Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 19 Jul, 2021

By Hangyu Ma, CFA, FRM and Lei Yue

In our previous article, “Anticipate the Unknown: A Fundamentals Approach to Detect Signs of Private Company Credit Deterioration”, we showed how company fundamentals can be used to detect timely and early warning signs of deterioration in a company’s creditworthiness, even for private companies. However, private companies often do not report any financials, and it is necessary to go beyond fundamentals to gain new insights to anticipate the unknown. To this purpose, S&P Global Market Intelligence’s Credit Analytics includes a rich suite of statistical tools, such as S&P Global RiskGauge, PaySense, and Probability of Default (PD) Model Market Signals (PDMS).

RiskGauge – Overall Creditworthiness Assessment

The RiskGauge Score provides a holistic credit risk score combining outputs from Credit Analytics PD Model Fundamentals (PDFN), PDMS, and CreditModel™ (CM).[1] While each model can be used separately for different purposes, the RiskGauge Score can be used to reinforce signals coming from each individual model and, thus, provide a less noisy and more reliable early indication of creditworthiness deterioration.

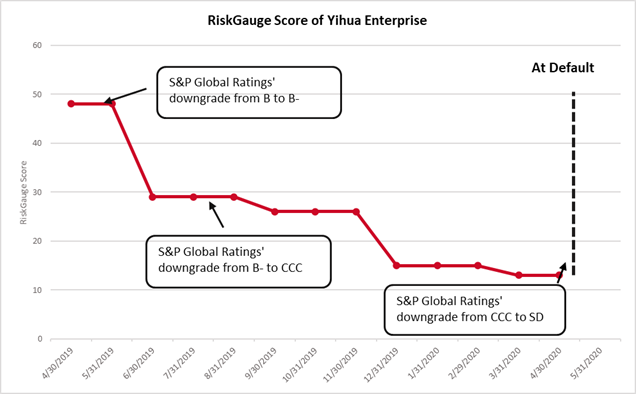

Yihua Enterprise [Group] Company Limited, a Chinese private industrial conglomerate, was downgraded by S&P Global Ratings to “SD” from “CCC” in May 2020, following two consecutive downgrades in April and July of 2019, respectively. Figure 1 below shows the continuous worsening of its RiskGauge Score, a clear indication of escalating credit risk, even a few months before the S&P Global Ratings action.[2]

Figure 1: RiskGauge Score of Yihua Enterprise

Source: S&P Global Market Intelligence as of June 21, 2021. For illustrative purposes only.

PaySense – Trade Payment Risk

A review of payment behavior is a critical component of any sound risk management practice. Although not directly related to default risk,[3] trade payment risk analysis offers a complementary way to help detect on-going liquidity issues and/or credit distress when paired with other Credit Analytics metrics. S&P Global Market Intelligence PaySense can identify potential delays of trade payables by leveraging historical trade payable data and macroeconomic factors.

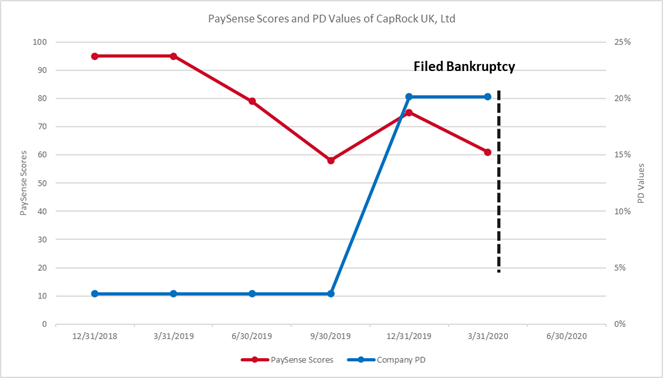

CapRock UK, Ltd, a private wireless telecommunication service company, filed for bankruptcy in April 2020. As shown in Figure 2 below, its PaySense Scores deteriorated dramatically one year before filing for bankruptcy, indicating higher trade payment risk worthy of further analysis. It is noteworthy that the signal from PaySense appeared months ahead of a PD jump (based on PDFN – Private Corporates), showing the added value of PaySense in hinting at distress in credit conditions.

Figure 2: PaySense Scores and PD Values of CapRock UK, Ltd

Source: S&P Global Market Intelligence as of June 21, 2021. For illustrative purposes only.

PDMS – A Credit Pulse

Apart from a company-specific analysis, risk analysts and asset managers can further look at PD levels and changes at an aggregated sector or country level. PDMS, a market-driven PD model based on daily equity prices, is particularly useful to provide a timely overview of the overall credit profile change in different industries or countries, especially under stressed conditions. Whilst PDMS is not applicable to private corporates, the overall industry credit trends of the public universe can provide a good pulse of the general credit environment, becoming a useful reference point for private companies, especially those without financials.

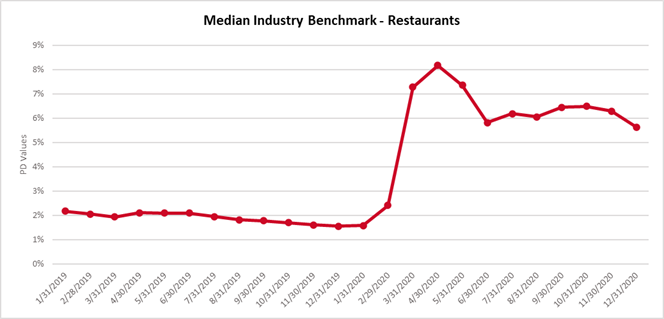

With the spread of the COVID-19 pandemic, most private companies were put under pressure and faced rising levels of credit risk. For example, the restaurants sector suffered dramatically due to lockdowns, barring any measures introduced by governments to support the economy and small- and medium-sized enterprises (SMEs). Figure 3 below shows the evolution of median PD values produced by PDMS for the restaurant industry, worldwide. The median benchmark remained at a stable and relatively low level during 2019, but experienced a sharp increase in 2020Q1 – the initial stage of COVID-19. Afterwards, it stabilized around 6%, still remaining three times higher than the industry benchmark before the pandemic.

Figure 3: Median PDMS Benchmark for Restaurant Industry

Source: S&P Global Market Intelligence as of June 21, 2021. For illustrative purposes only.

Summary

Apart from company fundamentals, there are several ways of detecting early warning signals of credit deterioration for private companies to help anticipate the unknown, each providing a specific perspective and complementing one other. PDMS industry credit trends and RiskGauge Scores are directly linked to credit risk, whilst PaySense Scores offer a bridge between traditional credit risk assessments and alternative datasets. The signals featured in this and the previous article provide risk managers with comprehensive tools to monitor large portfolios of private firms and identify early warning signs of credit deterioration.

Learn more about RiskGauge here

[1] PDFN is a global model generating a PD value based on company financials and a selection of socio-economic factors (e.g., country and industry risk scores) for public and private companies of any size. PDMS is a market-driven PD model, which leverages stock price and volatility, as well as credit default swaps market-derived signals and a selection of socio-economic factors, for public companies, globally. CM is a quantitative scoring model that utilizes both financial data from corporates and other socio-economic factors to generate a credit score that statistically matches a credit rating by S&P Global Ratings. S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit model scores from the credit ratings issued by S&P Global Ratings.

[2] The higher the RiskGauge Score, the lower the credit risk.

[3] “Trade Payment Risk Is Not Necessarily Default Risk”, S&P Global Market Intelligence, September 2020.

Theme

Location

Products & Offerings