Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 9 Feb, 2022

By Milan Ringol

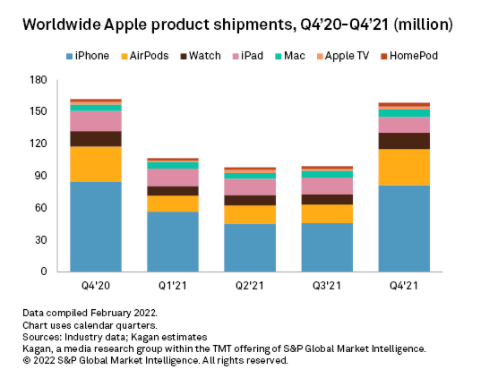

Apple's total product revenue climbed 9% year over year in the fourth calendar quarter of 2021, but Kagan estimates that unit shipments for the Apple devices we track fell 2% to 158.5 million as an increase in average selling prices offset ongoing supply constraints.

As Apple no longer reports device shipments, Kagan's quarterly Apple reporting provides estimates of company shipments based on business unit revenues, supply chain information and proprietary shipment and market share tracking models. Our model is based on calendar quarters that begin in January, instead of Apple's fiscal quarters that begin in October, such that all mentions of "quarter" refer to calendar quarters unless otherwise specified. Apple devices tracked in this quarterly update include the iPhone, Mac, iPad, Apple Watch, AirPods, Apple TV and the HomePod.

iPhone

Estimated iPhone shipments receded nearly 4% year over year in the December quarter partly due to an unfavorable comparison with the year-ago period, when the iPhone 12 lineup came out in October instead of the typical September launch.

The iPhone 13 started shipping in late September, shifting some early adopter sales to the third calendar quarter. Still, the new model was relatively competitive with its predecessor in the holiday quarter despite a higher price tag. The new lineup of handsets was particularly well received by Chinese consumers, with estimated shipments to China up 53% year over year.

iPad

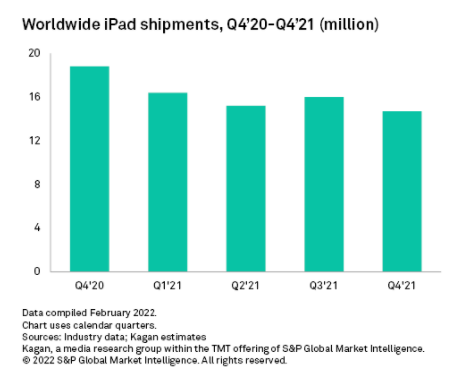

The component supply shortage for the iPad segment worsened in the December quarter resulting in an estimated 22% year-over-year drop in iPad shipments. There has been speculation that certain components shared between the iPhone and iPad that were in short supply were allocated to the iPhone 13 production line as a matter of prioritization. In the most recent earnings call, Apple CEO Tim Cook did not confirm this when asked directly but he acknowledged some component commonality between different products as well as a shortage around legacy node components, lending plausibility to the speculation.

Installed base

Apple's fourth quarter global installed base grew 11.1% year over year to 1.9 billion, with growth fueled primarily by its wearables division, which accounted for 43% of all new additions in 2021. Cross selling wearables to new iPhone buyers played a part in driving this growth, with new additions to the iPhone segment comprising 30% of the 2021 total.

With contributions from Mike Paxton and Neil Barbour.

This article is part of a recurring, quarterly series of articles covering Kagan's estimates of Apple product shipments. MI clients can access our full report that breaks out Apple product shipments and installed base, as well as individual analysis on each product segment.