Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 24 Apr, 2024

By Cheryl Tay

Highlights

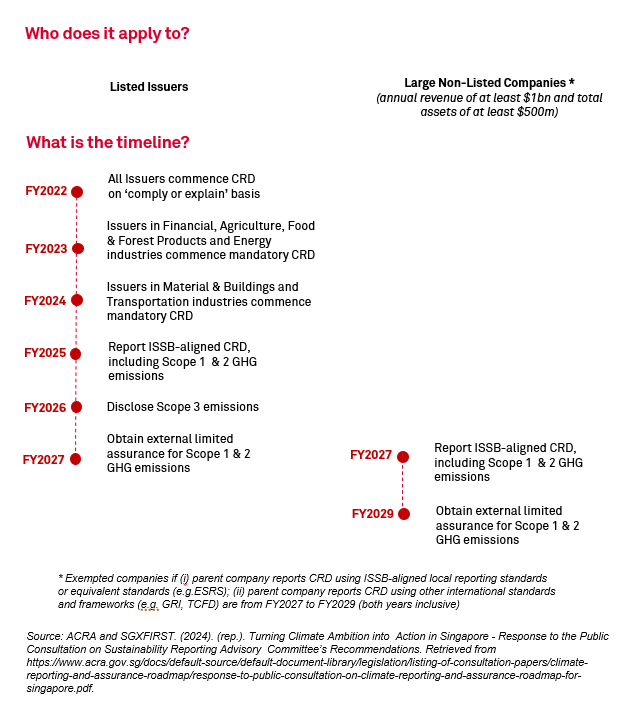

ISSB-aligned CRD, including Scope 1 and 2 GHG emissions, will be mandatory for all listed issuers to report and file from FY2025 and large non-listed companies from FY2027.

The ISSB Foundation Pack is a comprehensive four-module solution, designed to support companies on their ISSB reporting journey.

S&P Global Market Intelligence hosted a roundtable on 18 April 2024 for over 40 SGX listed and non-listed large companies to discuss Singapore’s upcoming mandatory CRD reporting Framework.

Singapore’s Climate Reporting and Assurance Roadmap

On 28 February 2024, Singapore announced it will implement mandatory climate-related disclosure [1] (CRD) requirements for listed and large non-listed companies in line with the International Sustainability Standards Board (ISSB) standards starting as early as 2025.

The specific obligations for each group will be implemented in a phased approach, in line with the recommendations from the Sustainability Reporting Advisory Committee (SRAC), following the conclusion of a public consultation[2] initiated by the Accounting and Corporate Regulatory Authority (ACRA) and Singapore Exchange Regulation (SGX Regco), in September 2023.

Mandatory Reporting

ISSB-aligned CRD, including Scope 1 and 2 greenhouse gas (GHG) emissions, will be mandatory for all listed issuers to report and file from FY2025 and large non-listed companies from FY2027. ACRA will review in 2027 whether to extend the CRD reporting requirements to smaller non-listed companies.

Mandatory Scope 3 GHG emissions reporting will be required for listed issuers from FY2026. Large non-listed companies will not be required to report Scope 3 GHG emissions before FY2029.

External Limited Assurance Requirements

Listed issuers are required to conduct limited assurance on their Scope 1 and 2 GHG emissions from FY2027, while large non-listed companies will be required to do so from FY2029.

Exemptions

Currently, Large Non-Listed Companies (NLCos) whose parent company reports using ISSB-aligned local reporting standards or equivalent standards (e.g. European Sustainability Reporting Standards (ESRS)) are exempt from reporting and filing CRD with ACRA, provided that the NLCos activities are included within the publically available parent company report. Similarly, should the parent company uses other international standards and frameworks, e.g., the Global Reporting Initiative or the Task Force on Climate-related Financial Disclosures (TCFD). In that case, the NLCo will be exempt from reporting and filing CRD with ACRA for a transitional three-year period from FY2027 to FY2029.

Phased Approach

Prior to its February 2024 announcement, SGX Regco has been gradually introducing CRD to listed companies. In FY2022, all Listed issuers were to commence CRD on a “comply or explain” basis. This was followed by developments in FY2023, where issuers in five select industries (Financial, Agriculture, Food & Forest Products and Energy) were required to commence mandatory CRD. In FY2024, two additional sectors (Material & Buildings and Transportation) were added to the list.[3]

S&P Global Market Intelligence Solutions to support you wherever you are in your reporting journey

The ISSB Foundation Pack is a comprehensive four-module solution, designed to support companies on their ISSB reporting journey.

Starting with an ISSB Disclosure Benchmark & Gap Analysis, we identify the extent to which the company’s public reporting is aligned with ISSB (IFRS S2) recommendations. We review publicly available climate disclosures in Sustainability Reports, the company’s latest CDP Climate Change Questionnaire and up to three of their peers. From this analysis, we provide an overview of the disclosure coverage and quality, which will determine the overall alignment of each company against the ISSB framework.

The Climate Risk Analytics module includes a detailed Transition Risk Assessment on Policy and Market Risks through the lens of carbon pricing based on three future carbon price scenarios. This is followed by a Physical Risk assessment under two climate scenarios—Shared Socio Economic Pathways 5 and 2 (SSP5 and SSP2)—for eight climate hazards (Water Stress, Temperature Extremes, Coastal Flooding, Drought, Wildfire, Tropical Cyclone, Fluvial and Pluvial flooding). The output is a Climate Risk Assessment Report, which captures forward-looking carbon pricing risk and physical risk impact metrics.

Carbon Footprint Analytics helps the company to measure their Scope 1, 2 and 3 emissions using a quantitative approach aligned with the GHG Protocol. Full assurance support can also be provided when external verification is required.

Finally, the Science-Based Target Setting module supports the company in identifying the appropriate target-setting approach and emissions reduction trajectories aligning with different temperature scenarios to set science-based emissions reduction targets.

Find out more here: ISSB Reporting | S&P Global (spglobal.com)

Sustainability Reporting Grant Schemes

The Singapore government has also announced high-level details about grant schemes to defray the costs associated with sustainability reporting for first-time reporters.

Sustainability Reporting Grant

The Sustainability Reporting Grant is for large companies with an annual revenue of S$100 million and above. It will cover up to 30 percent of qualifying costs, capped at S$150,000 per company, for the preparation of a company’s first sustainability report. Administered by the Economic Development Board (EDB) and Enterprise Singapore (EnterpriseSG), to qualify for the grant, disclosures must be consistent with the ISSB standards.[4]

SME Sustainability Reporting Support Programme

While sustainability reporting is currently not mandatory for small and medium enterprises (SMEs), EnterpriseSG, will partner appointed sustainability service providers to launch a programme supporting SMEs preparing their first sustainability reports in late 2024 and will be available for three years. EnterpriseSG will help defray 70% of eligible costs for the first year and 50% of costs for the next two years.4

S&P Global Market Intelligence Roundtable on Navigating Singapore’s Climate Risk Reporting Framework

S&P Global Market Intelligence hosted a roundtable on 18 April 2024 for over 40 SGX listed and non-listed large companies to discuss Singapore’s upcoming mandatory CRD reporting Framework. Rong Yu, Head of ESG Solutions for ASEAN and Greater China from S&P Global Sustainable1 moderated a fireside chat with Ms. Esther An, Chief Sustainability Officer of City Developments Limited (CDL) and the Chairperson of the Sustainability Reporting Advisory Committee (SRAC). The discussion captivated the audience with great insights about SRAC’s public consultation process, key concerns heard from corporates, and CDL’s own sustainability reporting journey. One highlight of the session was CDL's “4Is” underpinning organizational wide buy-in and actions: Integration, Innovation, Investment and Impact.

Get ready for ISSB. Request more information about how our sustainability specialists can provide an end-to-end solution to meet your ISSB reporting needs.

[1] Climate reporting to help companies ride the green transition: All listed issuers to report from FY2025 and large non-listed companies from FY2027. (2024, February 28). ACRA. Retrieved from https://www.acra.gov.sg/news-events/news-details/id/778.

[2] ACRA and SGXFIRST. (2024). (rep.). Turning Climate Ambition into Action in Singapore - Response to the Public Consultation on Sustainability Reporting Advisory Committee’s Recommendations. Retrieved from https://www.acra.gov.sg/docs/default-source/default-document-library/legislation/listing-of-consultation-papers/climate-reporting-and-assurance-roadmap/response-to-public-consultation-on-climate-reporting-and-assurance-roadmap-for-singapore.pdf.

[3] SGX mandates climate and board diversity disclosures. (2021, December 15). SGX. Retrieved from https://links.sgx.com/1.0.0/corporate-announcements/YM3DMQ4BXJGNY7M7/5ea23195801ce7a06ae85b29c40d5b4f8697a5edfaa0f8378c60cd60b7f106a0.

[4] Supporting Businesses in the transition to a low-carbon and sustainable future. (2024). Ministry of Trade & Industry.

Case Study

Case Study