Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Case Study — 29 Sep, 2023

Highlights

THE CLIENT: A large European-based bank with a global reach

USERS: The credit risk team

In a time of economic uncertainty and geopolitical unrest, the alternative assets industry remains resilient. Assets under management are expected to rise from $13.7tn as of year-end 2021 to $23.3tn in 2027, a compound annual growth rate increase of 9.3%.[1] As Alternative Investment Funds (AIFs) mature, greater transparency is needed, especially given the trend for some funds to access loans from banks and other financial institutions to boost their leverage. This increased leverage poses potential credit risks to those providing fund financing.

Basel IV, also known as Basel 3.1, is the latest in a series of international accords aimed at bringing greater standardization and stability to the worldwide banking system. It began implementation on January 1, 2023, although banks will have five years to fully comply. Under the regulation banks must demonstrate that their internal models are effectively capturing the risk level of a portfolio.

Members of the credit risk team at this large European bank had been using a qualitative approach to assess the credit risk of AIFs the bank was funding. To help meet regulatory requirements, they needed to develop a more standardized approach with more quantitative inputs and demonstrate that this internal model was appropriately capturing risk levels.

The credit risk team was facing a number of challenges when estimating the credit risk of AIFs:

Members of the team wanted reliable data to build a quantitative credit risk model for AIFs, plus a way to benchmark the credit scores to meet the requirements of Basel IV. They reached out to S&P Global Market Intelligence ("Market Intelligence") to see how the firm could assist.

Specialists from Market Intelligence first described Preqin alternative asset data available on S&P Capital IQ Pro, a one-stop desktop solution for essential intelligence. This would help power the development of a quantitative model. They then described the AIF Credit Assessment Scorecard ("AIF Scorecard") that provides a powerful capability to consistently measure credit risks across AIFs that have different strategies and structures, including hedge funds, private equity funds, fund of funds (FOFs) and fund-like entities. These two capabilities would enable the team to:

|

Assess the credit risks of different AIFs |

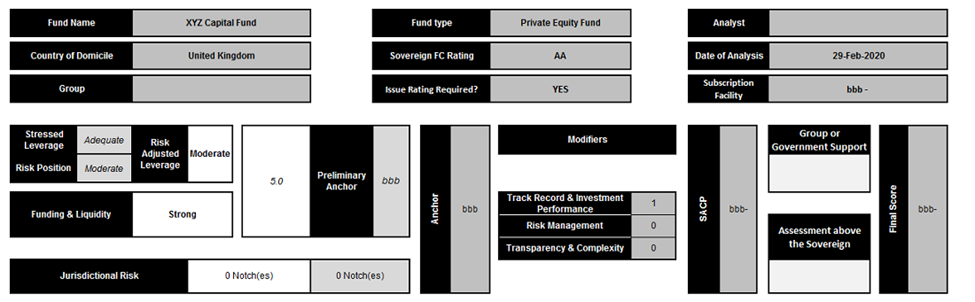

Market Intelligence’s AIF Scorecard (shown in Figure 1 below) analyzes the specific risk factors relevant to AIFs. The Scorecard provides a granular and transparent framework for assessing credit risk. It uses measures that can affect the likelihood of default, which are sensitive to changes in an AIF’s market conditions. They include:

|

Figure 1: The AIF Scorecard

Source: S&P Global Market Intelligence. Simplified version for illustrative purposes only. SACP = Stand-alone Credit Profile

|

Access best-in-class alternative asset data for a quantitative model |

The Preqin dataset provides analytics and research on the alternative assets industry, including private equity, private debt, hedge funds, real estate, infrastructure and natural resources. Preqin's data supports daily activities, including asset allocation, portfolio management, fund manager selection and business development. The dataset includes:

|

Key Benefits

Members of the credit risk team used the Preqin data to construct a quantitative model and then the AIF Scorecard to benchmark the model's results for submission to regulators. They have been benefiting from having:

Preqin Global Report 2023: Alternative Assets", Preqin, January 19, 2023, https://www.preqin.com/insights/research/reports/alternatives-in-2023/ceo-foreword.

Theme

Products & Offerings