total broadcast brokered volume of $83.6 million was 67% higher than in the first half of 2020 and reached $151.4 million on July 29, exceeding 2020's total of $148.3 million.