S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Blog — 19 Jan, 2023

Highlights

Federal Council brings ordinance on mandatory climate disclosures.

Banks, insurers and large public companies to issue climate-related financial disclosures from 2024 onward.

Decision-makers also want climate-related disclosures when they allocate assets, extend financing and price risks.

Climate scenario analysis is key to determining climate-related risks and opportunities and facilitates a financial institution in setting its climate goals

During a meeting in late November 2022, the Federal Council[1] adopted the implementing ordinance on climate disclosures for large Swiss companies, bringing it into force as of 1 January 2024. Public companies, banks and insurance companies with 500 or more employees and at least CHF 20 million in total assets, or more than CHF 40 million in turnover, are obliged to report publicly on climate issues.

The ordinance follows the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and requires disclosures on:

Reporting on several areas requires a strategic review of governance and strategy, which is largely internal. For a financial institution the ordinance largely relates to assessing the impact of climate-related events on credit and underwriting risk and reducing financed emissions to achieve climate goals. One of the key challenges in this process is the use of forward-looking scenario analysis to assess climate-related risks and opportunities given the lack of robust methodologies to determine credit risks, multiple temperature pathways suggested by the climate science community, the role of technological change and issues posed by inconsistent or missing data.

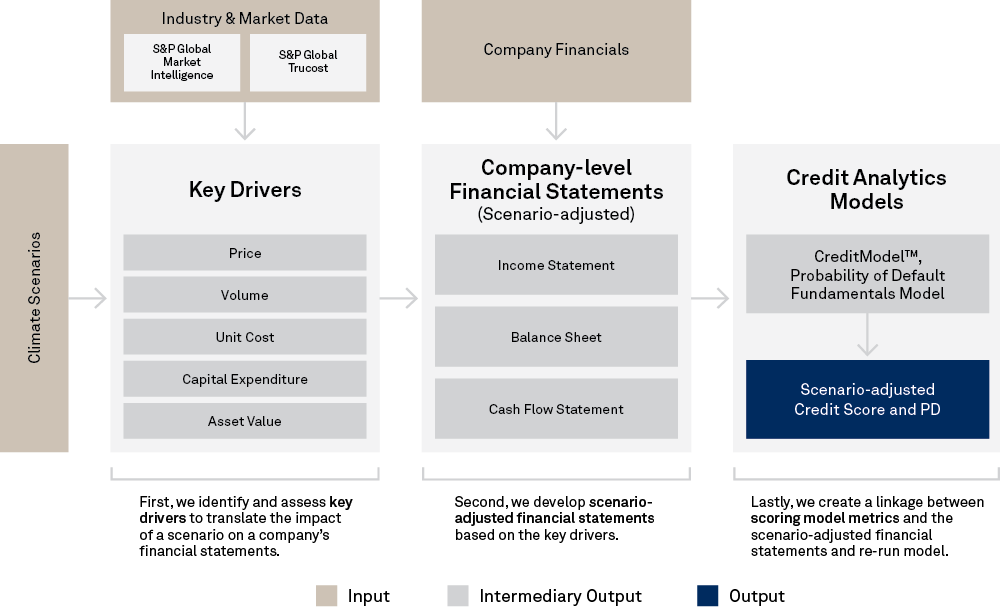

S&P Global Market Intelligence has developed a variety of analytics and datasets to help clients deal with these challenges. Climate Credit Analytics, developed in collaboration with Oliver Wyman, is a bottom-up approach using scenarios aligned with the Network for Greening the Financial System (NGFS), which enables comprehensive and consistent sector-specific modelling, including an evaluation of key high carbon-emitting sectors. As shown in Figure 1, the solution leverages S&P Global Market Intelligence’s proprietary datasets and capabilities, including financial and industry-specific data, sophisticated quantitative credit scoring methodologies and best-in-class company-level environmental data from S&P Global Trucost. Analysis can be undertaken at a counterparty or portfolio-level, and the output includes projected financials of counterparties for the forecast period, along with credit scores[2] and probabilities of default.

Figure 1: Climate Credit Analytics Framework

Source: S&P Global Market Intelligence. January 2023. For illustrative purposes only.

Climate Credit Analytics reflects the latest climate scenarios and methodologies, helping users remain on track with changing market dynamics and regulations. The analysis is designed to meet the needs of financial institutions on complex subject matters, such as quantifying the financial impact of climate risk and providing the necessary insights to make financing decisions with conviction.

[1] Federal Council brings ordinance on mandatory climate disclosures for large companies into force as of 1 January 2024, The Federal Council, www.admin.ch/gov/en/start/documentation/media-releases.msg-id-91859.html.

[2] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit model scores from the credit ratings issued by S&P Global Ratings.

To learn more about Climate Credit Analytics, contact us here.