Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 11 May, 2022

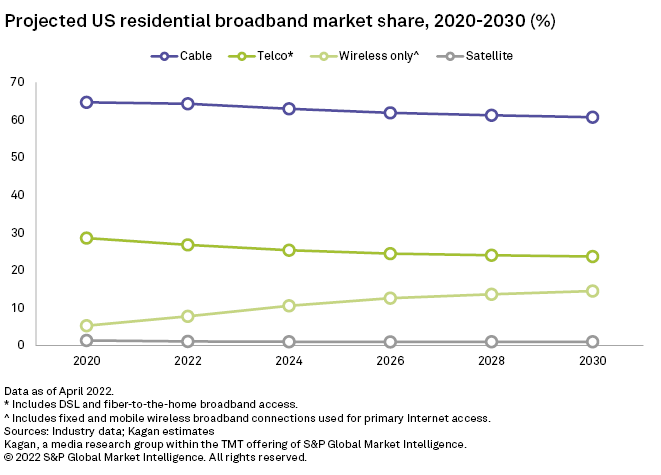

The U.S. residential broadband outlook is increasingly dominated by market share battles amid surging investment and technological advance as residential service penetrations exceed 90% of occupied households.

Telcos are keying in on fiber upgrades, carriers are fueling 5G fixed wireless residential and commercial broadband replacement, upstarts are readying fleets of orbiting alternatives and cable is fortifying with a mix of DOCSIS 4.0 and fiber of its own.

Behind it all is private investment aimed at capturing high-margin revenue and surging public money, most notably the federal push for better high-speed internet accessibility through the $42.45 billion Broadband Equity Access and Deployment, or BEAD, project. The subsidies promise to turn up the heat on the entire sector.

According to Kagan's update forecast, U.S. residential broadband subscriptions are on track to top 122 million at the end of 2022. There simply are not enough subscribers to accommodate the growth ambitions of each segment. Cable operators believe they can continue to take market share, the telcos believe they can steal momentum with fiber, the wireless services believe 5G is their answer to residential substitution and the satellite services believe they can elevate access everywhere.

Market share outlook: