Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Nov 29, 2024

By Chris Williamson and Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

The coming week is top and tailed with manufacturing PMI surveys and the US nonfarm payroll report, interspersed with a slew of data to guide expectations on economic growth and policy around the world.

The manufacturing PMI data due Monday will be eagerly assessed by being the first tranche of global news available since the US election. How producers around the world will be reacting to the changing business environment, notably in respect to the threat of US tariffs, will be top of mind. While there may be limited immediate impact on the PMI survey data on current conditions, such as output and orders, the forward-looking future expectations data will be important to consider, especially in terms of any divergences between the US and mainland China. For China, the threat of tariffs is set amongst renewed stimulus from the authorities, making the data flow difficult to predict, especially in the light of potential front-loading of shipments to the US ahead of tariffs.

Services PMI data due mid-week will also be keenly awaited after the flash surveys showed a widening gulf between the strongly-expanding US services economy and the flagging services economies of Europe. While political uncertainty has lifted in the US post-election, Europe remains dogged by concerns over political instability (especially in France, where the government is under pressure as it seeks to cut public spending, and Germany), exacerbated by the proximity of the ongoing war in Ukraine. In the UK, companies have also responded disappointingly to the Labour government's first major fiscal announcements in the Autumn Budget.

These growth divergences will be important to monitor in relation to potential changes to the outlook for monetary policy both in the US and Europe, especially with the US employment report due on Friday. The minutes from the FOMC meeting and recent policymaker rhetoric have highlighted how US growth has been encouragingly resilient, dampening expectations of further aggressive rate cutting, but a weak payroll print could add to speculation of the need for more stimulus. In Europe, in contrast, the growing recession risk is encouraging speculation of more stimulus. For the latter, also keep an eye on industrial production data for France and Germany and unemployment numbers for the eurozone as a whole.

Join our webinar on 4th December to learn more about the latest signals from the worldwide PMI surveys

Join this webinar to get immediate reactions and exclusive insights into the newly released Purchasing Managers' Index (PMI) data — on release day. Analysis coming directly from the economic experts behind the world's most market-moving economic surveys.

Monday 2 Dec

Worldwide Manufacturing PMIs, incl. global PMI* (Nov)

Australia Building Permits and Retail Sales (Oct)

Indonesia Inflation (Nov)

France Industrial Production (Oct)

Italy Unemployment Rate (Oct)

Eurozone Unemployment Rate (Oct)

Italy GDP (Q3, final)

United States ISM Manufacturing PMI (Nov)

Tuesday 3 Dec

South Korea Inflation (Nov)

Turkey Inflation (Nov)

Switzerland Inflation (Nov)

South Africa GDP (Q3)

Brazil GDP (Q3)

United States JOLTs Job Openings (Oct)

Wednesday 4 Dec

Worldwide Services, Composite PMIs, inc. global PMI* (Nov)

Australia GDP (Q3)

Brazil Industrial Production (Oct)

United States ADP Employment Change (Nov)

United States ISM Services PMI (Nov)

United States Factory Orders (Oct)

United States Fed Beige Book

S&P Global Sector PMI* (Nov)

Thursday 5 Dec

South Korea GDP (Q3, final)

Australia Trade (Oct)

Philippines Inflation (Nov)

Switzerland Unemployment Rate (Nov)

Germany Factory Orders (Oct)

Taiwan Inflation (Nov)

Eurozone Construction PMI* (Nov)

United Kingdom S&P Global Construction PMI* (Nov)

Europe Sector PMI* (Nov)

United States Trade (Oct)

United States Initial Jobless Claims

Brazil Balance of Trade (Nov)

Friday 6 Dec

Thailand Market Holiday

Australia Home Loans (Oct)

Thailand Inflation (Nov)

India RBI Interest Rate Decision

Germany Trade and Industrial Production (Oct)

United Kingdom Halifax House Price Index* (Nov)

France Trade (Oct)

Eurozone GDP (Q3, 3rd est.)

Canada Trade (Oct)

United States Non-Farm Payrolls, Unemployment Rate, Average Hourly Earnings (Nov)

United States UoM Sentiment (Dec, prelim)

Saturday 7 Dec

China (Mainland) Trade (Nov)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

Worldwide manufacturing, services and sector PMI

Global manufacturing, services and detailed sector PMI data will be released for November in the new week. This follows the release of flash PMI data which revealed that major developed economies continued expand in November but with widening divergences across countries and sectors. Whether these divergences are prevalent on the global scale will be assessed with the incoming PMI data releases. Changes in business sentiment across the globe since the US election will also be eagerly awaited.

Americas: Fed comments, US labour market report, US ISM PMI, UoM sentiment, trade data; Canada trade and employment data

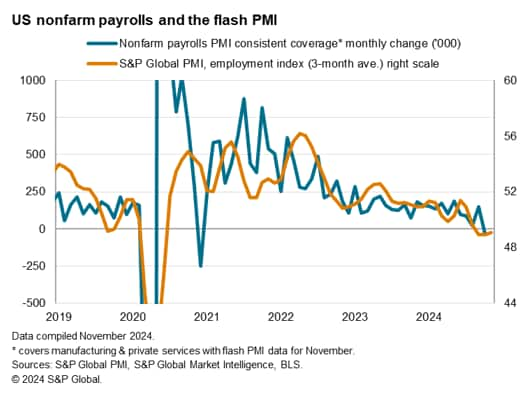

The last jobs report data ahead of the December 17-18 Federal Open Market Committee (FOMC) meeting will be released on Friday and watched for clues on labour market conditions. Flash US PMI data indicated that private sector employment fell for a fourth straight month in November. Meanwhile, final PMI, including ISM, figures will be watched in the coming week to assess the growth and inflation trends in the penultimate month of the year. Fed comments will also be followed through the week for clues ahead of the final Fed meeting of 2024. While a rate cut is widely anticipated, the minutes from the November meeting underscored how many on the FOMC saw no rush to get the policy rate down to its neutral level.

Separately, Canada updates trade and employment data, the latter closely watched for guidance on the Bank of Canada's next move.

EMEA: Eurozone GDP; German trade and factory orders

Besides the release of PMI data for the UK and Eurozone, including detailed sector data, key releases for the region include the third estimate for eurozone's Q3 GDP. Germany also updates trade and factory orders data for October with weakness in the goods producing sector flagged via October's PMI data and also in more up-to-date flash figures for November.

APAC: Australia Q3 GDP, trade data; China trade data; South Korea, Taiwan, Indonesia, Philippines inflation

Australia's third quarter GDP data will be published on Wednesday with prior PMI figures having outlined a softening growth pace, while the latest November flash PMI further showed the quickest reduction in private sector output in ten months. Another key release in the region will be trade data out of mainland China, with the November Caixin PMI released earlier in the week to offer an early look into export conditions. Finally, a series of inflation data will be updated across the APAC region through the week.

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location

Products & Offerings