Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Apr 18, 2023

By Jamil Naayem

Real GDP growth recorded a strong 8.0% year over year in the fourth quarter of 2022 and reached 2.7% when compared to revised Q3 2022 estimates (quarter over quarter), according to preliminary data published by Qatar's Planning and Statistics Authority.

Qatar's real GDP grew by a robust 8.0% year over year in the fourth quarter of 2022, as per preliminary estimates released by the Planning and Statistics Authority, in line with our expectations and propped up by strong services sector activity amid the FIFA World Cup hosting in November-December.

S&P Global Market Intelligence expects growth in the real economy to slow in the near term, within the context of weaker global demand, tighter financing conditions, and unfavorable base effects due to the World Cup hosting in the fourth quarter.

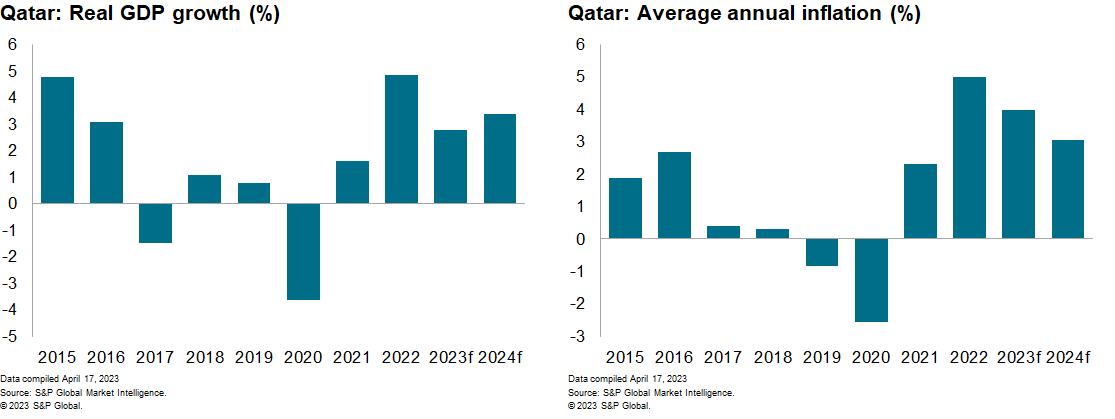

Robust Q4 economic activity lifted real GDP growth to close to 4.8% in 2022, a level unseen since the middle of the last decade. Qatar's strong Q4 2022 real economy performance falls in line with our expectations. S&P Global Market Intelligence estimated Q4 2022 real GDP growth at 7.8% year over year (and full year growth at 4.7%).

2023-24 expectations

We continue to expect slower real GDP expansion throughout 2023 as weaker global demand, higher domestic interest rates, and less favorable Q4 base effects weigh on real GDP growth performances. We expect 2.8% real GDP growth for 2023 and a slightly higher 3.4% increase in 2024.

Given the long-standing currency peg to the greenback, the Qatar Central Bank has been raising its key policy rates since March 2022, in line with its US counterpart. We expect at least one more interest rate hike from the US Federal Reserve, with additional increases likely unless signs of real weakness emerge somewhere. We therefore likely have not seen the last interest rate hike from the Qatari central bank during this tightening cycle.

We forecast lower global commodity prices on a yearly basis, receding global supply chain disruption concerns, and higher borrowing costs to help reduce inflationary pressures in Qatar. We believe that average annual inflation will decline from a high of 5.0% in 2022 to 4.0% in 2023 before falling further to 3.0% in 2024.

We expect moderating global energy prices to lead to lower albeit still healthy fiscal surpluses/GDP closer to mid-single digits in 2023-24 (10% in 2022).

Enhanced foreign currency earnings generation and comfortable fiscal surpluses will allow the government to reimburse part of its foreign currency debt stock, thus leading to even more moderate sovereign debt-to-GDP ratios in the near term.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.