S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

ECONOMICS COMMENTARY — May 17, 2024

By Chris Williamson and Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Download full report(opens in a new tab)

Flash PMI will offer the earliest insights into economic conditions in May, in a week when the FOMC minutes and inflation data from the UK, Canada and Japan are also in focus. Central bank meetings in New Zealand, South Korea, Indonesia and Turkey are also scheduled.

The attention on when the US Fed will lower rates is expected to heighten in the new week with the release of FOMC minutes and appearances by various Fed speakers. According to the latest S&P Global Investment Manager Index survey, risk appetite in the equity market has risen to the highest level since late 2021, in part reflecting confidence in the health of US corporate earnings as well as the belief that the Fed will proceed with lowering rates before the end of the year. Additionally, flash US PMI data will be updated on Thursday, providing insights on whether inflationary pressures have further eased in May, following the cooling of both output and selling price growth in April, which will be crucial to the interest rate outlook.

Turning to Europe, May flash PMI data will be the highlight of the week, shedding light on growth and inflation trends for both the UK and eurozone. Prior data showed both economies gaining growth momentum at the start of the second quarter, accompanied by better-than-expected GDP growth in the first quarter. Official UK inflation data for April will also be closely watched for confirmation on whether a June Bank of England rate cut is on the cards.

In APAC, flash India PMI will be the only emerging market economy flash data due alongside those for Japan and Australia, offering the earliest looks into business conditions. April data showed India's economy continuing to grow at one of the strongest rates seen over the past 14 years and Australia's expansion to be running close to a two-year high. At the same time, Japan's economy continued to gain momentum, adding to the brightening APAC picture.

Several central bank meetings unfold in New Zealand, South Korea and Indonesia, though no changes in monetary policy settings are expected. Instead, Japan's inflation numbers will be in focus with the au Jibun Bank PMI having indicated a heightening of cost pressures in Japan on the back of a softening yen in April. A rising CPI trend may well fuel expectations of a rate hike.

The flash PMI data for May will provide important signals for economic growth midway through the second quarter, accompanied by fresh signals for other metrics such as order books, employment and inflation.

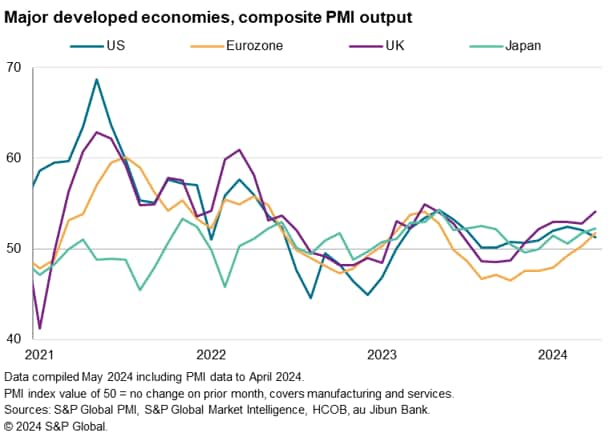

To recap on the April data, the biggest surprise was the acceleration of growth signalled by the United Kingdom composite PMI, which hit a 12-month high to outpace all other major developed economies and added to confirmation that the brief recession seen late last year is over. Faster growth was also signalled in the eurozone, where the HCOB PMI likewise signalled a gathering recovery from the malaise seen late last year by striking an 11-month high. Japan's recovery also gained pace, with the au Jibun Bank PMI rising to an eight-month high. So far so good.

In contrast, while US growth continued to be signalled in April, the rate of expansion slowed to a four-month low, notably dropping below that of both the eurozone and the UK. Worryingly, the US slowdown was in response to the first fall in new orders for six months, which in turn fed through to reduced hiring. The April US PMI from S&P Global recorded a fall in employment for the first time since the pandemic lockdowns.

May's updated flash PMI numbers will therefore be eagerly awaited to gauge whether global growth momentum has shifted from the US to Europe, perhaps because speculation has mounted that lower interest rates are likely to be seen as early as June in Europe, with US cuts not expected until later in the year. We will be keen to see whether May's PMI data alter these rate cut expectations.

Monday 20 May

Canada, Norway, Switzerland, India Market Holiday

China (Mainland) Loan Prime Rate (May)

Malaysia Trade (Apr)

Germany PPI (Apr)

Taiwan Export Orders (Apr)

Tuesday 21 May

Australia Westpac Consumer Confidence (May)

Australia RBA Meeting Minutes

Eurozone Balance of Trade (Mar)

Canada Inflation (Apr)

Wednesday 22 May

Singapore, Thailand, Malaysia Market Holiday

Japan Balance of Trade (Apr)

Japan Machinery Orders (Mar)

New Zealand RBNZ Interest Rate Decision

United Kingdom Inflation (Apr)

Indonesia BI Interest Rate Decision

South Africa Inflation (Apr)

United States Existing Home Sales (Apr)

United States FOMC Meeting Minutes (May)

Thursday 23 May

Indonesia Market Holiday

Australia Judo Bank Flash PMI, Manufacturing & Services*

Japan au Jibun Bank Flash PMI, Manufacturing & Services*

India HSBC Flash PMI, Manufacturing & Services*

UK S&P Global Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

New Zealand Retail Sales (Q1)

South Korea BoK Interest Rate Decision

Singapore Inflation (Apr)

Taiwan Industrial Production (Apr)

Hong Kong SAR Inflation (Apr)

Turkey TCMB Interest Rate Decision

Mexico GDP (Q1, final)

Eurozone Consumer Confidence (May)

United States New Home Sales (Apr)

Friday 24 May

Indonesia Market Holiday

New Zealand Trade (Apr)

Japan Inflation (Apr)

Singapore GDP (Q1, final)

Malaysia Inflation (Apr)

Singapore Industrial Production (Apr)

United Kingdom Retail Sales (Apr)

France Business Confidence (May)

Canada Retail Sales (Mar)

United States Durable Goods Orders (Apr)

United States UoM Sentiment (May, final)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

Flash PMI releases for May

May flash PMI will be released on Thursday for insights into economic conditions across the four largest developed economies, as well as India and Australia, midway into the second quarter. The flash data will provide the earliest insights into whether growth momentum has been sustained after the global economy expanded at the fastest rate in ten months in April, albeit with still-elevated price pressures.

Americas: Fed minutes, US durable goods, existing home sales and new home sales data, Canada inflation

Fed minutes from the May FOMC meeting will be released midweek and parsed for clues on when a Fed cut may arrive, if at all, in 2024. This will be amidst various Fed speaker appearances through the week.

Additionally, a series of economic data including durable goods orders, existing home sales and new home sales, will be expected through the week.

Canada's inflation data will meanwhile be a tier-1 release to watch with the market taking the cue here to formulate expectations for whether the Bank of Canada will lower interest rates in June.

EMEA: UK inflation and retail sales data

Besides flash PMI, the other key update due in Europe will be UK's inflation figures in the week. According to early PMI price indications, UK CPI may remain relatively sticky in the coming months amid still-elevated service sector inflation and rising manufacturing sector costs. As shown in April's PMI data, service sector cost inflation rose with the pass-through of the latest National Living Wage increase. While the consensus points to a June Bank of England rate cut, the latest inflation numbers will be crucial to a data dependent central bank's ultimate decision.

APAC: RBNZ, BoK, BI meetings, RBA meeting minutes, Japan inflation, trade data, Thailand GDP

A busy central bank week is anticipated for APAC economies with monetary policy meetings in New Zealand, South Korea and Indonesia, while minutes from the May Reserve Bank of Australia meeting will also be released. That said, no surprises are expected from the abovementioned central bank meetings.

Separately, April's inflation figures will be closely watched in Japan for monetary policy implications. As it is, the April au Jibun Bank PMI indicated that price pressures have heightened as stronger cost inflation in both the manufacturing and service sectors contributed to the steepest rise in overall output prices in a year, with services inflation at a decade high.

Download full report(opens in a new tab)

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.