Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Case Study — 13 Jan, 2023

By Katriona Ho

The credit risk departments at energy and commodity companies are charged with managing counterparty risks for their large domestic and overseas exposures. While many companies attempt to leverage in-house models, this is often challenging given a lack of financial data and output comparability across regions and sectors, plus the need to derive credit limits that can sufficiently capture risk factors.

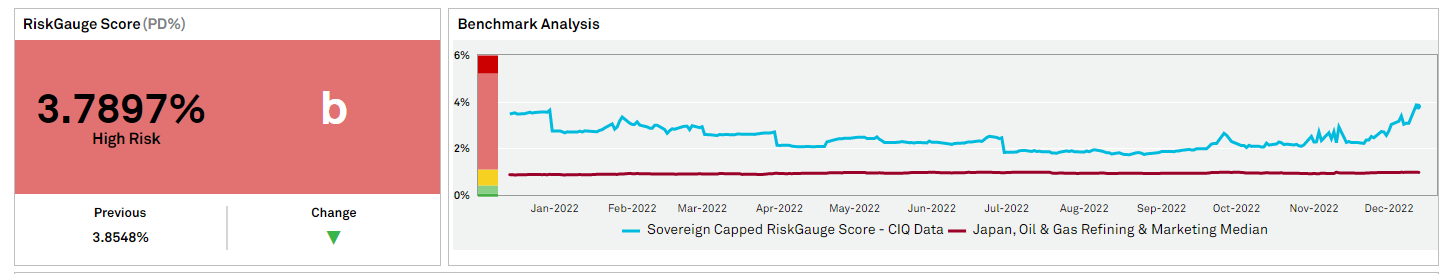

Credit Analytics, part of S&P Global Market Intelligence’s Credit & Risk Solutions suite of analytical tools, addresses these challenges with cutting-edge models and robust data to reliably score and monitor potential risk exposure to rated, unrated, public and private companies across the globe. Credit Analytics includes comprehensive RiskGauge credit reports applicable for over 50 million public and private companies worldwide,[1] including small- and medium-enterprises (SMEs). As shown in Figure 1, RiskGauge provides a holistic credit risk score based on elements of Credit Analytics’ fundamental and market-based models.

Figure 1: RiskGauge Score, Probability of Default (PD)%

Source: S&P Global Market intelligence. January 2023. For Illustrative purposes only.

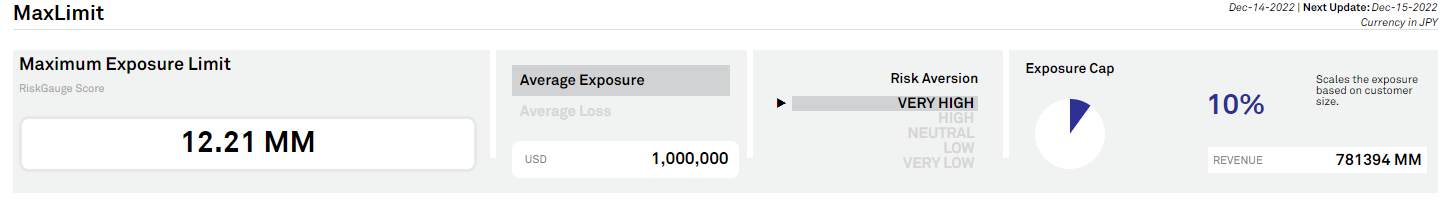

Credit Analytics also includes MaxLimit that identifies maximum exposure by considering both sides of the equation: a customer and a supplier. The output accounts for the customer’s creditworthiness, the dynamic assessment of their industry payment behavior and additional size adjustments. The output can then be adjusted based on a supplier’s risk appetite using one of two approaches: (1) the maximum loss capacity that, on average, the supplier can withstand from the portfolio of exposures, or (2) the average exposure based on the supplier’s production/sale capability.

A Large Energy Company Leverages Credit Analytics to Reduce Risk Exposure

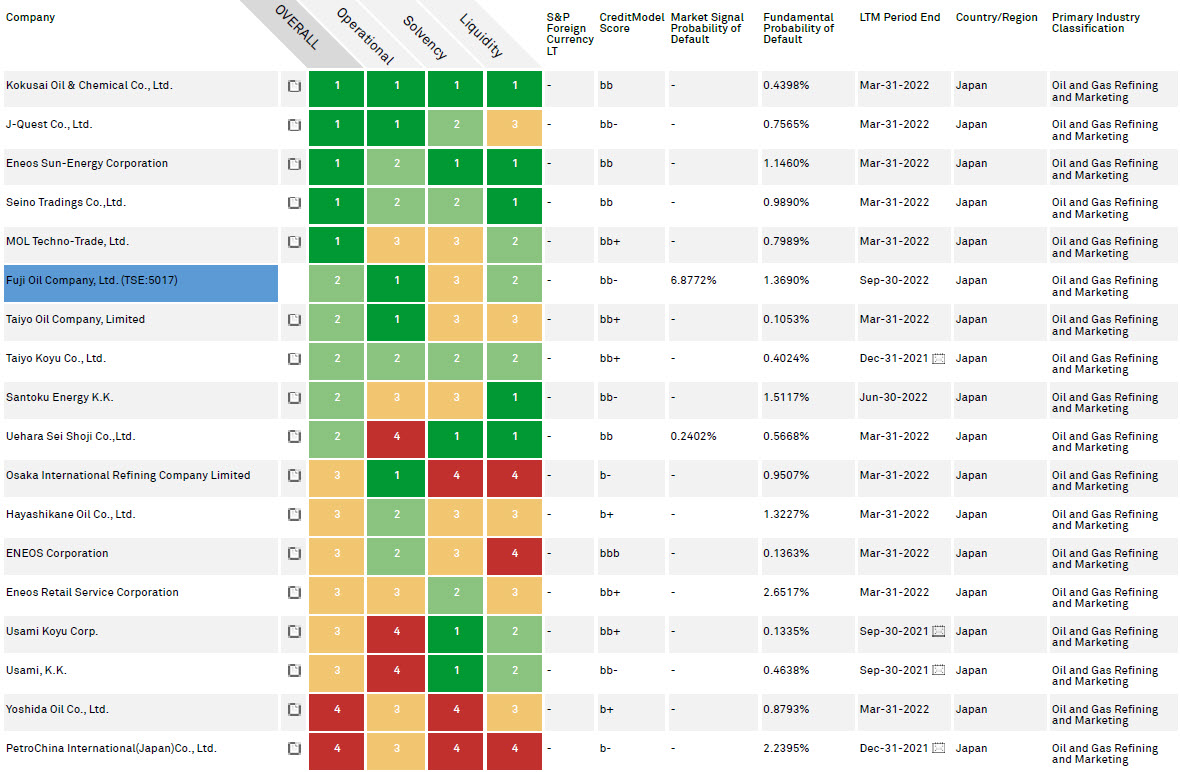

One of the largest national energy companies in North Asia has been using Credit Analytics for its overseas exposure management. The company was impressed by the model coverage, which included the details it needed on public and private companies in the oil and gas industry around the globe, private shipping and logistic companies in Europe, energy and transportation conglomerates in North America and a diversified financial institution in South Asia. Credit Analytics has been an optimal solution for its needs, generating comparable outputs across regions and including features such as peer analysis shown in Figure 2.

Figure 2: Sample Peer Analysis

Source: S&P Global Market intelligence. January 2023. For Illustrative purposes only.

For exposure management, the company’s credit risk team leverages the MaxLimit framework to oversee the short-term liquidity position and optimize the business for growth opportunities. Members of the team explored the MaxLimit outputs shown in Figure 3 in detail, including average loss, average exposure, risk aversion and exposure cap, which met with their expectations and internal standards.

Figure 3: Sample MaxLimit Outputs

Source: S&P Global Market intelligence. January 2023. For Illustrative purposes only.

With Credit Analytics, team members are benefiting from a ready-built model that is easy-to-use, efficient and highly cost effective. They also value the ongoing support from S&P Global Market Intelligence’s team of specialists who are very familiar with credit risk analysis and the inner workings of all the analytical tools.

Please click here for more information on Credit Analytics and its components.

[1] Coverage as of December 2022.

Products & Offerings

Segment