Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jun 14, 2024

By Chris Williamson and Jingyi Pan

More central bank meetings are anticipated in the UK, Australia, Brazil, Switzerland, Norway and Indonesia in a busy week for policy-watchers. Fresh economic indicators are also in abundance, with flash June PMI surveys accompanied by industrial production and retail sales data out of the US and mainland China as well as inflation figures from the UK and Japan.

US industrial production and retail sales figures, will be tracked for second quarter GDP growth momentum. This will be important to watch after the Fed expressed further hesitation with just one rate cut now signalled in 2024 and policymakers keen to see demand come into line with supply. June's S&P Global Investment Manager Index revealed that investors' risk appetite has deteriorated amid concerns over US economic growth and as monetary policy continues to be seen as a drag for US equities.

The Bank of England will meanwhile be a key major central bank meeting to watch. Although more up-to-date economic indications will arrive later in the week via the June flash PMI, UK inflation figures, due just ahead of the BoE decision, will be sought for confirmation on whether underlying price pressures - notably in the service sector - remain elevated to a degree that might rule out any rate cuts in the near future. Markets are not pricing in a rate cut until nearer the end of the year, though August may still be in play.

The Reserve Bank of Australia meanwhile has the market speculating on a hike due to high inflation, while Brazil's central bank is widely expected to pause its rate cuts.

In Asia, a busy economic calendar is filled with activity data out of mainland China. This includes industrial production, retail sales and fixed asset investment numbers. These follow Caixin PMI data showing business activity expanding at the fastest pace in a year with better conditions cutting across both manufacturing and service sectors.

Japan's May CPI will also be due just around the time of June au Jibun Bank Flash PMI release. Yen weakness was a lingering theme for rising import prices, especially among goods producers, in May. As such, CPI indications will play an important part in guiding the intensity of Bank of Japan hawkishness in the near-term.

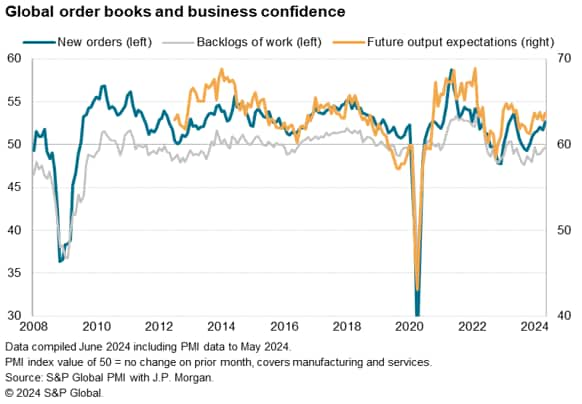

June flash PMI data will provide the earliest look at mid-year economic conditions. Clues can be sought from the survey's forward-looking indicators. Encouragingly, new orders and business expectations about the year ahead all lifted higher at the global level in May, and a near steadying of backlogs of work is itself a promising sign.

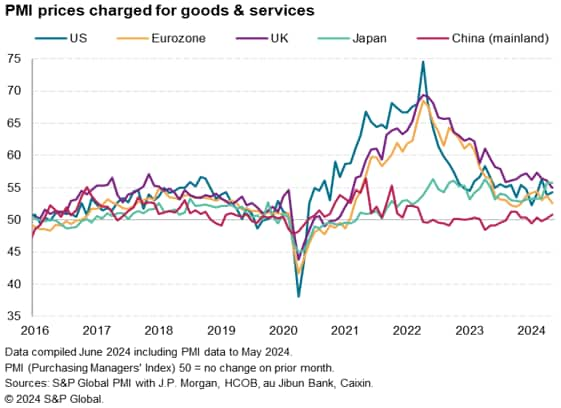

That said, the prices picture from the PMIs had been mixed in May among the major economies, cooling in Europe but picking up in the US and remaining especially high in Japan. A concern was that still-elevated services inflation was accompanied by signs of renewed inflation in manufacturing.

Monday 17 Jun

India, Indonesia, Malaysia, Philippines, Saudi Arabia, Singapore, Turkey, UAE Market Holiday

Japan Machinery Orders (Apr)

Singapore Non-oil Exports (May)

China (Mainland) Industrial Production, Retail Sales, Fixed Asset Investment, Unemployment Rate (May)

Italy Inflation (May, final)

Canada Housing Starts (May)

United States NY Empire State Manufacturing Index (Jun)

Tuesday 18 Jun

Indonesia, Turkey Market Holiday

Australia RBA Interest Rate Decision

Eurozone Inflation (May, final)

Eurozone ZEW Economic Sentiment (Jun)

Germany ZEW Economic Sentiment (Jun)

United States Retail Sales (May)

United States Industrial Production (May)

United States Business Inventories (Apr)

Wednesday 19 Jun

US, Turkey Market Holiday

Japan Balance of Trade (May)

Japan BoJ Meeting Minutes (Apr)

Indonesia Trade (May)

United Kingdom Inflation (May)

South Africa Inflation (May)

Canada BoC Summary of Deliberations (Jun)

Brazil BCB Interest Rate Decision

Thursday 20 Jun

New Zealand GDP (Q1)

China (Mainland) Loan Prime Rate (Jun)

Germany PPI (May)

Indonesia BI Interest Rate Decision

Switzerland SNB Interest Rate Decision

Norway Norges Bank Interest Rate Decision

United Kingdom BoE Interest Rate Decision

United States Building Permits, Housing Starts (May)

Eurozone Consumer Confidence (Jun, flash)

Friday 21 Jun

Australia Judo Bank Flash PMI, Manufacturing & Services*

Japan au Jibun Bank Flash PMI, Manufacturing & Services*

India HSBC Flash PMI, Manufacturing & Services*

UK S&P Global Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

Japan Inflation (May)

United Kingdom Retail Sales (May)

Canada Retail Sales (Apr)

United States Existing Home Sales (May)

United States CB Leading Index (May)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

June flash PMI due Friday

Flash PMI figures for June will be published on Friday, providing the earliest insights into business conditions across major developed markets and India. Inflation indications will be watched in particular after price pressures were revealed to have remained elevated in May, albeit with variations by region. India's June PMI will also provide an early look into emerging markets performance, which had supported global growth midway through the second quarter of the year.

Americas: US retail sales, industrial production, building permits data, BCB meeting and Canada retail sales

US activity data including retail sales and industrial production figures will be released in the week and watched for clues as to GDP strength in the second quarter. According to the latest May S&P Global US Manufacturing PMI, output expanded at a sharper pace in May, contributing to the fastest overall output growth in just over two years amid signs of improving manufacturing performance and strengthening services growth.

Brazil's central bank's meeting will meanwhile be watched closely as markets are pricing in a pause in the easing cycle, which has seen 325 basis points of cuts since last August, amid concerns over high inflation.

EMEA: BoE meeting, UK inflation and retail sales, Germany ZEW economic sentiment

The Bank of England convenes for their June meeting. A rate cut is not expected due to high services inflation, but markets will be looking for guidance as to whether an August rate cut is on the table. Although inflation has fallen to 2.3%, this is thanks to a lower household energy cap. Prices still rose 0.3% month on month. A key concern is that wages are still rising at an elevated rate , causing the latest PMI data to signal persistent steep rate of selling price inflation in May. CPI data on Wednesday will prelude the BoE decision.

APAC: RBA, BI meetings, China industrial production, retail sales, Japan inflation and trade

The Reserve Bank of Australia and Bank Indonesia update monetary policy settings with the RBA in focus given speculation that interest rates may be lifted in the upcoming meeting amid elevated inflation in Australia. The latest Judo Bank Australia Composite PMI revealed that the rate of output price inflation further rose in May.

Additional key data releases in the week include industrial production and retail sales figures from mainland China after Caixin PMI data indicated that business activity expanded at the fastest pace since May 2023 amid improvements in both the manufacturing and service sectors. Japan's inflation reading will also be due at the end of the week.

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.