Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Aug 16, 2024

By Chris Williamson and Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Central bank updates will be in abundance in the fresh week including the release of the latest FOMC meeting minutes and the Jackson Hole symposium. August flash PMI will be the data highlight of the week, providing clues on output and inflation developments ahead of the highly anticipated September Fed meeting. Additionally, key official data releases include inflation figures from the eurozone and Japan.

More insights into whether the Fed will cut interest rates in September will be provided via both July's Federal Open Market Committee (FOMC) meeting minutes and the Jackson Hole symposium in the week. This is especially with the July US CPI release having mirrored the recent PMI price trend in showing easing inflationary pressures, thereby building anticipation for the Fed to cut rates soon. As far as US equity investors are concerned, positive sentiment has risen surrounding central bank policy being a positive contributor to market returns. This is according to the latest August S&P Global Investment Manager Index.

Flash PMI data for August will meanwhile be released on Thursday for the earliest insights into economic conditions. These early economic signals will also be crucial inputs to guide policy ahead of the September FOMC meeting, especially on the prices front for the US. Central bankers across the US and Europe will likely be keen to see that rising cost pressures in July have not translated to higher selling prices that could threaten hopes for rate cuts.

Eurozone inflation data will be eagerly awaited as economists assess the potential for further rate cuts from the ECB. Other economies releasing inflation data include Canada, Japan, Hong Kong SAR, Singapore and Malaysia, with Canada and Japan notably in the spotlight in relation to monetary policy decisions after the Bank of Japan recently raised interest rates and the Bank of Canda reduced its policy rate. Other tier-1 data due in the week include GDP data from Mexico and also Thailand.

Several central bank meetings also take place in the week in Turkey, South Korea, Thailand and Indonesia, though no changes to interest rates are expected across the APAC central banks. Insights on when rate cuts will commence will nevertheless be sought from these meetings.

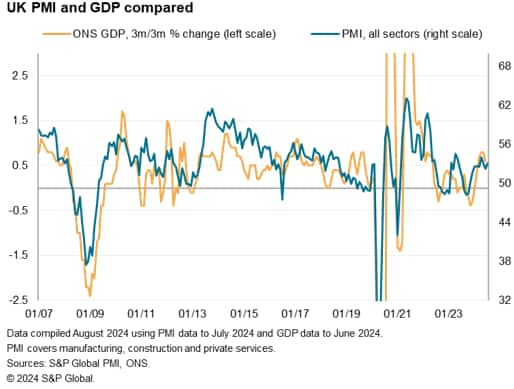

Official data confirmed recent upbeat survey evidence, indicating that the UK economy is faring well in 2024. Gross domestic product rose 0.6% in the second quarter, according to initial estimates form the Office for National Statistics, building on a solid 0.7% gain in the first three months of the year.

Further growth is anticipated for the second half of the year, though most economists - including those at the Bank of England - are expecting the pace of expansion to cool. This slowing in part reflects base effects, as the first half of the year has seen the economy rebound from a mild technical recession in the second half of 2023.

However, survey data suggest that the underlying pace of growth has remained robust into July, suggesting that any slowdown in the third quarter GDP numbers should not be overly concerning. The PMI's headline index tracking output in the manufacturing, services and construction sectors registered 53.1 in July, in line with the average seen in the second quarter. At this level, the PMI is broadly indicative of the UK economy growing at a quarterly pace approaching 0.3%.

Note also that the PMI data show the UK outperforming all other major developed economies bar the US, registering in particular a marked outperformance of manufacturing. Only India and Thailand reported faster manufacturing growth than the UK in July, according to S&P Global's PMI surveys.

Further clues of the UK's third quarter performance will be provided by the upcoming flash PMI data for August.

Monday 19 Aug

Japan Machinery Orders (Jun)

Thailand GDP (Q2)

Malaysia Trade (Jul)

Spain Trade (Jun)

China (Mainland) FDI (Jul)

Tuesday 20 Aug

South Korea Consumer Confidence (Aug)

New Zealand Trade (Jul)

China (Mainland) Loan Prime Rate (Aug)

Australia RBA Meeting Minutes (Aug)

Germany PPI (Jul)

Switzerland Trade (Jul)

Eurozone Current Account (Jun)

Taiwan Export Orders (Jul)

Hong Kong SAR Inflation (Jul)

Eurozone Inflation (Jul, final)

Turkey TCMB Interest Rate Decision

Mexico Retail Sales (Jun)

Canada Inflation (Jul)

Wednesday 21 Aug

South Korea Business Confidence (Aug)

South Korea PPI (Jul)

Japan Trade (Jul)

Thailand BoT Interest Rate Decision

Indonesia BI Interest Rate Decision

South Africa Inflation (Jul)

Canada New Housing Price Index (Jul)

United States FOMC Minutes (Jul)

Thursday 22 Aug

Australia Judo Bank Flash PMI, Manufacturing & Services*

Japan au Jibun Bank Flash PMI, Manufacturing & Services*

India HSBC Flash PMI, Manufacturing & Services*

UK S&P Global Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

South Korea BoK Interest Rate Decision

Malaysia Inflation (Jul)

Turkey Consumer Confidence (Aug)

Taiwan Unemployment Rate (Jul)

Mexico GDP (Q2, final)

Eurozone Consumer Confidence (Aug, flash)

United States Existing Home Sales (Jul)

United States Jackson Hole Symposium (Aug 22-24)

Friday 23 Aug

Japan Inflation (Jul)

Singapore Inflation (Jul)

Taiwan Industrial Production (Jul)

Canada Retail Sales (Jun)

United States New Home Sales (Jul)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

August flash PMI data due Thursday

Flash PMI data for August will be released across major developed economies including the US, UK, Eurozone, Japan and Australia, in addition to India. Growth conditions will be observed, especially to see whether service sector gains can continue to help offset a weakening manufacturing picture, after July PMI data pointed to global manufacturing falling into decline.

Americas: Fed minutes, Jackson Hole Symposium, Canada inflation, house prices

Minutes from the end-July Federal Open Market Committee (FOMC) meeting will be published midweek for detailed insights into the Fed's thoughts amid high expectations for a September rate cut. Additionally, Fed appearances at the Jackson Hole Symposium will also be viewed as an additional opportunity for US central bankers to telegraph their intentions for rates. The comments will be watched in conjunction with the release of August flash PMI, offering the earliest insights into output and price trends in the US.

Over in Canada, July's inflation figures will be updated on Tuesday with S&P Global Canada PMI data having alluded to higher, but still modest increases in selling prices in July.

EMEA: Eurozone inflation, consumer confidence, Germany PPI, TCMB meeting

The data highlight of the week for Europe will be flash PMI updates for August, shedding light on the latest growth and inflation developments across sectors.

Besides which, the final July print for eurozone inflation will be due at the start of the week. Flash August consumer confidence data will also provide insights into European consumer morale for a comparison with business sentiment available via the PMI Future Output Index.

APAC: RBA minutes, China Loan Prime Rate, BoK, BoT, BI meetings, Japan trade, Thailand GDP, Japan, Hong Kong SAR, Singapore, Malaysia inflation

Central bank meetings in South Korea, Thailand and Indonesia are set to unfold in the new week, while the Reserve Bank of Australia releases August meeting minutes. The Bank of Korea, Bank of Thailand and Bank Indonesia are broadly expected to maintain the status quo regarding monetary policy settings in their upcoming meetings, with potential rate cuts likely due only later in the year.

On the data front, Japan releases inflation and trade data, with the former watched for any signs of rising price pressure after the latest au Jibun Bank Japan Composite PMI pointed to slightly higher selling price inflation. Inflation data will also be due from Hong Kong SAR, Singapore and Malaysia while second quarter GDP will be updated for Thailand.

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.