S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

CASE STUDY — 17 Jul, 2024

A fast-growing insurance firm

Underwriting and pricing teams

On July 26, 2023, the U.S. Securities and Exchange Commission (SEC) adopted final cybersecurity disclosure rules that require public companies to file a Form 8-K within four business days of determining that a cybersecurity incident it has experienced is material. This is to include details on the nature, scope and timing of the incident and its impact, or reasonably likely impact, on the company.

An emerging and fast-growing insurance company takes a very analytical and data-driven approach to analyzing risks across its many lines of business. Members of the underwriting team saw an opportunity to leverage these filings to help them understand potential claims within their existing customer base and better price risk for new policies. While the filings are readily available through EDGAR, the SEC's data retrieval system, the team needed the information in a format that was more readily useable and that they could query leveraging Python & SQL.

Members of the underwriting team wanted to find SEC filings that had already been parsed and in a machine-readable format to save time preparing the data for their internal platform. The team also wanted to develop a reliable and accurate approach to test their hypothesis that SEC filings could help uncover insights about cybersecurity risks as a means of pricing cyber risks more accurately across the market. The insurance company was a client of S&P Global Market Intelligence ("Market Intelligence") but wanted to explore and test S&P Global data offerings and capabilities before committing to a broader subscription. |

The underwriting team wanted to find a source of machine-readable text to make it easy to unlock data from unstructured documents to uncover actionable insights. |

Specialists from Market Intelligence described their Machine Readable Filings dataset that includes parsed text from annual and interim reports broken into the various sections identified by a company, with extraneous information such as page numbers, images and tables removed.

Market Intelligence specialists let the underwriting team explore available S&P Global datasets prior to subscribing via S&P Capital IQ Workbench ("Workbench") powered by Databricks. Workbench is a cutting-edge technology that enables users to test, explore and experiment with datasets from S&P Global and curated third-party providers in a scalable and secure cloud-based environment, with no installation required. With a web-based notebook environment, users can create, collaborate and share documents that contain live code, equations, visualizations and explanatory text. Workbench and Machine Readable Filings data enabled the underwriting team to:

|

Test and experiment with data |

Workbench provides access to data needed to perform exploratory analysis or build models. Users can easily analyze and review 80+ pre-built notebooks[1] created by S&P Global data analytical experts or customize their own to better understand and see first-hand the value of the data. Workbench facilitates multi-language support in a single notebook inclusive of R, Python, SQL and Scala, and supports interoperability between programming code that is executed in different languages. Code, text and data are automatically version controlled, tracking changes that have been made and ensuring that team members are all using the latest information. With Workbench, users can create tables, charts, dashboards, animations, and more to see correlations and capture the power of the data. The environment enables teams to collaborate across notebooks in their company's own secure and scalable workspace. Users can share notebooks and work with colleagues through real-time co-authoring and commenting to enable streamlined teamwork while maintaining control. |

|

Leverage starter notebooks |

Starter notebooks are consistently structured to include three main elements across datasets: (1) Basic information to help a user understand the data – such as providing a dataset overview and the schema, (2) Editable queries so a user can start to see details of the database, and (3) Sample queries that begin to detail potential client use cases for the dataset. |

|

Create extensive visualizations with Plotly |

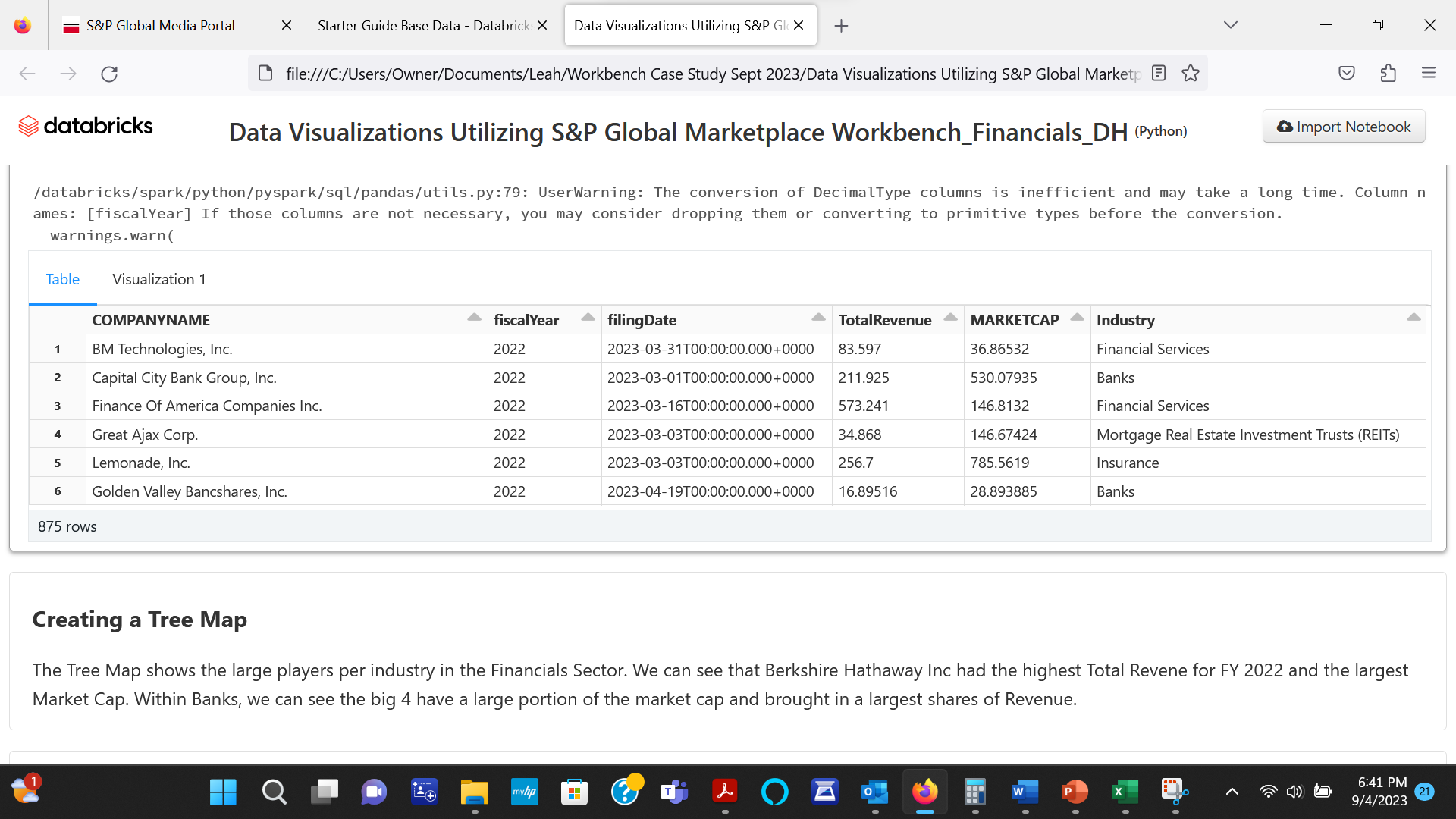

Plotly provides additional flexibility over the built-in data visualizations from Databricks with a free and open-source graphing library for Python. This facilitates the creation of charts directly from a Pandas data frame. Figure 1: Sample visualization with industry, FY 2022 total revenue and market capitalization.

|

|

Access parsed text for SEC filings |

The Global Machine Readable Filings dataset provides parsed text for global annual and interim reports, broken down into the various sections identified by the company, with extraneous information removed. The parsed text is in database format at the "part", "item" and "sub-section" level and is updated every two hours. Global Machine Readable Filings performs Natural Language Processing (NLP) on an entity's filings over time to enable users to monitor strategic initiatives and understand earnings, M&A plans, tactical execution, ESG efforts, new products and much more. For the U.S. SEC regulatory filings, the dataset includes:

Data is also available for S&P Global sourced annual reports, quarterly, supplemental and ESG documents. |

With Workbench, members of the underwriting team were able to query, analyze and visualize S&P Global Machine Readable Filings dataset in one place to seamlessly explore insights on cybersecurity issues. They were able to verify the hypothesis that the filings would yield useful insights on cybersecurity issues to enable them to anticipate potential claims with existing customers and make more informed pricing decisions for new policies. They subscribed to the Machine Readable Filings, which enabled them to:

The team is now looking to leverage the Machine Readable Filings dataset to uncover additional insights for their risk assessment process.

S&P Global was awarded the Databricks Marketplace Financial Services Partner of the Year for 2023.

Explore the S&P Capital IQ Workbench and the Machine Readable Filings dataset on the S&P Global Marketplace.

[1] Numbers as of January 2024.