Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 20 Oct, 2022

By Milan Ringol

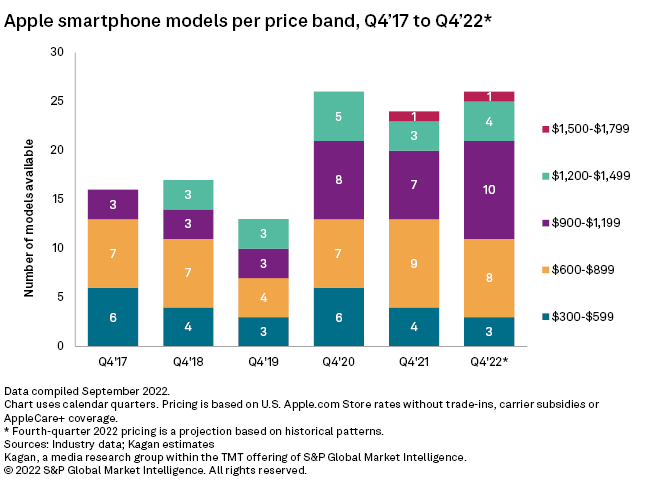

The iPhone 14 lineup was announced on Sept. 7, with four new models, three of which share the price points of their direct predecessors from the iPhone 13 lineup. While this might seem that the cost of buying an Apple smartphone would remain the same as it was prior to the 14 launch, the discontinuation of the budget-friendly iPhone 11 and iPhone 12 mini, along with the introduction of the iPhone 14 Plus, instead increased the median price for all iPhones by $100.

While price point shuffling took place for most models with the launch of the iPhone 14 lineup, a handful of those price adjustments created the biggest impact. While three price points under $900 were removed from the mix, a new $1,299 price point was created, and the $900-$1,199 price band gained three new devices in existing price points. With just these changes, Apple effectively raised the median price of its iPhones in total from $829 to $929.

Now, after the launch of the iPhone 14 lineup, the distribution of iPhone models across the price bands has started to lean toward the high-end. Among the 26 available models currently offered, 15 models (58% of total) cost over $900 with 10 models in the $900-$1,199 price band. Compare this to the year before when the iPhone 13 lineup was released, and 13 models (54% of total) for sale instead were under $900 with 9 of those in the $600-$899 price band. The $600-$899 band used to have the most models among all price bands, going as far back as 2017, except in fourth-quarter 2020 when premium flagships from both the iPhone 11 and iPhone 12 lineups were both offered.

The price restructuring over the years resulted in more overlaps between the models across different storage capacity configurations. Note that Apple's smartphones typically have a fixed 64 GB or 128 GB storage capacity, but they also offer the same models with more storage capacity at higher prices. The main purpose of the price restructuring is to make upselling easier by providing a slightly better offering at a slightly higher cost. It could be for the same model with more storage or for the next level model at similar storage capacity. With the most recent pricing changes, the overlaps have moved toward the premium flagship price points, to nudge more customers toward picking up the highest margin products.

MI clients can access our full report that breaks out the historical pricing of individual Apple smartphone models as well as an analysis on Apple's pricing strategy for the iPhone segment.

For more information on Apple's products, refer to Kagan's quarterly Apple review here.

For more information on smartphone shipments, revenue, and average selling price, refer to Kagan's quarterly smartphone market review here and annual smartphone market projections here.