Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Sep 27, 2022

Where should you build your next hotel or export office?

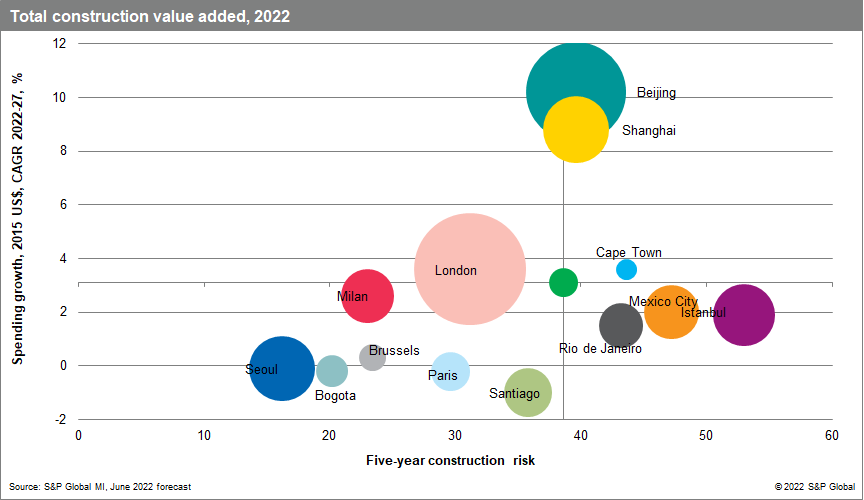

London, Beijing, or Shanghai are among the most attractive cities for construction investment over the next five years, according to an analysis of our regional data and risk scores for select markets.

Capital cities and financial centers are better positioned to withstand the slowdowns in construction markets globally. In financial centers, income from financial services influences other structure types, such as retail, hospitality, and institutional buildings.

London — helped by its status as a global financial and trade center, a seat of government and one of the largest construction markets in the world — has very low risk, and its five-year growth outlook is on the edge of being above average.

Beijing and Shanghai — a government capital and financial and trade center, respectively — have relatively strong construction markets with above-average growth in the five-year outlook and above-average risk. Profitable opportunities exist in markets with higher risk scores, which can be mitigated with attention to contracts and other key details.

Balancing opportunity and risk

Since construction activity has a long lead time for planning, permitting and execution, our research used a five-year forecast compound growth rate to measure expansion and renovation potential. Market size and growth come from our Regional Explorer data set.

Our risk scores account for long-run investment considerations including currency fluctuations, the ease of repatriating earnings, the ability to enforce contracts and protect intellectual property, materials cost stability, and labor force metrics. Risk scores come from our Global Construction Outlook.

Large, established markets like financial centers tend to have slower growth and lower risk than smaller, emerging markets.

Still, being a government center is no guarantee of growth. In our analysis, Mexico City, where the government has dialed back on infrastructure spending, is forecast to have below-average growth in the next five years.

Pockets of strength and weakness

Cities that depend on business travel or tourism, including parts of Greece and Mexico, will be among the first to recover from the weak construction market seen in 2020-21. These cities have the strongest near-term outlook, with that growth likely to slow toward the end of the five-year outlook.

Areas with strong trade connections, such as the Panama Canal, also have strong construction outlooks over the next five years.

Cities that depend on manufacturing carry above-average risk in our five-year outlook as global economic growth slows and energy costs rise.

For example, in Germany, the strongest growth can be found in cities such as Berlin, the capital; Dusseldorf, which has a mix of consulting and financial businesses; and Frankfurt, a banking powerhouse. In places like Stuttgart or Munich, where there is a greater manufacturing component to the economy, growth is slower.

Impact on construction equipment

In the near term, construction equipment makers are playing catch up following supply chain issues that delayed deliveries of equipment.

The emphasis on infrastructure in the US, mainland China, India and Saudi Arabia is promising for the construction equipment, and may help to offset the impact of rising interest rates on construction and the ability to finance machine purchases.

Posted 27 September 2022 by Marie Lechler, Director, Trade and Supply Chain Product Management, S&P Global and

Scott Hazelton, Director, Construction, S&P Global Market Intelligence

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.