Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — May 24, 2024

By Chris Williamson and Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Data releases including US core PCE inflation, eurozone inflation and China PMI figures are likely to be the economics highlights as we approach the end of May. The busy data calendar will also see GDP updates from the US, Canada and India. Japan meanwhile releases a barrage of data for BoJ and yen watchers to digest.

April US PCE inflation, coupled with personal income and spending data, have the potential to turn the risk sentiment tide once again. This comes after the minutes from the FOMC's May meeting undermined market confidence pertaining to US rate cuts, with some policymakers having speculated on the need to raise rates. While better than expected CPI data has since soothed some concerns over rates, the May flash US PMI has rekindled uncertainty over the Fed's forward path, showing output prices rising at a sharper rate amid a reviving economic upturn. Output growth hit the fastest in over two years, fanning fears that the economy may be heating up once again.

In contrast to the US, eurozone inflationary pressures have eased in May, according to the HCOB Flash Eurozone PMI, which ECB watchers will hope to see reflected in the release of official flash CPI data for May. With anticipation having built for the ECB to lower rates as soon as June, the upcoming CPI update will need to bring good news on inflation for the door to open for a rate cut.

Meanwhile growth conditions have further improved in the eurozone, including for Germany. Flash PMI data have so far also hinted at improvements in confidence in Germany and more widely across the eurozone in May, and sentiment data releases in the coming week will be eyed for confirmation of these improving trends.

In APAC, PMI data from mainland China's National Bureau of Statistics will be due at the end of the week to give clues as to growth and price momentum in May. Around the region, in Japan, India and even Australia, flash PMI data have so far shown better growth being recorded in May. India in particular has exhibited consistently strong economic growth so far via PMI indications as we anticipate the GDP update for the first three months of 2024. Additionally, Japan releases industrial production, unemployment data and consumer confidence figures.

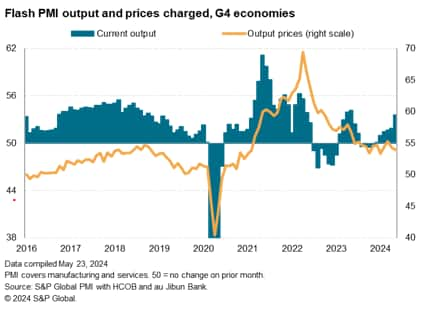

The major developed economies are showing signs of gaining further growth momentum on average midway through the second quarter, according to the flash PMI data. Output of the combined manufacturing and service sectors is rising across the four major developed economies - the 'G4' - at the fastest rate for a year. Growth is being led by the US, which showed a welcome revival after a sudden slowing in April, but growth has also accelerated further in the eurozone and Japan and remains robust in the UK.

Inflation meanwhile remains elevated by pre-pandemic standards across all G4 economies, albeit to greater extents in the UK and Japan than the US and the eurozone. While service sector inflation rates are generally trending lower, which will be welcome news to policymakers concerned over second-round wage-related price pressures, there are signs of renewed price pressures appearing in manufacturing, albeit not yet in the eurozone.

As such, the reviving growth trend and worryingly slow descent of inflation hints at some continued caution among policymakers in the US and Europe in loosening monetary policy, especially as some policymakers may be keen to see how stronger growth impacts pricing power and wage negotiations.

Monday 27 May

US, UK Market Holiday

China (Mainland) Industrial Profits (Apr)

Germany Ifo Business Climate (May)

Hong Kong SAR Trade (Apr)

Tuesday 28 May

Australia Retail Sales (Apr, prelim)

Germany Wholesale Prices (Apr)

United States S&P Global/Case Shiller Home Price (Mar)

United States CB Consumer Confidence (May)

Wednesday 29 May

Australia ANZ Business Confidence (May)

Japan Consumer Confidence (May)

Germany GfK Consumer Confidence (Jun)

Germany Inflation (May, prelim)

United States Fed Beige Book

Thursday 30 May

Brazil, Malaysia Market Holiday

Australia Building Permits (Apr, prelim)

Switzerland Balance of Trade (Apr)

Spain Inflation (May, prelim)

Switzerland GDP (Q1)

Italy Unemployment Rate (Apr)

Eurozone Economic Sentiment (May)

Eurozone Unemployment Rate (Apr)

Eurozone Consumer Confidence (May, final)

Mexico Unemployment Rate (Apr)

United States GDP (Q1, 2nd est.)

United States Wholesale Inventories (Apr)

South Africa SARB Interest Rate Decision

United States Pending Home Sales (Apr)

Friday 31 May

Malaysia Market Holiday

South Korea Industrial Production (Apr)

Japan Unemployment Rate (Apr)

Japan Industrial Production (Apr, prelim)

China (Mainland) NBS PMI (May)

Thailand Industrial Production (Apr)

Japan Housing Starts (Apr)

Germany Retail Sales (Apr)

France Inflation (May, prelim)

France GDP (Q1, final)

Turkey GDP (Q1)

Italy GDP (Q1, final)

United Kingdom Mortgage Lending and Approvals (Apr)

Eurozone Inflation (May, flash)

Italy Inflation (May, prelim)

India GDP (Q1)

Canada GDP (Q1)

United States Core PCE Price Index (Apr)

United States Personal Income and Spending (Apr)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

Americas: US Q1 GDP, core PCE, personal income and spending data, Canada GDP

The second estimate of US Q1 GDP will be updated in the coming week after the initial estimate came in below expectations at 1.6%. Meanwhile the Fed's preferred inflation gauge, the core PCE price index, will be released for April on Friday. This follows the lower-than-expected US CPI print which provided a boost for market sentiment. In line with the CPI release, further signs of easing inflationary pressures are anticipated for the core PCE price index at present.

Additional focus on other economic releases will include the US personal income and spending numbers, as well as consumer confidence, with perceived improvements in consumer strength having contributed to improved risk sentiment of late. Also watch out for home prices and pending home sales data.

Canada's Q1 GDP will also be announced at the end of the week, with improved performance expected from the end of 2023 amidst indications of rising composite PMI readings.

EMEA: Eurozone May inflation, German Ifo business climate, GfK consumer confidence data

The key data release of the week will be May flash inflation data due from the eurozone. Early HCOB Flash Eurozone PMI indications showed that price pressures eased in May but remained above pre-pandemic average levels.

Additionally, business and consumer sentiment figures will also be due from Germany. The latest HCOB Flash Germany PMI revealed that business confidence rose to the highest in over two years amid renewed new orders expansion and faster output growth.

APAC: China NBS PMI, India GDP, Japan industrial production, unemployment rate, consumer confidence

Ahead of worldwide PMI data on June 3, mainland China's NBS PMI will be due on Friday. Consensus expectations at the time of writing indicate a slight slowdown in growth momentum is anticipated midway into the second quarter.

Separately, India updates GDP growth readings for the January to March period. Early HSBC India PMI data showed India continuing to expand at a sharp pace, including April seeing one of the quickest monthly expansions in 14 years.

Japan's industrial production, employment and consumer confidence figures will also be updated in the week. According to the au Jibun Bank Flash Japan PMI, manufacturing output declined at a less pronounced and only marginal pace in May, signalling better conditions compared to April. Overall employment conditions also improved midway into the second quarter.

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.