Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jul 26, 2024

By Chris Williamson and Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Central bank meetings in the US, UK and Japan are set to be the highlights in a busy data week in which we are also looking forward to US payrolls, Eurozone inflation and GDP, plus worldwide manufacturing PMI updates. Additional tier-1 data releases are also due from several other economies as US earnings continue to trickle in.

The fresh week brings several major central bank meetings, the most important likely being the US Federal Open Market Committee gathering, even though a rate cut is not widely anticipated. Instead, the US central bank will be watched for admission of progress on the inflation front alongside the July employment report. June saw the unemployment rate edge up to 4.1%, its highest since November 2021, and payrolls rise by 206K in a development which many saw as signalling a softening of the labour market and supporting expectations of a September FOMC rate cut.

Meanwhile the Bank of England looks set to kickstart their easing cycle in August, with the latest July flash PMI prices data indicating that selling prices, which are a good proxy for CPI, increasing at the slowest pace since February 2021.

The path forward for the Bank of Japan (BoJ) appears relatively more uncertain, with the Japanese central bank contemplating a hike. The latest au Jibun Bank Flash Japan PMI outlined intensifying price pressures, supporting a BoJ's move, but the uneven growth between manufacturing and services adds to uncertainty over whether the BoJ will indeed act at the upcoming meeting.

On the data front, we will also be looking closely at eurozone inflation numbers for July after the latest HCOB Flash Eurozone PMI outlined softening output price inflation amid a fading economic recovery in the region. GDP will meanwhile be released on Tuesday for an official early estimate of eurozone growth in the second quarter.

Finally, worldwide manufacturing PMI will be updated at the start of August for insights into conditions in the goods producing sector. In particular, Asian manufacturing conditions will be closely watched after the latest HSBC Flash India PMI showed faster production growth in July. Click here for a full recap on the June manufacturing PMIs.

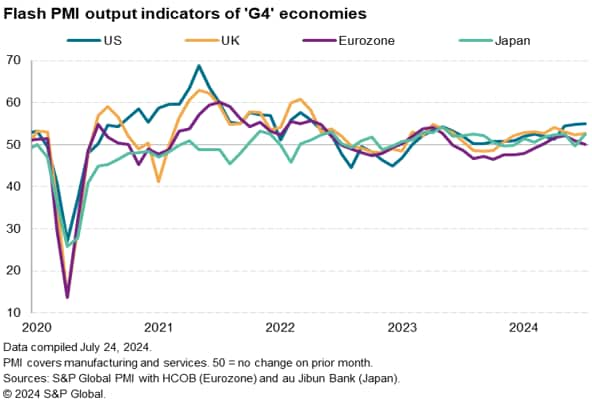

Flash PMI data provided mixed news on economic trends in the major markets. US growth accelerated to the fastest since April 2022, outpacing the other 'G4' major developed economies for a third successive month. Growth also rebounded sharply in Japan after a brief decline in June, posting the joint-largest expansion seen over the past year. Robust growth was likewise seen in the UK, the pace of expansion reviving after a lull that was often attributed by companies to paused spending ahead of the General Election.

In contrast, growth slowed in the eurozone to register a near stagnation of output, indicating the region's weakest performance since February.

The US and Japanese expansions were powered by resurgent service sector activity, which offset declines in manufacturing output. The eurozone also saw a steep manufacturing decline, but its service sector expansion also waned. This waning would likely have been even greater had the French services PMI not been buoyed by the Paris Olympics; a boost which is likely to prove short lived.

The UK therefore stood out as the only major G4 economy to report higher manufacturing output in July, which it enjoyed alongside a sustained service sector upturn. What's more, the pace of manufacturing growth hit a two-year high, widening the UK's outperformance relative to the G4 to its greatest since August 2020.

Monday 29 Jul

Thailand Market Holiday

Taiwan Consumer Confidence (Jul)

United Kingdom Mortgage Lending and Approvals (Jun)

Tuesday 30 Jul

Japan Unemployment Rate (Jun)

Australia Building Permits (Jun, prelim)

Spain Inflation (Jul, prelim)

Eurozone GDP (Q2, flash)

Eurozone Economic Sentiment (Jul)

Germany Inflation (Jul, prelim)

Mexico GDP (Q2, prelim)

United States S&P/Case-Shiller Home Price (May)

United States JOLTs Job Openings (Jun)

United States CB Consumer Confidence (Jul)

Wednesday 31 Jul

South Korea Industrial Production (Jun, prelim)

Japan Industrial Production and Retail Sales (Jun)

Australia Inflation (Q2)

China (Mainland) NBS PMI (Jul)

Japan BoJ Interest Rate Decision

Japan Consumer Confidence (Jul)

Japan Housing Starts (Jun)

Germany Retail Sales (Jun)

Saudi Arabia GDP (Q2, prelim)

France Inflation (Jul, prelim)

Germany Unemployment Rate (Jul)

Taiwan GDP (Q2, advance)

Hong Kong SAR GDP (Q2, advance)

Eurozone Inflation (Jul, flash)

Italy Inflation (Jul, prelim)

United States ADP Employment Change (Jul)

Canada GDP (May)

United States Fed Interest Rate Decision

Brazil BCB Interest Rate Decision

Thursday 1 Aug

Switzerland Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI* (Jul)

South Korea Trade (Jul)

Australia Trade (Jun)

Indonesia Inflation (Jul)

United Kingdom Nationwide Housing Prices (Jul)

Eurozone Unemployment Rate (Jun)

United Kingdom BoE Interest Rate Decision

United States ISM Manufacturing PMI (Jul)

Friday 2 Aug

South Korea Inflation (Jul)

Australia Home Loans (Jun)

Switzerland Inflation (Jul)

Italy Industrial Production (Jun)

United States Non-Farm Payrolls, Unemployment Rate, Average Hourly Earnings (Jul)

United States Factory Orders (Jun)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

Worldwide manufacturing PMI for July

Manufacturing PMIs from around the world will be updated for insights into whether conditions have continued to improve and also if selling price inflation has risen further after rising at the fastest rate for 15 months in June.

Americas: US FOMC meeting, labour market report, ISM Manufacturing PMI, Canada, Mexico GDP

The upcoming Federal Open Market Committee (FOMC) meeting will be assessed for any dovish slant ahead of the September iteration, where expectations have gathered for the Fed to start lowering rates. Promising signs were presented by the July US Flash PMI, which indicated that prices rose at a slower pace.

The US labour market report will also provide a key assessment of rate cut probabilities, with the consensus pointing to lower job additions in July and recent data having shown unemployment to be slowly edging higher.

Additional key US data releases in the week include ISM Manufacturing PMI, JOLTs job openings, consumer confidence, factory orders, and house prices.

EMEA: BoE meeting and UK mortgage approvals, Eurozone GDP, unemployment and inflation

Bank of England (BoE) policymakers convene with the consensus pointing (tentatively) to the commencement of their easing cycle. This comes after indications of BoE voters having moved to a "finely balanced" view in June, paving the way for an August cut. At the same time, we have also seen S&P Global Flash UK PMI data registering the slowest increase in firms' selling prices since early 2021.

In the eurozone, Q2 GDP will be due from the region with expectations having built for slower growth at around 0.2% q/q, which have been in line with PMI indications. More up-to-date July inflation numbers will also be released with the latest HCOB Flash Eurozone PMI prices data indicating that output price inflation fell, notably in the service sector. The latter hits at positive news from the upcoming CPI release.

APAC: China PMI, BoJ meeting, Australia and Indonesia inflation, Taiwan, Hong Kong SAR GDP

In APAC, manufacturing PMI releases will be in abundance, including both the NBS and Caixin PMI releases from mainland China. Additionally, Asia Manufacturing PMI will also be watched after the region was shown to have led global goods output growth in June.

On the central bank front, the Bank of Japan (BoJ) convenes midweek with speculation that rates will be lifted amid higher prices, signs of resilient growth, and hawkish comments from policymakers. Official data releases also due from across the region include GDP for Taiwan and Hong Kong SAR.

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.