Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — May 06, 2024

By Chris Williamson and Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Central bank meetings in the UK and Australia will be in focus post the Fed meeting, while key data releases include UK output data and China's inflation and trade figures in the week. Additionally, we continue to anticipate a series of PMI releases such as worldwide services figures and detailed sector data for insights into the main drivers for growth and inflation.

The Bank of England and Reserve Bank of Australia convenes to update monetary policy settings further into May with their views regarding inflation and the policy path forward curiously watched after the Fed meeting fuelled anticipating for higher-for-longer Fed rates. In particular, the market appears to be on the fence regarding whether the RBA will lift rates as soon as May amid sticky inflation, as seen via PMI data, making this a 'live' meeting. The AUD/USD pair, which had lost grounds so far this year amid diminishing Fed cut expectations, will be one to digest the takeaways from the upcoming RBA meeting.

In contrast, the BoE is largely set to keep rates unchanged in May, but uncertainty shroud their next move as with the Fed. This is especially with resilient economic and inflation conditions in the UK alluded to by PMI indications. As it is, UK Q1 GDP, alongside March output figures, will be due on Friday with the consensus pointing to better first quarter performance compared with Q4 2023.

Additionally, worldwide services and composite data will be due at the start of the week, followed by detailed sector data for more in-depth analysis of global economic conditions. In particular, inflation performance in the relatively better performing service sector will be key in guiding the overall inflation trend after manufacturing prices data showed intensifying inflationary pressures (see box).

Official confirmation of the inflation trend in mainland China is also expected with the update of CPI and PPI data for April. As it is, the Caixin China Manufacturing PMI revealed that factory output prices have continued to fall at the start of the second quarter, reflecting subdued inflation conditions. That said, cost pressures have renewed amidst rising energy and input costs in April, foreshadowing potential amelioration of falling PPI in the coming months.

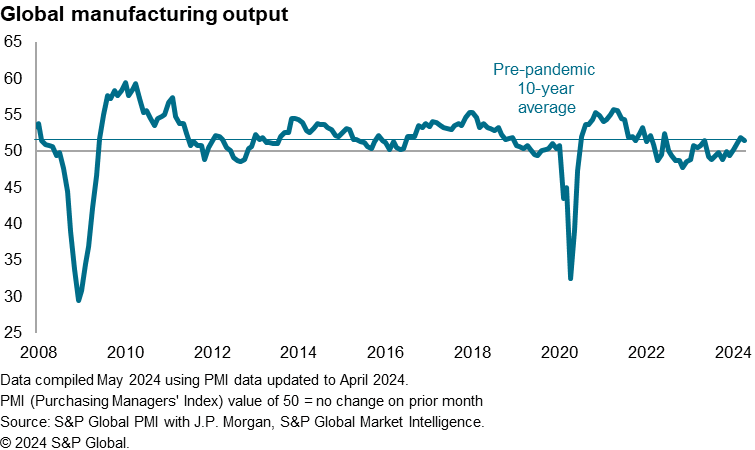

April's JPMorgan Global Manufacturing PMI, compiled by S&P Global, revealed that worldwide manufacturing conditions continued to improve, contrasting with early flash G4 indications of a slowdown in goods production. While having slowed from March, the rate of output growth remained close to the pre-pandemic 10-year average as new orders rose for a third straight month for manufacturers. Faster output growth in emerging markets mainly drove the change.

That said, price pressures intensified even as supply chain conditions further improved. Amid heightened concerns over sticky inflation and the impact on global monetary policies, the resurgence in manufacturing sector price inflation places added focus on how the relatively elevated service sector inflation will trend. The upcoming service sector PMI will therefore be closely watched at the start of the week, ahead of detailed sector PMI data to help pinpoint the key sources of inflationary pressures.

Monday 6 May

UK, Japan, South Korea, Thailand Market Holiday

Worldwide Services, Composite PMIs, inc. global PMI* released across May 3-6 (Apr)

Indonesia GDP (Apr)

Canada Average Hourly Wages (Apr)

Tuesday 7 May

Philippines Inflation (Apr)

Australia Retail Sales (Mar)

Thailand Inflation (Apr)

Australia RBA Interest Rate Decision

Germany Trade (Mar)

United Kingdom Halifax House Price Index (Apr)

France Trade (Mar)

Eurozone HCOB Construction PMI* (Apr)

Taiwan Inflation (Apr)

United Kingdom S&P Global Construction PMI* (Apr)

Eurozone Retail Sales (Mar)

Global Sector PMI* (Apr)

Wednesday 8 May

Germany Industrial Production (Mar)

Sweden Riksbank Interest Rate Decision

Taiwan Trade (Apr)

Brazil Retail Sales (Mar)

Brazil BCB Interest Rate Decision

United States Wholesale Inventories (Mar)

Thursday 9 May

Norway, Switzerland, Sweden Market Holiday

Japan BoJ Summary of Opinions (May)

Philippines GDP (Q1)

China (Mainland) Trade (Apr)

Malaysia BNM Interest Rate DEcision

United Kingdom BOE Interest Rate Decision

Mexico Inflation (Apr)

United States Initial Jobless Claims

Friday 10 May

Japan Household Spending, Current Account (Mar)

Malaysia Industrial Production (Mar)

United Kingdom monthly GDP, incl. Manufacturing, Services and Construction Output (Mar)

United Kingdom GDP (Q1, prelim)

Turkey Industrial Production (Mar)

Italy Industrial Production (Mar)

China (Mainland) Current Account (Q1, prelim)

Brazil Inflation (Apr)

India Industrial Production (Mar)

Mexico Industrial Production (Mar)

Canada Employment (Apr)

United States UoM Sentiment (May, prelim)

Saturday 11 May

China (Mainland) CPI, PPI (Apr)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

Worldwide services and sector PMI releases

Post the release of worldwide manufacturing PMI data, which showed the global manufacturing expansion sustaining in April albeit with rising inflationary pressure, we look to services PMI and detailed sector PMI updates for a complete update. The inflation trend will be the key focus given the heightening of central bank policy uncertainties (see box).

Americas: US UoM sentiment, Canada employment, Brazil BCB meeting and inflation data

Following the May FOMC meeting, which further dampened hopes of a Fed cut, a relatively quiet week awaits. That said, data releases such as the May Michigan consumer sentiment figures are nevertheless anticipated for insights into whether economic conditions continue to trend in line with expectations of stubborn inflation.

Additionally, Canada releases April employment figures after the S&P Global Canada PMI data indicated that growth in employment remained subdued in April, though accelerating slightly from March on improvements in the service sector.

Central bank meetings meanwhile unfold in Brazil and Mexico, with Brazil's inflation data also out in the week.

EMEA: BoE meeting, UK GDP and Germany trade

The Bank of England updates their monetary policy decision on Thursday with no changes to rates expected in their May meeting. An upturn in the pace of economic growth in the UK, coupled with sticky service sector inflation, as seen via PMI data, suggest that current business conditions are more consistent with rate hikes rather than rate cuts. The BoE's views will therefore be closely watched, especially with the latest Fed meeting having led the way in quashing hopes for any imminent cuts.

Additionally, key data due from Europe include UK GDP and Germany trade figures. First quarter GDP will be due alongside March output figures in the UK. To recap, the S&P Global UK Composite PMI earlier indicated that output growth remained solid and close to February's nine-month high in March, reflecting improvements in the first quarter relative to Q4 2023. March's expansion was also supported by broadening economic growth.

APAC: RBA, BNM meetings, China trade and inflation data, BoJ summary of opinions, Indonesia GDP

In APAC, the Reserve Bank of Australia meeting will be key, in addition to mainland China's trade and inflation data.

A narrow consensus currently points to the RBA holding rates though expectations have gathered for the RBA to raise rates amid sticky inflation, the latest as seen via Judo Bank Australia PMI indications.

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.