Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Apr 12, 2024

By Chris Williamson and Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Data releases in the week ahead will provide further important clues as to the next moves in central bank policy, and in particular add to speculation as to when US and European policymakers may start to pivot to lower rates.

After stronger than anticipated US inflation data, showing headline inflation rising to 3.5% and core inflation stuck at 3.8%, markets have further scaled back the expected number of rate cuts by the FOMC. At the end of last year, the first of six cuts in 2024 had been priced in for March. That then got pushed back to three cuts starting in June, and with the latest CPI print a full 25 basis point cut is now not priced in until November. Forget six or even three rate cuts in 2024, at this rate markets are increasingly speculating that the FOMC may only be able to deliver one. These jitters had been reflected in the S&P Global Investment Manager Index survey, which had recorded lower risk appetite.

The degree to which US inflation might cool further in the coming months will be in part determined by the strength of economic growth in the US, hence the upcoming releases of industrial production and retail sales will be eagerly assessed for clues as to GDP in the first quarter. Any upside surprises will add to pessimism about the Fed's inflation fight.

Meanwhile markets are growing more optimistic about inflation being beaten to target in the eurozone, and final consumer price inflation data for March will be watched in the context of a growing prospect of the ECB making its first cut in June. If so, eyes will be focused on the currency market's reaction, as a weakening euro will be a concern to the ECB. Trade and industrial production data will also be updated for the eurozone, and will help guide recession risks and hence also influence views on ECB policy.

Speculation is also mounting that the Bank of England could lower rates in June, with inflation expected to fall further when CPI data are released during the week. However, much will also depend on favourable labour market data.

First quarter GDP will meanwhile be released for mainland China alongside monthly data on industrial production, retail sales and investment. All will be scoured for hopeful signs that the economy is at least managing 5% growth.

Other key releases include inflation for Japan and Canada.

With two of the Bank of England's nine rate setters having withdrawn their calls for rate hikes at the latest Monetary Policy Committee meeting, speculation has risen that UK interest rates could start to fall in the coming months. The precise timing remains highly uncertain, and the upcoming inflation and labour market data due in the week ahead will add to the debate. Inflation is likely to fall, largely due to base effects (as we noted last week), but the MPC will also want to see signs that wage effects are also continuing to move in the right direction. Regular pay growth is still rising at an annual rate of 6.1%, though that's down from a recent peak of 7.9%.

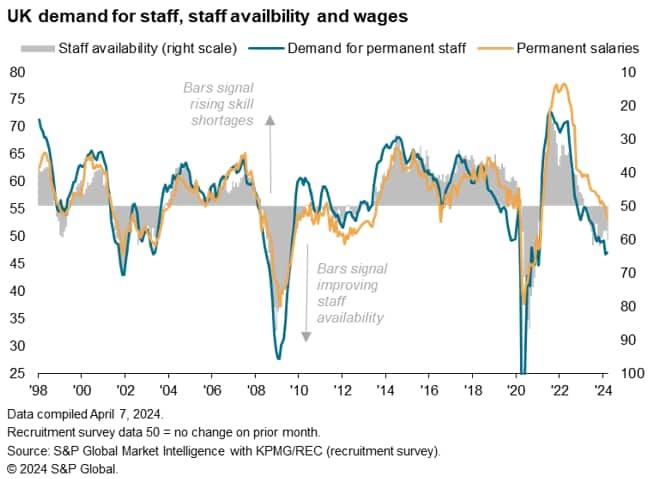

Encouragingly from a monetary policy perspective, a softening of the UK labour market was signalled by the latest recruitment industry survey, which is compiled by S&P Global each month on behalf of the Recruitment and Employment Confederation (REC) and KPMG, and which is watched closely by the Bank of England. The survey, based on questionnaire responses from around 400 recruiters, ranging from large employment agencies to specialist head-hunters, found demand for staff from employers to have fallen sharply in March. In fact, excluding the pandemic, the recent demand slump has been the most severe since the global financial crisis in 2008-9.

A corollary of the downturn in demand for staff has been an improvement in the availability of candidates to fill vacancies. Staff availability has in fact now improved for 13 successive months after two years of continual decline, which has in turn fed through to a gradual easing of pay growth from the survey record highs seen in the first half of 2022. If borne out by the official data, this easing pay trend will further open the door for rate cuts.

Monday 15 April

Indonesia, Thailand Market Holiday

Japan Machinery Orders (Feb)

India WPI (Mar)

India Trade (Mar)

China (Mainland) 1-Year MLF Announcement

Turkey Unemployment (Feb)

Eurozone Industrial Production (Feb)

United States Retail Sales (Mar)

United States Business Inventories (Feb)

United States NAHB Housing Market (Apr)

Tuesday 16 Apr

Thailand Market Holiday

China (Mainland) GDP (Q1)

China (Mainland) Industrial Production, Retail Sales, Fixed Asset Investment (Mar)

China (Mainland) Unemployment (Mar)

Indonesia Trade (Mar)

Germany Wholesale Prices (Mar)

United Kingdom Labour Market Report (Mar)

Italy Inflation (Mar, final)

Eurozone Trade Balance (Feb)

Eurozone ZEW Economic Sentiment (Apr)

Germany ZEW Economic Sentiment (Apr)

Canada Inflation (Mar)

United States Building Permits, Housing Starts (Mar)

United States Industrial Production (Mar)

Wednesday 17 Apr

India Market Holiday

New Zealand Inflation (Q1)

Japan Trade (Mar)

Singapore Non-oil Domestic Exports (Mar)

United Kingdom Inflation (Mar)

South Africa Inflation (Mar)

Eurozone Inflation (Mar, final)

Brazil Business Confidence (Apr)

United States Net Long-term TIC Flows (Feb)

Thursday 18 Apr

Australia Employment (Mar)

Australia Unemployment Rate (Mar)

Switzerland Trade Balance (Mar)

United States Existing Home Sales (Mar)

Friday 19 Apr

Japan Inflation (Mar)

Malaysia GDP (Q1, prelim)

Germany PPI (Mar)

United Kingdom Retail Sales (Mar)

France Business Confidence (Apr)

Spain Balance of Trade (Feb)

India RBI Meeting Minutes

* Access press releases of indices produced by S&P Global and relevant sponsors here.

Americas: Canada inflation, US retail sales, industrial production, building permits

Canada's March inflation figure will be due on Tuesday for insights into inflation conditions at the end of the first quarter. According to consensus at the time of writing, a further easing of the headline inflation rate from 2.8% in February is expected, in line with indications from PMI selling prices. If indeed the case, this will underscore further progress in the Bank of Canada's fight against inflation and is supportive of the central bank lowering rates from mid-2024. That said, policymakers evidently remain watchful of the price trends.

Separately, a busy economic calendar for the US sees the release of retail sales and industrial production figures. The market has pencilled in expectations for industrial production growth to have accelerated in March, as signalled by recent manufacturing PMI data, while retail sales growth may slightly decelerate in March. Building permits and housing starts data will also be closely watched on Tuesday.

EMEA: UK inflation and labour market reports, retail sales data, German ZEW survey and eurozone final CPI, industrial production

The UK updates inflation and labour market data in the week. According to consensus expectations, both headline and core inflation rates are expected to ease, albeit only slightly. This is amidst indications of relatively sticky inflation observed for the UK based on PMI price indices.

Meanwhile the labour market report will be closely watched with more recent recruitment industry survey data outlining the fact that firms are cutting employment in March and that pay growth in the UK was the slowest in over three years.

Additionally, Germany ZEW survey data coupled with eurozone final March inflation and industrial production figures are updated through the week. Positive news of output and new orders declining at the softest rates since early 2023 in eurozone's goods producing industry was outlined earlier by the HCOB Eurozone Manufacturing PMI.

APAC: China GDP, industrial production data, Japan CPI

In APAC, key data releases in the week include the data barrage from mainland China on Tuesday. Q1 GDP, March retail sales, industrial production and fixed asset investment figures are all anticipated. A 5.0% GDP growth rate is anticipated according to professional forecasters and further reinforced by the trend observed in the Caixin China PMI.

Japan's March CPI figure will also be anticipated for guidance amid speculation that the Bank of Japan may raise rates in the near-term.

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.