S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Blog — 10 Dec, 2022

By Mohsin Ali Khan and Sahil Modi

The pain of the global financial crisis of 2008 was felt throughout the world, leading to the establishment of various regulatory bodies and introduction of regulations to avoid a repeat of what happened. One of the key elements of Basel Committee on Banking Supervision's response was to introduce the Basel III framework to address shortcomings of previous regulations. This framework puts an increased focus on Common Equity Tier 1 (CET 1) capital, the level of capital requirements, and new buffers, amongst other things.

In this blog, we explore how the capital requirements evolved during pre- and post-Covid periods, using European banks as a case study. In addition, we identify which buffers were used as levers by banks to ensure that they comply with the regulations while at the same time be able to support the economy in stressed times due to Covid.

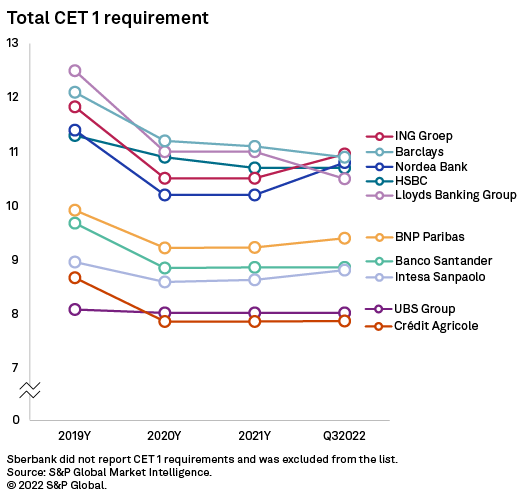

In the below graph, we look at the top 10 European banks by market cap at 2021 year-end. It is evident that the CET 1 requirements reduced substantially in 2020 compared to pre-Covid 2019. In 2022 Q3, we are seeing the numbers rise from 2020 level for some of the banks, but still not at the pre-Covid levels.

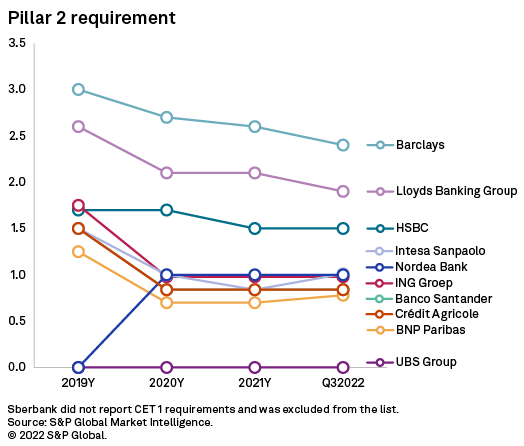

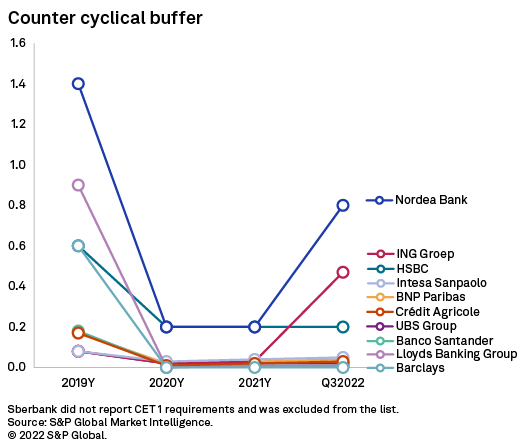

The additional regulatory requirements for banks were introduced to ensure resilience in stressful times, Covid being an example at hand. As these requirements led banks to build up substantial capital buffers leading up to Covid, regulators such as the European Central Bank relaxed some of these measures (especially towards Pillar 2 and Counter-Cyclical Buffer) to facilitate the banking sector’s support to the economy affected by the pandemic.

Using the CET 1 requirements data, this is visible through the graphs below where we see a decline in the Pillar 2 requirement and Counter-Cyclical buffer between 2019 and 2020:

This is just one example of how the data can be used to understand changes in overall CET 1 requirements and what components drove those changes. Other potential uses are performing credit analysis, stress testing of banks, incorporating this for standardized credit risk assessment, to name a few. In order to enable our clients to perform such analysis and enrich data on capital adequacy of banks, in our July 2022 release we added data fields related to CET 1 requirements as reported by banks. The data points are as follows:

We have the data available for 2,000+ banks and is being captured from 2019 onwards. Prior to this, we also released data on minimum capital requirements at country level, covering data points such as CET 1, Tier 1 Capital, Total Capital Ratios, Capital Conversation-, Counter-Cyclical-, Systematically Important Institution- buffers, Liquidity Coverage, Net Stable Funding, and Leverage Ratio. If you’re already a subscriber of S&P Capital IQ Pro, you can access the template by clicking here.

Footnote:

1. Basel III: international regulatory framework for banks

2. ECB Banking Supervision provides temporary capital and operational relief in reaction to coronavirus