S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Blog — 25 Jan, 2023

By Andrea Caruso and Lisa Hendrickson

This blog is written and published by S&P Global Market Intelligence; a division independent from S&P Global Ratings. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings.

Customers, suppliers, investors, boards of directors and governments are putting increased pressure on corporations to accelerate their approach to sustainability and net zero. Sustainability and net zero commitments have an impact on a company's business value drivers, including growth, profitability, capital efficiency and risk exposure.

Credit risk departments have both the opportunity and the imperative to incorporate environmental, social and governance (ESG) factors and climate risk in their analysis and contribute to driving their firm's sustainability agenda and journey to net zero.

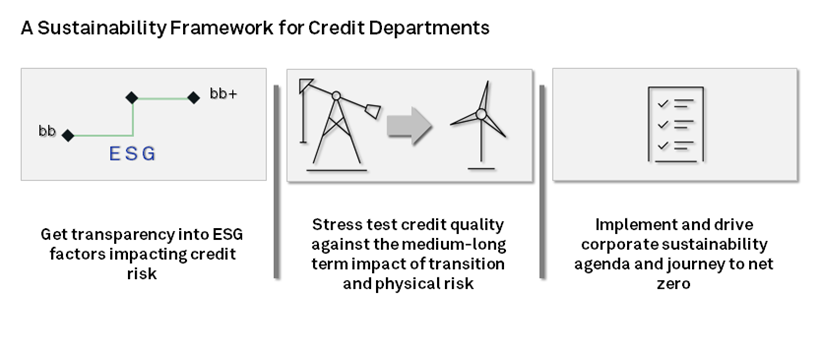

As shown in Figure 1, the Credit Analytics team at S&P Global Market Intelligence along with S&P Global Sustainable1(opens in a new tab) developed a three-pillar framework that assists credit departments as they assess, monitor and manage the credit risk implications of ESG factors and climate risk (transition and physical), while aligning decisions with the company’s sustainability and net zero agenda.

Figure 1: Sustainability Framework for Credit Departments

Source: S&P Global Market Intelligence. For illustrative purposes only. As of December 2022.

Get transparency into ESG factors affecting credit risk. How to incorporate ESG factors in the credit risk assessment of customers, vendors and suppliers.

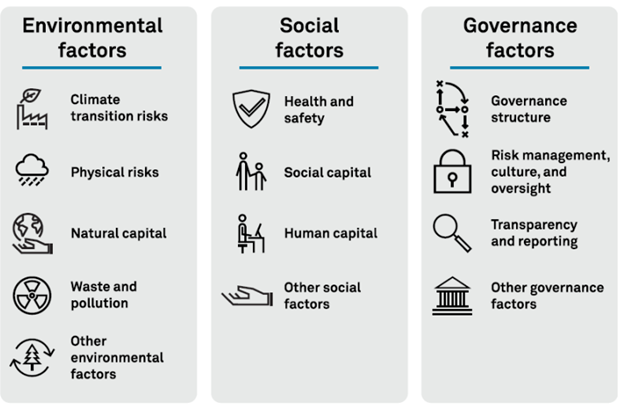

ESG factors typically incorporate an entity's effect on and impact from the natural and social environment and the quality of its governance; however, not all ESG factors materially influence creditworthiness. In fact, entities with strong creditworthiness may not necessarily have strong ESG credentials and vice versa. Therefore, we define ESG credit factors as those that can materially influence an entity’s financial stability.

Figure 2 illustrates examples of key ESG credit factors that have affected creditworthiness according to S&P Global Ratings or may influence this in the future. Some events may relate to more than one of the ESG credit factors, and these factors can have a negative or positive impact on creditworthiness, depending on whether they represent a risk or an opportunity.

Figure 2: Key ESG Credit Factors

Source: General Criteria: Environmental, Social, and Governance Principles in Credit Ratings, S&P Global Ratings, October 10, 2021.

Credit Assessment Scorecards with ESG Credit Metrics by S&P Global Market Intelligence plus, in the coming months, RiskGauge™ reports and scores, enable credit risk managers to evaluate the material impact of E, S, and G factors on the credit quality of any customers, suppliers, vendors, and investments. Taking a pragmatic approach that scales across a large base of customers, vendors, and suppliers, we also provide an initial evaluation of the impact of ESG credit factors on an entity’s credit risk using country and industry assessments as without requiring an analyst to conduct a company-by-company detailed analysis.

Stress test credit quality against the medium- to long-term impact of transition and physical risk. How to use climate scenarios to evaluate the impact on credit quality.

Pricing credit relationships over the medium and long term requires evaluating the impact on profitability, and hence credit quality, due to the capital invested to transition to a low-carbon economy, as well as any asset depreciation due to physical risk impacts from events such as hurricanes, wildfires, and sea level rise.

S&P Global Market Intelligence has developed two complementary solutions that provide a sector-specific and granular assessment at a company level or an optimized approach for portfolios with large numbers of private companies and limited data.

A Fundamentals-Driven Approach, Climate Credit Analytics (CCA) projects a firm's complete financial statement and corresponding credit score changes based on climate-linked transition and (in the coming months) physical risk scenarios. This is ideal for significant exposures to carbon-intensive sectors and for assessing credit risk via fundamentals-driven models.

Market Valuation-Driven Approach, Climate RiskGauge (CRG): CRG evaluates the impact of carbon taxes on a company's earnings conditioned on climate-linked transition and macro-economic physical risk scenarios relying on limited company specific data.

Both approaches enable credit risk professionals analyze climate scenarios’ financial and credit risk implications by producing financials, credit scores and probabilities of default over different time horizons that can span years or decades. For example, users can conduct analysis over the long term, by selecting scenarios from the Network for Greening the Financial System (NGFS) out to 2050, or over the short term, by evaluating the impact of a globally applied carbon tax phased over a three-year time horizon. They can also apply regulatory scenarios, such as those published by the European Central Bank (ECB scenarios), in their analysis.

Whether or not ESG factors and transition/physical risks are material to the credit quality of counterparties, they may provide additional insights for a credit manager to consider when pricing the risk or reward of a relationship.

S&P Global provides frameworks and data on over 10,000 public and 2.5 million private companies[1] that credit departments can use to assess how a customer, vendor, or supplier’s sustainability strategy and policy might impact their operational footprint (Scope 1 and 2) and their value chain (Scope 3) emissions or advance/slow the corporation’s agenda while providing essential information to help assess these metrics.

ESG Scores (opens in a new tab) provide critical insights into a company's environmental policies and reporting, management and employee diversity, human rights and labor practices, corporate and supplier risk management, cybersecurity business ethics, and corporate governance.

Trucost Environmental Dataset(opens in a new tab) measures a company's environmental impact across GHG (greenhouse gases), water, waste, and multiple other dimensions. It can be used to identify and manage environmental and climate risk and compare peer performance.

Trucost Environmental Private Company Dataset(opens in a new tab) covers carbon greenhouse gas (GHG) emissions, land, water, air pollutants, and waste disposal, natural resource and water use, and revenue generated from each sector of a company's operations.

As companies move towards a model that integrates sustainability metrics into financial decision-making, the relevance of climate mitigation and adaptation strategies shifts to center stage, signaling that the company recognizes the changing landscape. Accounting for these new conditions within corporate strategy, operations, risk management, and reporting shows a considered effort to protect the company from controllable risks while looking for opportunities in the transition to a lower-carbon economy.

To learn more about these capabilities, contact us here(opens in a new tab).

Products & Offerings