Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Case Study — 9 Feb, 2024

By Paul Vinzani

The Client:

A large U.S.-based wealth manager

Internal Users:

Financial advisors

Redistribution End Clients:

Retail brokerage clients

Many wealth managers are looking to enhance their retail experience through robust online portals that increase the breadth of financial data available to customers. In addition to supporting client needs, enhanced portals also play a critical role in helping wealth managers gain a competitive edge in the market through access to credit ratings from S&P Global Ratings. Our feed solutions for S&P Global Ratings offer reliable and flexible delivery and one of the industry’s largest databases of current and historical credit ratings across corporate, sovereign, U.S. public finance and structured asset classes.

This large U.S.-based wealth manager offers investment advisement, asset management and trading capabilities for retail clients. The firm's financial advisors wanted to display credit ratings from S&P Global Ratings alongside their customer's holdings and have powerful search capabilities for customers to easily identify a specific issuer or fixed income security. This information would also be included within statements exported via locked .pdf format accessible from the platform. The financial advisors felt it was critical to provide as much intelligence to their clients as possible regarding investment risk and changes to credit quality, while displaying the most up to date information available from ratings agencies and market data providers.

Pain Points

Members of the wealth management team were concerned with limitations on information that could be shared externally. As part of their goal to increase their client experiences and remain competitive, they felt that credit ratings from S&P Global Ratings would be an important enhancement for the large volume of their clients investing in fixed income securities. They wanted to:

The team reached out to S&P Global Market Intelligence ("Market Intelligence") to see what was possible.

Wealth managers continue to increase the sophistication of their online platforms to ensure that the technology and data are enhancing the customer experience and helping them remain competitive in the retail wealth and asset management space.

The Solution

Specialists from Market Intelligence discussed RatingsXpress delivered via XpressfeedTM, a powerful data feed management solution. This would provide the wealth manager with:

|

|

Access to trusted credit ratings | RatingsXpress offers one of the industry’s largest databases of current and historical credit ratings from S&P Global Ratings with entity- and security-level data in one schema. The credit ratings cover nearly one million securities:

|

|

A reliable and flexible delivery mechanism | Xpressfeed offers streamlined delivery of credit ratings from S&P Global Ratings. The solution enables wealth managers to ensure accurate, timely delivery of critical information while helping to automate client statement reporting processes. |

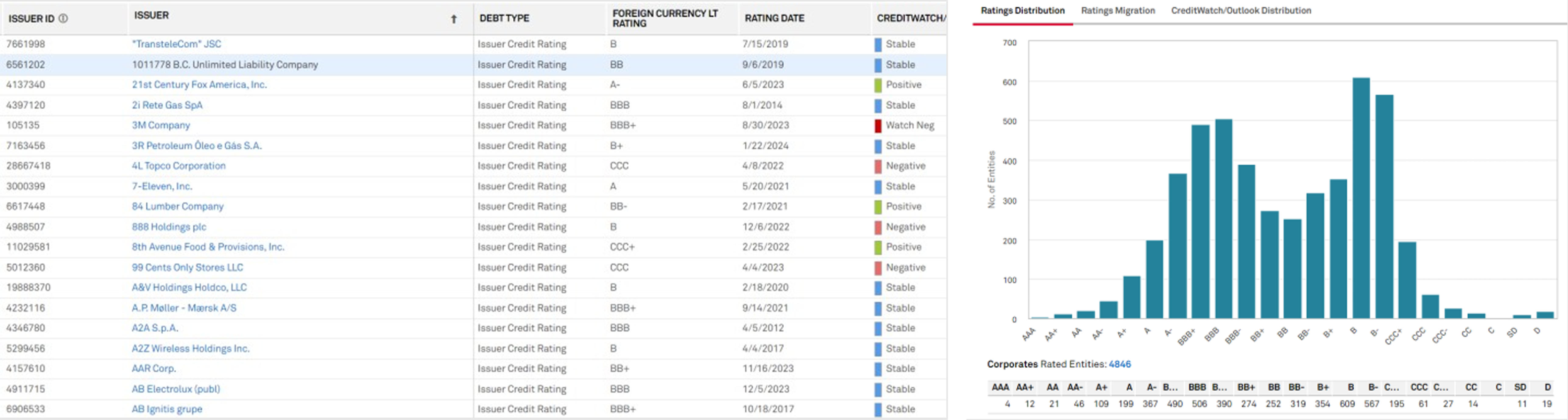

Figure 1: Sample Platform Display

Source: Market Intelligence. For illustrative purposes only.

Key Benefits

The wealth manager is now able to license one of the industry’s largest databases of current and historical credit ratings in a way that:

This is helping the firm both acquire and retain important customers by responding to their needs for deeper investment insights.

Click here for more information on the solution mentioned in this Case Study.

1Coverage numbers as of January 2024.

Theme

Products & Offerings