Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 1 Feb, 2021

By Kwame Campos

Highlights

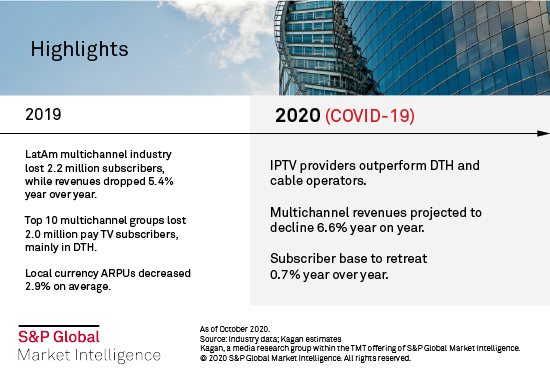

Latin America's top telecommunications groups lost 2.0 million subscribers in 2019 as a result of cord cutting in Brazil, mainly on DTH

IPTV outperformed cable and DTH in 2020, but the segment was still expected to lose 0.7% subscribers during the year

After losing 2.2 million subscribers in 2019, the multichannel industry in Latin America and Caribbean is expected to lose another half a million subscribers in 2020. Revenues felt the primary impact of the COVID-19 pandemic due to currency depreciation.

Already a client? Click here to see the full multichannel report.

Multichannel subscriber base continued to decline in 2019

The Latin American multichannel industry lost 2.2 million subscribers in 2019, ending the year with 69.6 million pay TV households, according to Kagan estimates. Subscriber losses due to cord cutting in Brazil's direct-to-home segment was the main driver behind this trend.

The region saw the DTH industry lose 2.4 million subscribers, a 7.4% decline year over year. Meanwhile, IPTV was the only segment that showed subscriber growth, adding 706,721 pay TV households.

Cable and DTH were the leading multichannel distribution platforms in the region in 2019 with 50.4% and 43.7% of subscribers, respectively. IPTV ranked third with 5.0% of pay TV households, gaining 1 percentage point year over year. Fixed wireless continued its declining trend, accounting for 0.2% of multichannel subs in 2019.

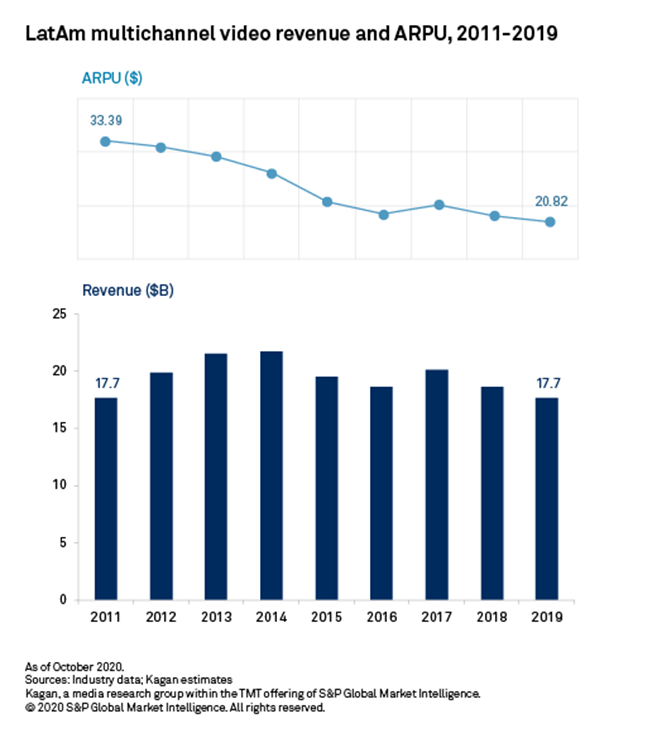

A combination of declining subscribers and ARPUs drove multichannel revenues down in 2019. We estimate the multichannel industry generated $17.67 billion in 2019, 5.4% lower year over year. Local-currency ARPUs declined 2.9% in 2019, according to our local-currency ARPU index. A 1.4% average currency depreciation dragged U.S. dollar denominated ARPUs down 4.2% during the period.

Top groups saw 2.0 million net disconnections in 2019

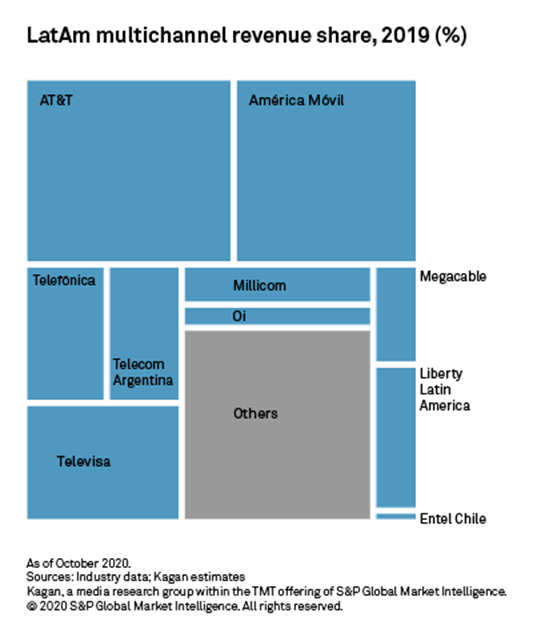

América Móvil SAB de CV, AT&T Inc. and Grupo Televisa SAB are market leaders in terms of subscribers, accounting for 52.2% of the region's pay TV households in 2019. Only four of the 10 groups providing multichannel services in the region added subscribers in 2019. AT&T experienced the largest subscriber loss with 851,917 net disconnections from its DTH subsidiary Vrio Corp., formerly DIRECTV Latin America.

Despite its large subscriber losses, AT&T maintained its leading position in pay TV revenues with $3.95 billion during 2019. Revenues for the 10 groups offering multichannel services covered in this report declined 8.0% on average, with AT&T experiencing the largest decline at 14.8% year over year. Millicom International Cellular SA, in contrast, showed the largest multichannel revenue increase with 25.6% growth year over year. The main driver for Millicom's revenue growth was the revenue generated by Panama's Cable Onda 90, acquired in 2018.

The top 10 multichannel groups' ARPU declined 7.4% year over year in 2019, with Telecom Argentina experiencing the largest drop at 18.2% year over year, mainly due to currency depreciation, as the Argentine peso dropped 41.6% in value during the year. Mexican operators Televisa and Megacable Holdings S. A. B. de C. V. showed the lowest ARPU among the groups covered in the report.

2020: mixed results and currency depreciation

We anticipate the region's multichannel subscriber base to decline 0.7% in 2020, with revenues declining 6.6% due mainly to currency depreciation.

Multichannel operators in Latin America observed mixed results in the first half of 2020. Amid the COVID-19 pandemic, IPTV multichannel operators outperformed cable and DTH operators, showing a 6.7% increase in subscribers, while cable and DTH operators saw 2.8% and 4.1% declines on average, respectively, up to third-quarter 2020. This analysis excluded the impact of subscriber losses in Venezuela, caused by the shut down of CANTV and DIRECTV Venezuela operations during the year, with the latter being partially recovered since the operation was taken over by Scale Capital, under the brand SimpleTV.

Latin American currencies depreciated 10.2% on average in 2020, which led to an average service revenue decline of 15.5% during the first nine months of the year for the groups operating in the region.

To see our 2019 Latin American Top Groups multichannel overview, click here.

This article is based on Kagan's Latin America Multichannel & Broadband Market Overview report, which explores operational and financial trends affecting the telecommunications industry in the region. It also contains profiles, including footprint maps, for the top 11 telecommunications groups offering multichannel products in Latin America: América Móvil SAB de CV, AT&T Inc., Telecom Argentina, Liberty Latin America Ltd., Megacable Holdings SAB de CV, Millicom International Cellular SA, Telefónica SA , Grupo Televisa SAB, Oi SA, Entel Chile and Telecom Italia SpA.

Blog

Blog

Location

Products & Offerings