Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jul 12, 2024

By Chris Williamson and Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Euro area policymakers meet to set monetary policy while counterparts at the Bank of England assess new inflation and labour market data. Second quarter economic growth figures will also be released for mainland China alongside a raft of key activity indicators for the United States, including retail sales and industrial production. Inflation data for Japan will likewise be eagerly awaited as speculation mounts on the possibility of a rate hike by the Bank of Japan.

Chances of the European Central Bank cutting interest rates again at its July meeting are low given the recent stubbornness of inflation in the service sector, in turn largely linked to elevated pay growth. While final data will be eyed to confirm that inflation has fallen to 2.5%, services inflation is running at 4.1%. Instead, accompanying ECB commentary will be scoured for clues that the path to lower rates later in the year remains intact, with cuts pencilled-in by many for the ECB's September and December meetings.

The Bank of England has meanwhile been on hold, despite better news on headline inflation, amid sticky wage growth. Updated pay data in the official monthly labour market report will therefore need to show cooling earnings growth if any chances of an August rate cut are to be kept alive. Similarly, inflation will need to confirm that the recent cooling of price pressures looks sustainable. Headline inflation fell to 2.0% in June, meeting the Bank of England's target. But annual growth in employees core earnings is still running at 6.0%.

Clues as to the strength of economic growth in the US during the second quarter will be also provided in the coming week by a broad-brush of official data relating to industrial production, retail sales, inventories and the housing market. S&P Global PMI survey data currently point to US GDP rising by a robust 2.0%. With the FOMC having reduced its signalling to just one rate cut in 2024, the strength of demand in the economy will be an important guide to policy.

In Asia, a full picture of mainland China's economic growth in the second quarter will be provided by GDP data, which is expected to show a cooldown in growth, while inflation data in Japan will be assessed for guidance on whether the Bank of Japan could hike rates amid signs of price pressures building on the back of a weakened yen.

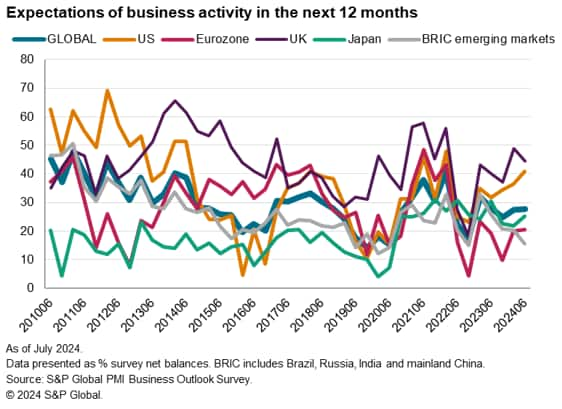

Global business optimism has shown resilience so far this year, though regional variations have become more apparent, according to S&P Global's Business Outlook Survey. The survey is the largest of its kind, tracking expectations of key metrics for the year ahead in 12,000 manufacturers and service providers across 17 economies. The reports have been produced for 15 years on a tri-annual basis, with data collected in February, June and October.

The June survey saw the net balance of firms expecting a rise in output over the coming year minus those expecting a decline remain steady at +28%, which is among the highest readings seen over the past six years barring some pandemic-related bouts of optimism, when economies reopened from virus containment restrictions.

However, this steady optimism masks widening regional variations, most notably with increasingly elevated sentiment in the United States and Japan contrasting with weakening sentiment in the emerging markets, and subdued confidence in the eurozone. Except for some pandemic-lows, BRIC emerging market sentiment is the second-lowest recorded since data were first collected in 2009 (led by muted views in mainland China) and eurozone optimism is among the lowest recorded since the region's debt crisis in 2012.

Sentiment in China and Europe is being pulled down by worries over protectionism, tariffs and trade wars, as well as political uncertainty - many of which are factors cited as drivers of growth in the US. However, the US political environment clearly represents a key area of uncertainty for business, and should be closely tracked in the October survey. The UK meanwhile remains the most optimistic as firms anticipate greater political stability.

Monday 15 Jul

Japan Market Holiday

China (Mainland) GDP (Q2)

China (Mainland) Industrial Production, Retail Sales, Fixed Asset Investment, Unemployment (Jun)

Indonesia Trade (Jun)

Germany Retail Sales (May)

India Trade (Jun)

India WPI (Jun)

Eurozone Industrial Production (May)

Tuesday 16 Jul

China (Mainland) Communist Party of China Third Plenum

Japan Tertiary Industry Index (May)

South Korea Export Prices (Jun)

Germany Wholesale Prices (Jun)

Italy Inflation (Jun, final)

Eurozone Balance of Trade (May)

Germany ZEW Economic Sentiment (Jul)

Italy Balance of Trade (May)

Canada Inflation (Jun)

United States Retail Sales (Jun)

United States Business Inventories (May)

United States NAHB Housing Market Index (Jul)

Wednesday 17 Jul

India Market Holiday

Singapore Non-oil Domestic Exports (Jun)

United Kingdom Inflation (Mar)

Indonesia BI Interest Rate Decision

Eurozone Inflation (Jun, final)

United States Building Permits (Jun, prelim)

United States Housing Starts (Jun)

United States Industrial Production (Jun)

Thursday 18 Jul

Japan Trade (Jun)

Australia Employment Change (Jun)

United Kingdom Labour Market Report (May)

Eurozone ECB Interest Rate Decision

South Africa SARB Interest Rates Decision

Friday 19 Jul

New Zealand Inflation (Q2)

Japan Inflation (Jun)

Malaysia GDP (Q2, prelim)

China (Mainland) FDI (Jun)

Germany PPI (Jun)

United Kingdom Retail Sales (Jun)

Eurozone Current Account (May)

Spain Balance of Trade (May)

Canada Retail Sales (May)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

Americas: US retail sales, housing market and industrial production

A better insight into second quarter economic conditions in the US will be provided by updated retail sales and industrial production data, both of which generally represent major components of GDP nowcasting models, as well as business inventories and a raft of data relating to the housing market. The latter includes the National Association of Homebuilders survey, housing starts and building permits. Current estimates suggest the US economy grew at an annualized rate of approximately 2% in the second quarter, which tallies with S&P Global's US PMI data.

EMEA: ECB meeting, UK CPI and labour market data

The European Central Bank meets before taking its summer break, but few are expecting a second rate cut given the recent stickiness of inflation in the service sector. However, the meeting will be eyed for confirmation that rates may well fall further later in the year, with many - including ourselves - pencilling in two 25 basis point cuts. Eurozone inflation (a final reading) and industrial production are also to be updated, the latter likely to show persistent weakness.

Meanwhile, in the UK, inflation has returned to target, but the Bank of England has remained too concerned about underlying pay pressures to cut rates. Hence, updated inflation and labour market data will be keenly awaited to see if this picture has changed.

APAC: Mainland China GDP, Japan inflation and trade and Bank Indonesia policy meeting

In APAC, second quarter GDP data are due for mainland China, for which our forecasting team anticipate year-on-year growth to have slowed from 5.3% in the first quarter to 5.0%. Quarterly annualised growth is likewise expected to have cooled from 7% to just below 5%. Recent signals from the Caixin PMI have likewise shown robust expansion, though some pull-back in the rate of growth was evident in June. The higher frequency data on industrial production, retail sales and investment will also be eagerly assessed for clues as to China's growth drags and drivers.

Inflation data for Japan will also be released amid ongoing speculation that rising import price pressures could encourage the Bank of Japan to raise interest rates alongside a tapering if its bond purchases. The impact of the multi-decade weak yen on Japan's exports will also be revealed via trade data.

Also watch out for GDP data for Malaysia, trade data for India and a rate decision from Indonesia, where the recent focus has been on stabilizing a weakened rupiah.

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.