Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Mar 14, 2025

By Chris Williamson and Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Central bank meetings in the US, UK and Japan are likely to see rates on hold, but will be eagerly watched for clues as the next moves as policymakers juggle differing signals for growth and inflation.

The FOMC decision is due on Wednesday and comes as most nowcast models indicate GDP growth slowing in the first quarter, with some such as the Atlanta Fed's GDPNow currently even pointing to a 2.4% annualized contraction. This looks like it is overstating the weakness, and survey data such as the S&P Global PMI point to a more moderate slowdown, though even the PMI data have fallen sharply to an extent now consistent with a mere 0.6% rate of growth in February. Surveyed companies report demand weakness from federal budget cutting and tariff-related uncertainty.

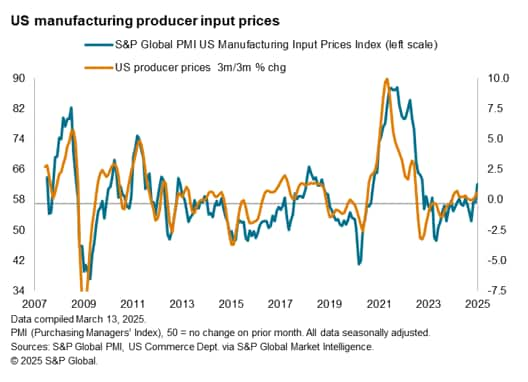

Meanwhile, lower than expected US CPI readings for February masked a worrying stickiness of underlying inflation, notably in core goods prices, which followed news from the PMI of factory goods prices rising at the sharpest rate for two years. Additional tariffs announced in March will only add to the concerns that the inflation trajectory is heading north. With the Fed still smarting from underestimating inflation after the pandemic, and non-farm payrolls pointing to resiliency in the job market, the markets think there's a high bar to imminent US rate cuts.

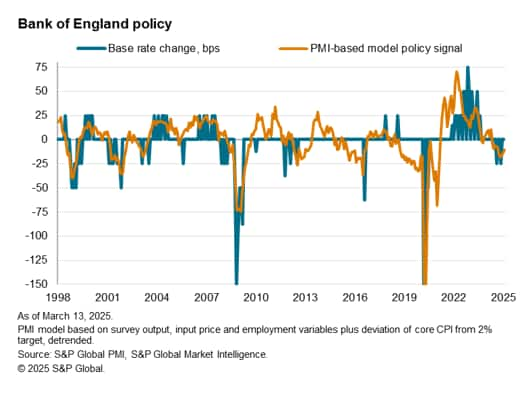

In the UK, the Bank of England is also expected to hold rates steady, having reduced its policy rate to 4.5% via a 25 basis point cut in February. The Bank also halved its economic growth forecast for 2025 to just 0.75% in a sign of rising concern about the weaker business and consumer sentiment seen since the tax hikes of the Autumn Budget and global tariff developments. These same factors are, however, also likely to pull inflation higher, meaning that the Bank of England's rate setters also face a juggling act between signs of weaker economic growth and rising inflation expectations.

While the Bank of Japan is also like to be on hold, the next move is expected to be a hike amid signs of higher wage growth. However, concerns are growing about a potential slowing of the Japanese economy amid tariff uncertainty. The February PMI, for example, showed business confidence sliding to a four-year low despite robust current output growth. A weakening of S&P Global's Business Outlook survey likewise underscored the heightened uncertainty facing businesses around the world.

Monday 17 Mar

Mexico Market Holiday

China (Mainland) Industrial Production, Retail Sales, Fixed Asset Investment (Jan-Feb)

China (Mainland) Unemployment Rate (Feb)

Singapore Unemployment Rate (Q4, final)

Indonesia Trade (Feb)

Italy Inflation (Feb, final)

Spain Trade (Jan)

Canada Housing Starts (Feb)

United States Retail Sales (Feb)

United States Business Inventories (Jan)

United States NAHB Housing Market Index (Mar)

Tuesday 18 Mar

Singapore Non-Oil Domestic Exports (Feb)

Eurozone Trade (Jan)

Eurozone ZEW Economic Sentiment (Mar)

Germany ZEW Economic Sentiment (Mar)

Canada Inflation (Feb)

United States Building Permits (Feb, prelim)

United States Housing Starts (Feb)

United States Industrial Production (Feb)

Wednesday 19 Mar

Japan Trade (Feb)

Japan Machinery Orders (Jan)

Japan BoJ Interest Rate Decision

Japan Industrial Production (Jan, final)

Indonesia BI Interest Rate Decision

South Africa Inflation (Feb)

Eurozone Inflation (Feb, final)

United States FOMC Interest Rate Decision

United States FOMC Economic Projections

Thursday 20 Mar

Japan Market Holiday

New Zealand GDP (Q4)

Australia Employment (Feb)

China (Mainland) Loan Prime Rate (Mar)

United Kingdom Labour Market Report (Jan)

Switzerland SNB Interest Rate Decision

Taiwan CBC Interest Rate Decision

United Kingdom BoE Interest Rate Decision

United States Existing Home Sales (Feb)

Friday 21 Mar

South Africa Market Holiday

New Zealand Trade (Feb)

Japan Inflation (Feb)

Malaysia Inflation (Feb)

Canada New Housing Price (Feb)

Canada Retail Sales (Feb)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

Americas: FOMC, BCB meetings; US retail sales, industrial production, building permits, existing home sales data; Canada inflation

The Fed convenes for their March meeting with no changes to interest rates expected according to consensus. The focus will be with the economic projections as the market mulls the potential for further rate cuts in 2025 amid US policy and growth uncertainties. According to the latest S&P Global Investment Manager Index, the majority of US equity investors expect the Fed to lower interest rates by 50 basis points or less in the next 12 months.

On the data front, US retail sales, industrial production and housing data will be released for official insights into February's economic performance. S&P Global US PMI earlier showed manufacturing output growth accelerating, while services PMI - which serves as a good proxy for retail sales performance - slowed midway through the first quarter.

Outside of the US, a central bank meeting in Brazil and Canada's inflation rate and retail sales are highlights.

EMEA: BoE meeting, UK labour data; Germany ZEW survey; Eurozone inflation

The Bank of England (BoE) updates their monetary policy decision on Thursday. According to consensus, more rate cuts are expected in 2025 following the February decision, albeit not at the upcoming meeting. This was amidst an intensification of price pressure, with the latest February PMI data showing the rate of output price inflation remained among the highest in the past year. Meanwhile the UK labour market report will be released for January, with more up-to-date KPMG/REC UK Report on Jobs having shown a further weakening of UK labour market conditions in February.

Final February eurozone inflation data will also be updated alongside trade data and the ZEW investor sentiment survey.

APAC: BoJ, BI meetings; China industrial production, retail sales data; Japan inflation and trade data; New Zealand GDP

Central bank meetings in Japan and Indonesia are convened in the coming week with no changes to rates expected according to consensus. The focus instead will be with the series of data releases including activity data out of mainland China and also inflation and trade data from Japan. Latest Caixin China PMI data revealed that February's business activity growth had been the fastest in three months, supported by improvements across both manufacturing and service sectors.

© 2025, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location

Products & Offerings